|

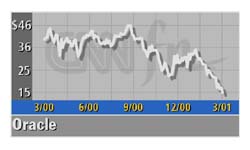

Oracle hits lower target

|

|

March 15, 2001: 6:48 p.m. ET

Software maker matches reduced profit forecast; lowers the bar

By Staff Writer Richard Richtmyer

|

NEW YORK (CNNfn) - Software maker Oracle Corp. reported a fiscal third-quarter profit that matched its recently reduced estimate. And executives lowered their targets for the current quarter in the face of slowing and uncertain end markets.

The company, which is the world's second-largest software supplier, said it earned $583 million, or 10 cents per share, during the quarter ended on Feb. 28. That compared with $503 million, or 8 cents per share, during the same period a year earlier.

At $2.7 billion, Oracle's third-quarter revenue was slightly above the $2.5 billion it reported during the same period a year earlier. The company's results matched the lower profit executives told Wall Street to expect earlier this month.

Prior to the pre-announcement, the Street had been expecting Oracle to report a profit of 12 cents per share for the quarter. Shares of Oracle (ORCL: Research, Estimates) fell $1.38 to $14.69 on Nasdaq ahead of the earnings news, which was released after the closing bell. They slipped another 12 cents to $14.56 in after hours trade.

In a teleconference with analysts Thursday evening, Jeffrey O. Henley, Oracle's chief financial officer, said the slowdown in the U.S. economy was primarily to blame for the shortfall, adding that the economy remains a wild card for its results in the current quarter and beyond.

"Right up to the end, we said we felt pretty good about the quarter, hadn't seen any indication of an erosion of our internal forecast, or heard of significant issues in regular conversations with the U.S. sales management," Henley said.

"All the major enterprise software companies who reported in December felt good about their outlook, so we felt like the enterprise software space ... was more recession resistant than other technology sectors were. The cracks started to appear in the last four days of the quarter," Henley added.

In the current quarter, Henley said the company expects to log a profit of 15 cents per share, compared with the Street's recent expectations for a profit of 17 cents per share, according to analysts polled by earnings tracker First Call.

For the full fiscal year, Henley said Oracle is aiming for earnings growth of about 31 percent.

"This is all predicated on the economy, and based on everything I've heard out there, it may be a reasonable assumption," he said.

Sales of Oracle's core database software rose 6 percent from the same quarter a year ago, the company said. Sales of applications, an area in which Oracle has sharpened its focus, were up 25 percent. Revenue from services was 12 percent higher than the same period a year earlier.

Larry Ellison, the company's chairman and chief executive, highlighted Oracle's new "11i" e-business software, which company watchers have pointed to as a wild card for its near-term prospects.

Historically, Oracle has focused on database software, a market which is slowing and expected to grow only modestly in the future. The company has only recently begun the transition to e-business applications, such as those in the 11i product line, and has identified the market as an important area of growth moving forward.

Executives at Oracle even claim that they were able to save $1 billion by implementing 11i software within their own business.

Over 3,000 customers currently are in the process of implementing the "11i" e-business software and more than 210 already are using the 11i software within their organizations.

"Oracle applications are ideally suited for rapid implementations because our e-business suite is complete and integrated -- no application customizations are required," Ellison said.

He said the company will continue to sharpen its marketing focus on the way its products can be implemented quickly, yielding saving in installation costs as well as speeding the cost-savings that results from having it in place. He said the company will continue to sharpen its marketing focus on the way its products can be implemented quickly, yielding saving in installation costs as well as speeding the cost-savings that results from having it in place.

However, Oracle's claims about the ease of use and effectiveness of the 11i software, as well as Ellison and other executives' statements about Oracle's financial position during the course of the third quarter, have become the subject of some controversy.

Oracle is facing at least three class-action lawsuits from shareholders in California, New York and Pennsylvania related to its March 1 earnings warning and its characterization of the 11i e-business suite.

The plaintiffs in those suits, all of which were filed this week, allege that the company, and Ellison specifically, misrepresented Oracle's actual financial status for the quarter by repeatedly stating throughout January and February that the previous third-quarter estimates were easily achievable, that Oracle's pipeline was "never stronger," its applications growth was "accelerating," its database and application sales were rapidly growing and that the slowing economy was showing no impact on its quarterly results.

At issue is Ellison's sale of $895 million worth of Oracle stock just a month before revealing the profit shortfall.

Responding to earlier criticism about the timing of Ellison's stock sale, Oracle explained that he had sold the shares in late January and early February because he had to exercise options that were about to expire. However, included in his sale in late January were seven million shares he already owned. He sold the shares for as much as $32 each.

The suits also allege that the company's claim that it saved $1 billion by using "11i" were fraudulent. They say the savings resulted from Oracle's decision to lay of 2,000 employees and that the company actually knew the 11i product was "fraught with massive technical problems."

Oracle refuted the charges. "The allegations are entirely without merit and will be defended vigorously," Oracle spokeswoman Jennifer Glass told CNNfn.com earlier Thursday.

In Thursday's teleconference, Oracle executives said that headcount during the third quarter had actually risen slightly and said they will consider laying off employees as they look for more ways to cut costs.

"You'll see us controlling our costs, and one of the ways we control costs is by managing headcount," Ellison said. "I don't think there is any company out there now that is not being asked to do more with less."

Software stocks have been under a lot of pressure in the wake of Oracle's warning, as investors viewed the company's statements that its database-software business would stall as a signal that the U.S. economic downturn is having an even broader impact on the industry than previously thought.

At Thursday's regular-session close, Oracle shares stood more than 68 percent below their 12-month high of $46.46.

|

|

|

|

|

|

|