|

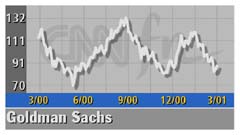

Goldman tops 1Q forecast

|

|

March 20, 2001: 1:14 p.m. ET

Investment bank's profit falls from year-earlier level but easily beats target

|

NEW YORK (CNNfn) - Goldman Sachs Group Inc. handily beat first-quarter earnings forecasts Tuesday even though its profit fell from year-earlier levels.

The investment bank said it earned $768 million, or $1.40 a diluted share, in the quarter ended Feb. 23, above average forecasts of $1.29 a share on Wall Street. The company earned $887 million, or $1.76 a share, a year earlier.

Net revenue from global capital markets financial advising rose to $730 million from $583 million a year earlier, and its revenue from equities increased to $1.2 billion from $858 million. Net revenue from global capital markets financial advising rose to $730 million from $583 million a year earlier, and its revenue from equities increased to $1.2 billion from $858 million.

Goldman cited strength in equity arbitrage as well as the contribution of Spear Leeds & Kellogg, the New York Stock Exchange specialist firm it acquired Oct. 31, 2000.

But its underwriting revenue fell to $415 million from $653 million, and the company posted a $140 million loss from principal investments, due to unrealized losses on the firm's investments in the high technology and telecom sectors. The firm posted net revenue of $214 million from those investments a year earlier.

Goldman did not change its forecasts or earnings guidance going forward. But the company acknowledged it faces a much tougher economic outlook, given current market conditions.

"There is no question that current economic and market activity have slowed considerably," CEO Henry M. Paulson Jr. said. "Recognizing the environment, we have increased our focus on controlling expense growth and driving efficiency. That said, we remain confident in Goldman Sachs' long-term growth potential."

Click here for a look at financial stocks

Analysts said that things the results were good given the drop in merger and acquisition and initial public offering activity compared with the year-earlier activity.

The results were "very impressive, especially given the market environment," Tim Ghriskey, portfolio manager of Dreyfus Fund, told Reuters. "Clearly the trading business made the quarter, helped by Spear Leeds, which obviously distorted it a little bit."

While net revenue from M&A advising rose 25 percent in the quarter, Goldman said the outlook for that sector and IPOs was weak. It said it was looking to cut non-compensation costs and said employee head count will be flat this year.

"We will continue to look at businesses strategically (and) those that we think are underperforming businesses, we would either reduce or get out of," said David Viniar, the company's chief financial officer, during a conference call. He declined to identify those businesses.

Shares of Goldman (GS: Research, Estimates) gained 4 cents to $90.98 in midday trading Tuesday.

-- from staff and wire reports

|

|

|

|

|

|

|