|

Fed cut hinges on size

|

|

March 20, 2001: 9:22 a.m. ET

In central bank's next move, the question is 'how much?'

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - Federal Reserve policy makers started meeting Tuesday and were widely expected to cut interest rates for the third time this year in a bid to keep the United States from slipping into recession -- but the question for Wall Street was not if but how much.

Economists are divided over whether the central bank will cut rates by half a percentage point or by a bigger three-quarters of a point, which many hard-hit stock investors want.

A slowdown that began last summer threatens to end 10 straight years of economic growth, the longest on record in the United States. But in a new twist for policy makers, a period of record stock ownership among Americans has coincided with a big drop in stock prices.

That has many experts arguing whether the central bank should respond to stock market losses that could hurt consumer spending and thus become a bigger-than-ever drag on the economy.

John Lonski, economist at Moody's Investors Service, hopes the Fed cuts rates by three-quarters of a point to purge the market of its "irrational pessimism" that threatens the expansion. John Lonski, economist at Moody's Investors Service, hopes the Fed cuts rates by three-quarters of a point to purge the market of its "irrational pessimism" that threatens the expansion.

"If the Fed only (cuts by half a percentage point), it risks putting downward pressure on equity prices," said Lonski. "The Fed is dealing with the unknown of how much more pervasive stock ownership is today."

But William Sullivan, a money market economist at Morgan Stanley Dean Witter, forecasts a half-point reduction. He says policy makers are concerned, but not alarmed, by weakening growth. Sullivan puts the chance of a larger cut at only one-in-seven, in part because of the central bank's unwillingness to appear that it stands ready to bail out the stock market.

The Dow Jones industrial average, which suffered its worst weekly point loss last week, tumbling 821 points, bounced back a bit Monday but, many investors believe, could still use a bailout.

"I hope it's (three-quarters of a percentage point) because that's what I think the market is really looking for," Nick Angilletta, global head of retail sales at Salomon Smith Barney, told CNNfn's The Money Gang Monday.

Cheaper money

But despite the stock market's increasing ties to the economy, the so-called "wealth effect," though it seems logical, is difficult to prove. "It's hard to quantify," Morgan Stanley's Sullivan said.

Either way, with consumer and business spending slowing, lower interest rates could eventually cut the cost of mortgages, credit card payments and car loans and turn around Corporate America's weakening profit outlook.

Steven Wood, economist at FinancialOxygen.com, is calling for the larger rate cut. Still, he points out that Alan Greenspan, the Fed chairman, can wait to lower borrowing costs later this year if needed. The Fed meets again in May.

"The deterioration in economic activity would argue for a more aggressive move, but the Fed has rarely moved by more than (half a point) during Greenspan's tenure," Wood said.

Greenspan showed up at about 8 a.m. ET and the meeting started roughly an hour later, Reuters reported. Greenspan showed up at about 8 a.m. ET and the meeting started roughly an hour later, Reuters reported.

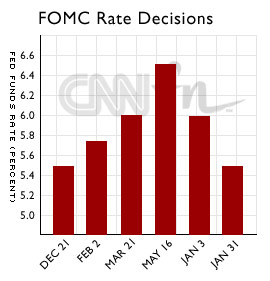

Tuesday's meeting comes after a busy January. The central bank cut rates by a half-percentage point on Jan. 3 and again on the 31st, bringing the federal funds rate that banks charge each other for overnight loans to 5.5 percent.

In a Reuters survey, 14 of 25 primary dealers of U.S. government securities expect the Fed's policy-setting Federal Open Market Committee (FOMC) to lower its target rate for fed funds by half a point. The other 11 firms forecast a three-quarter point cut.

When it comes to the rate debate, no one disagrees that the economy has weakened. During the final three months of 2000, the nation's gross domestic product fell to its lowest levels in 5-1/2 years.

Corporate profits have tumbled and equity prices have followed. The Nasdaq composite index is down more than 62 percent from its record high hit last year, and the S&P 500, a broader index, is in bear market territory for the first time since 1987.

The market losses could crimp the confidence and spending habits of American consumers who have poured trillions of dollars into stocks during the 1990s and whose spending accounts for about two-thirds of gross domestic product.

The Fed's announcement is due Tuesday afternoon.

|

|

|

|

|

|

|