|

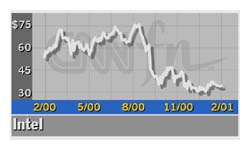

Intel sinks after warning

|

|

March 9, 2001: 12:52 p.m. ET

Chipmaker's stock sinks further after it says it will miss sales forecasts

|

NEW YORK (CNNfn) - Intel Corp. stock lost more ground Friday after the world's biggest chipmaker warned again about weak sales and said it was cutting 5,000 jobs to rein in costs.

Intel (INTC: Research, Estimates) stock sank $3.37 to $29.87 in afternoon Nasdaq trade, a drop of more than 10 percent, after its warning late Thursday.

The company, which is the largest supplier of microprocessors for personal computers and a leading supplier of chips used in networking and communications equipment, said its first-quarter revenue will be down about 25 percent from the previous quarter, compared with an already reduced estimate for a sequential revenue decline nearer 15 percent

Executives also said they expect the company's gross margin to be about 51 percent, compared with their previous estimate for a gross margin of 58 percent. They did not provide a specific earnings per share estimate.

But analysts, who on average had been expecting Intel to log a first-quarter profit of about 21 cents per share, now are expecting that figure to be nearer 15 cents per share, according to preliminary estimates collected by earnings tracker First Call.

For the year, analysts polled so far are now expecting Intel to report earnings of about 65 cents per share, compared with a previous estimate for a profit of $1.02 per share, First Call said.

Executives at Intel in Santa Clara, Calif., blamed the quarterly shortfall on lower demand for chips used in the networking, communications and server segments as well as weakening demand for their products in Asia and Europe.

When the company first lowered its quarterly targets in January, executives had pinned the blame primarily on weakness in the U.S. PC market and said their businesses elsewhere were holding steady.

Intel's news sparked a flurry of cautious comments from analysts who track the company. Prudential Securities downgraded its rating on Intel's shares Friday to "hold" from "accumulate," warning that chip demand will likely get worse before it gets better.

The 5,000 job cuts, which represent about 6 percent of the company's work force, are expected over the next nine months and will be mainly through attrition, Intel said. They are part of a broader cost-cutting plan Intel executive put in place last month.

In addition to the headcount reduction, Intel is taking steps including deferring salary increases, and aiming for a 30 percent decrease in discretionary spending on items such as travel. The company also has put on hold a plan to deliver free PCs to its salaried employees.

Intel is the latest in a string of tech companies hit by a slowdown in the economy that has hurt demand for computers and telecommunications gear.

Executives at another chipmaker, National Semiconductor, Thursday lowered their targets for the current quarter and fiscal year ending in May. And Yahoo! recently warned about first-quarter results, sparking a steep drop in its stock and speculation that the Internet company could become a takeover target.

|

|

|

|

|

|

|