|

Wall St. sidesteps loss

|

|

March 1, 2001: 5:21 p.m. ET

Nasdaq, S&P gain as investors see opportunity in hard-hit stocks

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - A late blitz of bargain hunting Thursday saved U.S. stocks from losses that nearly handed Wall Street its first official bear market in more than a decade.

Investors, shrugging off the latest financial problems from Corporate America, snapped up some of the market's hardest-hit technology stocks in the last moments of trading.

The Nasdaq composite index, lower by more than 3 percent earlier Thursday, finished with its first gain in three days. And the Dow Jones industrial average almost dug itself out of a 193-point hole.

But the biggest turnaround story goes to the S&P 500. Earlier Thursday, the index, one of the market's broadest gauges, traded 20 percent below its 52-week high, nearly closing at the level deemed a bear market by most analysts. But the biggest turnaround story goes to the S&P 500. Earlier Thursday, the index, one of the market's broadest gauges, traded 20 percent below its 52-week high, nearly closing at the level deemed a bear market by most analysts.

Explaining the gains, Ned Riley, chief market strategist at State Street Global Advisors, said the year-long sell-off has created some great values in tech stocks.

"The stocks in my judgment are very, very cheap," he told CNNfn's Street Sweep.

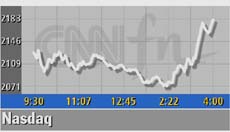

The Nasdaq rose 31.54 points, or 1.4 percent, to 2,183.37. Despite the gains, the first in three sessions, the index is still off 56.7 percent for its peak last March.

Marshall Acuff, equity strategist at Salomon Smith Barney, said that tech stocks, because they still trade at high multiples, could fall further.

"The Nasdaq could go lower," Acuff told CNNfn's The Money Gang. "I think 1,800 would not be surprising."

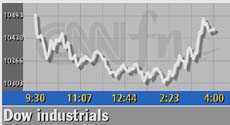

The Dow Jones industrial average dropped 45.14 to 10,450.14, while the S&P 500 rose 1.20 to 1,241.14.

The S&P 500 dodged a bullet. The index spent most of the session below the 1,221.97 mark, that if it held to the close, would have handed it a finish 20 percent below its March peak. The S&P 500 dodged a bullet. The index spent most of the session below the 1,221.97 mark, that if it held to the close, would have handed it a finish 20 percent below its March peak.

Sam Stovall, sector strategist at Standard & Poor's, said the S&P 500 reached this bear market milestone in October of 1990.

More stocks fell than rose. Declining issues on the New York Stock Exchange topped advancing ones 1,564 to 1,477 as 1.2 billion shares traded. Nasdaq losers topped winners 2,178 to 1,603 as 2.2 billion shares changed hands.

In other markets, Treasury edged higher. The dollar dropped against the euro but was little changed versus the yen.

Sifting through the wreckage

Credit some of the turnaround to IBM (IBM: Research, Estimates). IBM, which traded as low as $97.50 earlier Thursday, finished at $106.05, up $6.15.

The gains came after several news agencies reported that Salomon Smith Barney made positive comments on the world's largest tech company in sales. But Salomon said no note was released Thursday.

Whatever the cause, other tech stocks gained after being lower. Oracle (ORCL: Research, Estimates) rose $2.38 to $21.38 while Cisco Systems (CSCO: Research, Estimates) advanced 81 cents to $24.50.

Still, with the slowing economy sapping consumer and business spending, investors spent most of the session fretting about the latest round of companies warning they would miss their quarterly financial targets. Still, with the slowing economy sapping consumer and business spending, investors spent most of the session fretting about the latest round of companies warning they would miss their quarterly financial targets.

Gateway (GTW: Research, Estimates) fell $1.45 to $15.75 after the personal computer maker said it expects breakeven results in the current quarter. Analysts expected a profit.

Gateway is hardly alone. Competitors Dell Computer, Apple Computer and Hewlett-Packard all have lowered their sales or profit estimates in recent months.

3Com (COMS: Research, Estimates) lost $1.63 to $7.50. The computer networking provider said its losses in the current quarter would be wider than expected.

In addition to profit problems, investors have been disappointed that the Federal Reserve did not cut interest rates this week. Speaking to a Congressional panel, Fed Chairman Greenspan signaled Wednesday that a reduction in borrowing costs may not come until the Fed's next meeting March 20.

But John Forelli, portfolio manager at Independence Investment

Associates, is counting on the Fed to right the economy in time.

"I'm expecting the Fed to cut rates by (a half percentage point) at the end

of the month and then another (half-percentage point) per meeting until

June," he said.

A few glimmers of light emerged on the economic front, as new data showed that Americans' incomes rose last month and that the worst may be over for the hard-hit manufacturing sector

Consumer spending rose 0.7 percent while personal income grew 0.6 percent in January, the Commerce Department said. Both numbers were above expectations.

And while the National Association of Purchasing Management said the manufacturing economy failed to grow for a seventh straight month, its index advanced for the first time since December 1999. The NAPM index, a survey of industry executives, rose to 41.9 in February from 41.2 in January. But a reading below 50, according to NAPM, means that industrial activity has contracted.

And indeed the job market showed more signs of weakness, with the number of American workers filing new claims for unemployment benefits rising 39,000 last week to 372,000.

Corning joined the ranks of companies trimming their payrolls Thursday. The fiber-optics maker said it will cut 825 jobs in its photonic technologies division, citing weakness in the telecom industry. Corning (GLW: Research, Estimates) stock added $3.21cents to 30.25. Corning joined the ranks of companies trimming their payrolls Thursday. The fiber-optics maker said it will cut 825 jobs in its photonic technologies division, citing weakness in the telecom industry. Corning (GLW: Research, Estimates) stock added $3.21cents to 30.25.

But brokerage stocks fell after J.P. Morgan Chase (JPM: Research, Estimates) downgraded the group. Goldman Sachs (GS: Research, Estimates) declined 14 cents to $91.16, while Morgan Stanley (MWD: Research, Estimates) lost $1.53 to $63.30.

Click here for a look at the day's other downgrades.

J.P. Morgan Chase showed weakness as well, losing 55 cents to close at $46.11.

Among Dow losers, 3M (MMM: Research, Estimates) shed $3.15 to $109.60 while Boeing (BA: Research, Estimates) declined $2.55 to $59.65. The aircraft maker's headquarters in Seattle were closed Thursday after a powerful earthquake hit the area.

Al Goldman, chief market strategist at A.G. Edwards, sees opportunities amid the market's losses.

"The foundations for future fortunes are laid during a bear market," Goldman told CNNfn's Market Call.

UBS Warburg agreed. In a note earlier this week, the chief market strategist at the Swiss investment bank said the current climate of fear masks an "outstanding buying opportunity."

Investors found opportunities in some of the hardest hit tech stocks. JDS Uniphase (JDSU: Research, Estimates), which began 2000 above $80, rose $2.50 to $29.25 and Qualcomm (QCOM: Research, Estimates), which began 2000 above $176, gained $6.38 to $61.19.

But as if to hedge their bets, investors also moved into defensive sectors like tobacco, drugs and energy. Philip Morris (MO: Research, Estimates) gained 37 cents to $48.55, Johnson & Johnson (JNJ: Research, Estimates) rose $1.75 to $99.80, and Exxon Mobil(XOM: Research, Estimates) rose 35 cents to $81.40.

|

|

|

|

|

|

|