|

Wall St.'s anxious wait

|

|

March 19, 2001: 7:59 a.m. ET

Investors wary of obstacles before key Fed meeting on interest rates

|

NEW YORK (CNNfn) - A beat-up, battered Wall Street has to get through an anxious Monday before it gets to what every investor is waiting for this week: a Federal Reserve meeting, at which the central bank's policymakers are expected to cut interest rates.

A bit of a recovery after last week's huge decline was in the offing, if futures trading was any indication. Nasdaq-100 futures rose about 1 percent, pointing to a higher start for the Nasdaq market. Standard & Poor's futures were slightly higher, signaling a positive start for the S&P 500 and Dow Jones industrial average.

It's widely expected that Tuesday's Fed meeting will result in a half percentage point cut in interest rates, which would be the third such cut this year as the central bank tries to ward off recession. But some investors are hoping for a bigger, three-quarter point cut.

In the meantime, investors will have their antennae up, particularly for more of the profit warnings that have plagued stocks for much of the past year.

Wall Street is getting mixed signals from markets around the world. Major Asian markets edged lower Monday, although Tokyo's decline came just before the Bank of Japan announced an interest rate cut to near zero. European markets rose, with London getting a lift from a mining deal involving Billiton and Australia's BHP.

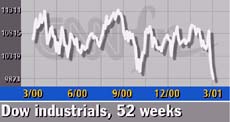

It will take quite an effort for Wall Street to do as poorly as it did last week. The Dow Jones industrials begin this week at 9,823.41 after losing a record 821 points, or 7.7 percent, last week. The Nasdaq composite index, at 1,890.91, is at its lowest point since November 1998. The S&P 500 begins at 1,150.53 after dropping 6.7 percent last week. It will take quite an effort for Wall Street to do as poorly as it did last week. The Dow Jones industrials begin this week at 9,823.41 after losing a record 821 points, or 7.7 percent, last week. The Nasdaq composite index, at 1,890.91, is at its lowest point since November 1998. The S&P 500 begins at 1,150.53 after dropping 6.7 percent last week.

Treasury prices fell early Monday, sending yields upward. The 10-year note yield rose to 4.79 percent from 4.76 percent late Friday, while the 30-year bond yield increased to 5.28 percent from 5.27 percent.

The dollar slipped slightly against the yen and euro.

In the advertising industry, there's a published report that Interpublic Group (IPG: Research, Estimates) is buying True North Communications (TNO: Research, Estimates) for $2.1 billion, or $40.24 a share. True North shares rose $1.31 Friday to $39.31. Interpublic shares fell 70 cents Friday to $35.30. In the advertising industry, there's a published report that Interpublic Group (IPG: Research, Estimates) is buying True North Communications (TNO: Research, Estimates) for $2.1 billion, or $40.24 a share. True North shares rose $1.31 Friday to $39.31. Interpublic shares fell 70 cents Friday to $35.30.

And Verizon Wireless, the No. 1 U.S. wireless service provider, said Monday it agreed to a three-year, $5 billion contract with Lucent Technologies, making the troubled equipment maker Verizon's biggest supplier of the latest wireless technology.

Lucent's (LU: Research, Estimates) shares ended Friday at $9.99, down $1.05. Verizon's (VZ: Research, Estimates) shares fell 72 cents to $47.33.

|

|

|

|

|

|

|