|

Wall St. surge ahead of Fed

|

|

March 19, 2001: 4:28 p.m. ET

Traders step in to boost major indexes ahead of Fed interest rate meeting

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - The major U.S. market indexes rallied Monday as traders stepped in to find bargains, but investors remained cautious ahead of the Federal Reserve's meeting on interest rates.

Despite the gains, the light volume signaled a lack of participation.

"It was a very reluctant rally but it shows how much the market can feed on itself," Timothy Ghriskey, senior equity portfolio manager with Dreyfus Corp., told CNNfn's Street Sweep. "It was a very reluctant rally but it shows how much the market can feed on itself," Timothy Ghriskey, senior equity portfolio manager with Dreyfus Corp., told CNNfn's Street Sweep.

Explaining what drove the rally, Bill Meehan, chief market analyst with Cantor Fitzgerald, said, "Some of it is short covering and some is people trying to position themselves ahead of the Fed."

The Dow industrials advanced 135.70 to 9,959.11, after briefly turning negative and dipping below 9,800. The Nasdaq erased earlier losses to jump 60.27 points, or more than 3 percent, to 1,951.18, while the S&P 500 gained 20.28 to 1,170.81.

The major indexes dipped lower midday after a US Bancorp Piper Jaffray analyst made negative comments about the personal computer sector as well as the share price for leading chipmaker Intel. The major indexes dipped lower midday after a US Bancorp Piper Jaffray analyst made negative comments about the personal computer sector as well as the share price for leading chipmaker Intel.

Traders stepped in during the last hours of trading, hoping to position and brace themselves for whatever the Federal Open Market Committee does and says about interest rates Tuesday afternoon.

"It's been typical for the market to rally into an FOMC meeting. You can't ignore it (the rally) but a lot is going to depend on the market's response to the Fed meeting tomorrow," Meehan said. "I'm watching and waiting."

The major indexes have fallen sharply recently and were due to start attracting some buying interest, said analysts. But not much was expected to happen with any real conviction until after the Fed's rate decision.

Market breadth was positive. On the New York Stock Exchange, advances led declines 1,969 to 1,101 as more than 1.11 billion shares changed hands. Winners outpaced losers on the Nasdaq 2,190 to 1,512 as more than 1.76 billion shares were traded.

In other markets, Treasury securities edged lower. The dollar rose against the yen and was little changed versus the euro.

Blue chips rally ahead of Fed

Investors sought out select stocks that looked like they had fallen far enough and were now at bargain levels. Most of the gains were made in consumer cyclical and industrial issues, seen as safer bets during times of economic uncertainty.

"You don't get a ton of people making huge bets ahead of the Fed meeting," said Art Hogan, chief market strategist with Jefferies & Co. "There's little corporate news and no economic data, so I think you'll get some bargain hunters here."

Procter & Gamble (PG: Research, Estimates) rose $1.20 to $65.90, 3M (MMM: Research, Estimates) surged $1.97 to $107.98, and DuPont (DD: Research, Estimates) gained $1.30 to $43.64.

In the last hours of trading, technology stocks joined the blue chip rally, but analysts attributed the gains to trading action ahead of the Fed.

"The focus is on the Fed tomorrow (Tuesday) and whether that will get people revived about the economy," said John Forelli, portfolio manager with Independence Investment Associates. "The market is really starting to look reasonably priced for the first time since 1998 -- relative to expectations and where interest rates are today."

IBM (IBM: Research, Estimates) rose $2.50 to $92.60, and Oracle (ORCL: Research, Estimates) gained $1.38 to $15.44.

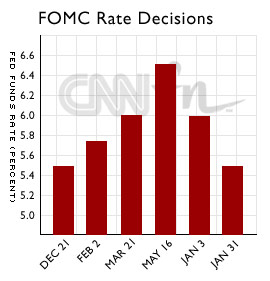

Most expectations are for the Federal Open Market Committee (FOMC), the Fed's policy-making body, to cut rates by at least a half percentage point when it meets Tuesday. So investors will be dissecting the specific language of the Fed's statement for insights into the FOMC's thinking. Most expectations are for the Federal Open Market Committee (FOMC), the Fed's policy-making body, to cut rates by at least a half percentage point when it meets Tuesday. So investors will be dissecting the specific language of the Fed's statement for insights into the FOMC's thinking.

"The rhetoric from the meeting will be the most important catalyst," Jefferies' Hogan said. But Hogan remains optimistic that the major indexes will start to trend higher once the Fed meeting is out of the way.

Charles Reinhard, senior U.S. investment strategist with Lehman Brothers, agreed. He told CNNfn's Before Hours that the two catalysts that will lift the markets higher are valuations and the Fed lowering interest rates.

Intel in the news

US Bancorp Piper Jaffray analyst Ashok Kumar said he sees no sustainable cyclical recovery in the PC sector until the second half of 2002, and expects leading chipmaker Intel (INTC: Research, Estimates) to retest its valuation lows of 1998.

Shares of Intel, both a Dow and Nasdaq component, fell 81 cents to $27.06.

Verizon Wireless, the No. 1 U.S. wireless service provider, said it agreed to a three-year, $5 billion contract with Lucent Technologies, making the troubled equipment maker Verizon's biggest supplier of the latest wireless technology. Lucent's (LU: Research, Estimates) shares rose $1.98 to $11.97. Verizon's (VZ: Research, Estimates) shares advanced $1.55 to $48.88.

Corning (GLW: Research, Estimates) gained $2.02 to $25.20 after the fiber-optic networking company warned its earnings per share for 2001 will miss Wall Street estimates. Corning (GLW: Research, Estimates) gained $2.02 to $25.20 after the fiber-optic networking company warned its earnings per share for 2001 will miss Wall Street estimates.

Analysts said it was not unusual to see Corning's stock hold up because the whole sector has taken a beating recently. Other fiber-optic stocks were mixed.

Ciena (CIEN: Research, Estimates) slipped 38 cents to $52.44, while JDS Uniphase (JDSU: Research, Estimates) advanced $2.19 to $24.63.

|

|

|

|

|

|

|