|

Wall St. poised to retreat

|

|

March 14, 2001: 8:14 a.m. ET

Gains may be one-day wonder as investors' jitters about earnings return

|

NEW YORK (CNNfn) - It looks like Wall Street will take it on the chin again Wednesday. Hopes for another rally have evaporated on fresh worries about corporate earnings and interest rates.

Both the Nasdaq-100 and Standard & Poor's futures fell sharply, with the Nasdaq futures trading as low as they're allowed to go, pointing to a big drop as U.S. markets open. As a result, two major indexes could slide below major milestones -- the Nasdaq composite index below 2,000 for the second time this week, and the Dow Jones industrial average below 10,000 for the first time since last October.

That would at least partially undo some of the market's rebound Tuesday, when investors seemed to take their first tentative steps toward getting back into badly battered stocks. The slump reached its nadir Monday, when the Nasdaq composite index fell below 2,000 for the first time since late 1998 and the Dow Jones industrial average suffered its fifth-biggest one-day point loss.

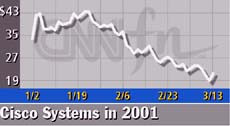

Contributing to the weakness is a reiterated warning from Cisco Systems CEO John Chambers, who said the economic conditions facing his networking equipment company remain as grim as they were in January. Chambers, at a New York investment conference, advised that the malaise may be spreading to the Asia-Pacific region, Europe and Latin America after having infected North America. Contributing to the weakness is a reiterated warning from Cisco Systems CEO John Chambers, who said the economic conditions facing his networking equipment company remain as grim as they were in January. Chambers, at a New York investment conference, advised that the malaise may be spreading to the Asia-Pacific region, Europe and Latin America after having infected North America.

Cisco Systems (CSCO: Research, Estimates) fell $1.37 to $20 in before-hours trading after rebounding $2.56 during regular hours Tuesday.

Another factor in the early gloom is a Wall Street Journal article quoting a former Federal Reserve official as predicting no more than a half-percentage point interest rate cut when policymakers meet next week. Some analysts have been hoping for a cut of three-quarters of a percent in an effort to stimulate the U.S. economy and prevent recession.

The Nasdaq starts the day at 2,014.78 following Tuesday's nearly 5-percent gain. The Dow industrials are at 10,289.80 after an 82-point advance, while the S&P 500 is at 1,197.66 after a nearly 1.5 percent gain Tuesday.

Asian markets struggled higher Wednesday but European stocks weakened in early trading because of the weakness in U.S. stock futures.

Treasury prices were little changed early Wednesday, with the 10-year note yield holding at 4.92 percent and the 30-year bond yield steady at 5.32 percent. The dollar was weaker against the euro and flat against the yen. Brent oil futures rose 4 cents to $25.86 a barrel in London.

CMGI, the Internet developer, reported late Tuesday that its loss widened to $2.6 billion in the latest quarter, and that it expects weak sales in the current quarter. The company also said it's looking into selling more businesses to make itself profitable. CMGI (CMGI: Research, Estimates) shares rose 6 cents to $3.91 Tuesday.

Two very different retailers -- discount apparel merchant Kohl's and luxury apparel merchant Saks -- reported better-than-expected fiscal fourth-quarter earnings late Tuesday. Kohl's (KSS: Research, Estimates) shares fell 65 cents to $61.61, while Saks (SKS: Research, Estimates) slipped 20 cents to $12.75. Two very different retailers -- discount apparel merchant Kohl's and luxury apparel merchant Saks -- reported better-than-expected fiscal fourth-quarter earnings late Tuesday. Kohl's (KSS: Research, Estimates) shares fell 65 cents to $61.61, while Saks (SKS: Research, Estimates) slipped 20 cents to $12.75.

Massachusetts officials are investigating pricing practices at drugmaker Schering-Plough as part of a broader inquiry into pricing practices across the drug industry. Schering-Plough (SGP: Research, Estimates) shares closed at $37.70 Tuesday, down 35 cents.

Starbucks' Japanese unit is reportedly planning an initial public offering of shares in Tokyo. Goldman Sachs Group has been hired by the fast-growing Starbucks Coffee Japan Ltd. to work on the IPO, the Wall Street Journal reported Wednesday. Starbucks (SUBX: Research, Estimates) shares closed at $44.75 Tuesday, down 19 cents.

|

|

|

|

|

|

|