|

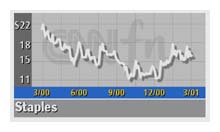

Staples pulls tracking IPO

|

|

March 20, 2001: 5:32 p.m. ET

Office supply retailer to convert Staples.com shares; QK postpones IPO

|

NEW YORK (CNNfn) - Staples Inc., the nation's No. 2 office supply retailer, withdrew Tuesday the planned IPO of a tracking stock that would reflect the performance of its online units.

Framingham, Mass.-based Staples (SPLS: Research, Estimates) plans to merge Direct, its small-business and consumer catalog business, with Staples.com. Subject to shareholder approval, the company expects to convert Staples.com stock into Staples Inc. common stock.

Staples will convert each Staples.com issued and outstanding share into 0.4396 share of Staples RD stock, the name of the company's common stock. The same formula will be used to convert Staples.com options into Staples common stock options, the company said in a statement.

At the same time, Staples RD stock will be renamed Staples common stock. At the same time, Staples RD stock will be renamed Staples common stock.

In November 1999, Staples shareholders approved the company's plans to create a separate Staples.com stock to reflect the performance of the company's e-commerce businesses. Staples.com stock reflected the operations of three different e-commerce sites -- staples.com, quillcorp.com and stapleslink.com.

"By combining Direct and Staples.com, we'll be able to operate more effectively and efficiently with a unified merchandising team, a unified marketing team and a unified customer support team," said Staples Inc. CEO Thomas Stemberg. "The integration also will allow us to eliminate the administrative costs that come from operating separate business units."

Jeanne Lewis, president of Staples.com, will now serve as president of Direct.com, leading the unified Direct and Staples.com business.

Shares for Staples dropped 50 cents to close at $15.75 Tuesday.

QK postpones

QK Healthcare Inc., a national wholesale distributor of selected healthcare products, postponed its IPO Tuesday, underwriters on the deal said.

The IPO was expected to price last week, and had been slated to price Tuesday and trade Wednesday. The underwriter declined to say whether QK would formally file with the Securities and Exchange Commission to withdraw the offering.

Ronkonkoma, N.Y.-based QK Healthcare had planned to offer 11 million shares at $14-to-$16 each via lead underwriter Lehman Brothers.

QK sells branded and generic pharmaceutical and medical/surgical products. The company had planned to trade under the New York Stock Exchange symbol "KRX."

|

|

|

|

|

|

|