|

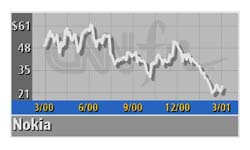

Nokia to sustain profits

|

|

March 15, 2001: 1:30 p.m. ET

Cell phone firm expects to hit earnings target though sales growth slows

|

LONDON (CNN) - Nokia, the world's biggest mobile phone maker, cut sales forecasts Thursday but reassured investors that its first-quarter profit would be in line with estimates.

The Finnish company cut its first-quarter sales growth estimate to about 20 percent from an earlier figure of 25-to-35 percent. But it also said it expects first-quarter earnings to reach its target of  0.19, or 17 cents per share, which would match last year's figure. 0.19, or 17 cents per share, which would match last year's figure.

| |

|

|

| |

|

|

| |

We expect to see solid growth for the first quarter as a whole, with better-than-anticipated margins.

|

|

| |

|

|

| |

|

|

| |

|

|

| |

Jorma Ollila

Chief executive

Nokia |

|

The news sparked a relief rally in the wireless segment, which has been under pressure lately amid increased signs of slowing growth and deteriorating profitability, which executives have blamed primarily on the slowing U.S. economy.

Shares in Nokia (NOK: Research, Estimates) more than 15 percent in New York Stock Exchange trade Thursday, standing $3.31 higher at $25.11.

That surge came in spite of the fact that Nokia cut is 2001 worldwide handset sales forecast to 450 million-to-500 million, down from its previous estimate in January of 500 million-to-550 million phones.

Angela Dean, an analyst at Morgan Stanley Dean Witter, said investors were focusing more on Nokia's confidence that it will maintain its profitability even in the more difficult market conditions.

"They're saying the earnings have held up as margins have improved," she said.

In a statement the Finnish company said it had an ongoing program to generate efficiencies from operations and find additional cost savings, without jeopardizing investment in research and development.

"Despite the more difficult market conditions ... we expect to see solid growth for the first quarter as a whole, with better-than-anticipated margins," Chief Executive Jorma Ollila said.

Operating margins fell to 21.3 percent in the fourth quarter of 2000 from 24.9 percent in the year-earlier quarter. Some analysts had expected margins to slump to 10 percent in the first quarter on increased competition and excess of products in the market.

Nokia's positive pre-announcement made it a stand-out among wireless phone makers.

Just this week, Ericsson, the third-largest mobile phone maker, said it would post a loss of up to 5 billion crowns, or $510 million, in the first quarter of 2001, versus an earlier forecast of roughly breakeven. Just this week, Ericsson, the third-largest mobile phone maker, said it would post a loss of up to 5 billion crowns, or $510 million, in the first quarter of 2001, versus an earlier forecast of roughly breakeven.

Ericsson's handset unit has proven to be a major burden to the company, losing more than $1 billion in the final quarter of 2000. Ericsson plans to farm out production of its mobile phones to lower cost producers in Asia.

Shares in Ericsson (ERICY: Research, Estimates) were up 25 cents at $6.16 in U.S. trade Thursday, a 4.2 percent rise on the day.

Similarly, Motorola (MOT: Research, Estimates), the U.S.-based mobile-phone maker which runs second to Nokia, warned last month that it will not meet its previous first-quarter financial targets. The company also has been implementing a broad restructuring plan, under which it will eliminate more than 16,000 jobs.

Both Motorola and Ericsson have blamed the sagging U.S. economy for their financial woes. Executives at Nokia also identified the United States as a source of weakness.

"The slower than expected sales growth in the first quarter is mainly due to stronger than anticipated impact of demanding market conditions. Especially in the United States, economic uncertainty has increased during the last weeks, " Nokia said in a statement.

Nokia said it expects first-quarter sales in its phone unit to grow between 15 percent and 20 percent, while sales at the network unit will rise 30 percent-to-35 percent.

The company also said its stocks of handsets were lower than a year earlier. French network equipment maker Alcatel has said it plans to close its phone manufacturing sites for two weeks because of excess inventories.

|

|

|

|

|

|

|