|

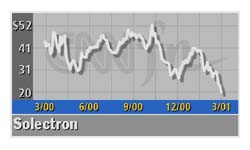

Solectron meets, warns

|

|

March 19, 2001: 5:15 p.m. ET

Contract manufacturer tops expectations, sees slowdown

|

NEW YORK (CNNfn) - Solectron Corp. reported a fiscal second-quarter profit Monday that narrowly beat the Street's expectations but said it expects to report third-quarter earnings amounting to about half what it previously had anticipated.

The company also said it is in the process of eliminating roughly 10 percent of its global work force as it faces slowing and uncertain demand for its services.

After the close of trading, Solectron, the leading supplier of contract electronics manufacturing services, or EMS, said it earned 30 cents per share during the quarter ended March 2, excluding extraordinary charges.

Analysts had generally expected the company to post a profit of 29 cents per share during the quarter, according to a survey conducted by earnings tracker First Call.

At $5.4 billion, Solectron's second-quarter revenue rose 85.5 percent from the same period last year.

However, executives at Solectron, which manufactures a range of products for high-tech outfits such as Ericsson, Cisco, IBM and others and then stamps the other companies' brand-names on them, said softening demand has cut into the company's profits.

"With significantly lower customer demand we are unable to support our recent levels of employment, and we have been reducing our work force at many sites," Koichi Nishimura, Solectron's chairman and chief executive, said in a statement.

"In addition, we will implement a plan to balance our capacity and capabilities as we prepare the organization for a re-acceleration of growth," Nishimura added. During the second quarter, Solectron recorded a restructuring charge of $25.2 million to consolidate its recently acquired NatSteel Electronics sites in Guadalajara, Mexico, and Budapest, Hungary, into existing Solectron sites.

Including one-time charges and the amortization of goodwill and other intangible items, Solectron reported second-quarter net income of $121.9 million, or 18 cents per share. In addition, Solectron said it expects to record a charge against earnings of between $300 million and $400 million over the next two quarters as it restructures additional facilities, relocates certain capabilities and changes the strategic focus of a number of sites based on anticipated future customer requirements.

The charge will cover employee severance, facilities, equipment and applicable facility and equipment-lease termination costs, and the write-off of goodwill associated with affected facilities, Solectron said.

In connection with the anticipated restructuring, Solectron said it expects to cut about 8,200 jobs from its total work force of 79,000.

During the quarter, Solectron, which has been on an acquisition tear, completed three transactions: the acquisition of NatSteel Electronics, a Singapore-based EMS company; the former Sony Corp. facilities in Nakaniida, Japan, and Kaohsiung, Taiwan; and the former IBM product repair facility in Amsterdam, establishing a significant European hub operation for Solectron's Global Services business.

Looking ahead, Solectron said it now expects to report an operating profit ranging between 12 cents and 16 cents per share on sales of between $4.1 billion and $4.5 billion in the current quarter, which ends June 1.

The Street had generally expected Solectron to report a fiscal third-quarter operating profit of 31 cents per share, according to the First Call survey.

Solectron executives said they could not provide financial guidance for the fiscal fourth-quarter because of the uncertain picture of customer demand.

Shares of Solectron (SLR: Research, Estimates) rose $1.39 to $21.49 on the New York Stock Exchange ahead of the earnings announcement Monday.

|

|

|

|

|

|

|