|

Tyson-IBP merger set?

|

|

March 20, 2001: 11:01 a.m. ET

SEC probe into IBP done; IBP 4Q drops 60%; company takes $60M charge

|

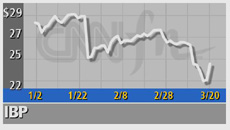

NEW YORK (CNNfn) - IBP Inc. expects Tyson Foods Inc. will consummate its $3.2 billion takeover now that regulators have completed their investigation into the nation's biggest meatpacker.

The Securities and Exchange Commission have finished their probe into IBP, opening the way for the two firms to complete their merger.

"We are pleased to report that all outstanding issues involving the SEC's financial review, as well as the accounting issues related to DFG, have now been resolved," said IBP Chairman and CEO Robert Peterson. "Today's earnings release brings this matter to a close and we now look forward to proceeding with the Tyson transaction."

IBP (IBP: Research, Estimates) said an internal investigation of its DFG Foods Subsidiary did reveal "potential manipulation of financial records and product theft," as well as mismanagement by former DFG managers. The company also said it would use the results of its audit as the basis for legal action it may take to recover its losses.

A Tyson spokesman said it was too early to determine the effect of the latest IBP announcement. A Tyson spokesman said it was too early to determine the effect of the latest IBP announcement.

On Jan. 1, Springdale, Ark.-based Tyson (TSN: Research, Estimates), the largest U.S. chicken producer, won the bidding war against Smithfield Foods (SFD: Research, Estimates), the No. 1 U.S. pork processor, for IBP. The takeover has been delayed several times.

Terms of the merger agreement called for Tyson to pay $30 per share cash for 50.1 percent of IBP's outstanding shares and the equivalent of $30 per share in stock for the remaining stake. Tyson will also assume $1.5 billion in IBP debt, up slightly from its original projection of $1.4 billion.

In February, Tyson terminated its cash tender offer for 50.1 percent of IBP Inc., but said it would try to acquire the company through a cash election merger, where IBP investors can choose cash or Tyson stock for their shares.

Tyson beat out rival Smithfield Foods (SFD: Research, Estimates), the No. 1 U.S. pork producer, in the bidding war for IBP.

The SEC investigation led to IBP taking a one-time, pre-tax charge of $60.4 million related to its acquisition of DFG, a Chicago-based hors d'oeuvres and appetizer maker it bought in 1998. The charge turned out to be much lower than the $108 million previously estimated.

Click to check other food and beverage stocks

IBP also reported Tuesday a 60 percent drop in fourth-quarter results, missing Wall Street forecasts, as the nation's biggest meatpacker got hurt by possible accounting irregularities at a subsidiary and higher costs.

The Dakota Dunes, S.D.-based company also said it expects 2001 earnings between $1.80 and $2.20 a share, ahead of analysts' average estimate of $1.54 a share, according to earnings tracker First Call.

For the quarter ended Dec. 30, 2000, IBP reported earnings before unusual items of $35 million, or 33 cents a share, down from $88 million, or 82 cents a share, a year earlier. Analysts on average had expected IBP to earn 40 cents a share, according to First Call.

Including $41 million in charges from accounting irregularities, IBP reported a fourth-quarter loss of $6 million, or 6 cents a share, compared with earnings of $77 million, or 71 cents a share. Fourth-quarter sales edged up to $4.4 billion from $4.1 billion.

The company also said higher raw material costs hurt earnings even though consumer demand for fresh beef and pork remained strong.

Tyson shares fell 73 cents to close at $12.74 Tuesday while IBP gained $1.30 to $23.75.

-- from staff and Wire reports

|

|

|

|

|

|

|