|

Sun rolls out new servers

|

|

March 21, 2001: 8:07 a.m. ET

'Sun Fire' systems are the lastest salvo in ongoing market share battle

By Staff Writer Richard Richtmyer

|

NEW YORK (CNNfn) - Sun Microsystems on Wednesday is unveiling its latest weapon in the ongoing battle for market share among the leading suppliers of network servers used to power Internet-based businesses.

Called Sun Fire, the new servers are built around the company's hotly-anticipated and oft-delayed UltraSparc III microprocessors and run the latest version of Sun's Unix operating system, called Solaris 8.

The Sun Fire systems are priced starting at $75,000 and are being aimed squarely at similarly priced products from companies, including IBM and Hewlett-Packard, which recently have stepped up their efforts in the potentially lucrative market for mid-price range servers.

As have the competing mid-range server offerings recently introduced by IBM and Hewlett-Packard, the Sun Fire systems incorporate features previously found in more expensive mainframe computers. For example, they use technology that enables users to upgrade the processors and other components without shutting down the system.

Competition in the market for mid-range servers has become increasingly fierce during the past year amid strong demand for such systems as corporations move ahead with plans to shift their businesses onto the Internet.

For its part, IBM has been very aggressive in its server efforts, taking aim specifically at the mid-range Unix server market and making it very clear that it aims to unseat Sun as the leader there.

Hewlett-Packard also has upped its efforts in the mid-range Unix server market with the introduction of its "SuperDome" server. However, HP executives have acknowledged that sales of those products, which only recently began shipping, have not been as robust as they had expected.

The latest industry data from technology research firm International Data Corp. show that IBM outpaced its competitors in the market for mid-range servers, posting a 29 percent market share gain in that segment.

At the same time, IDC's data showed that Sun overtook IBM as the top supplier of servers in the United States.

"It's more bad news for the competition," Scott McNealy, Sun's chairman and chief executive, said in a statement.

"After a year in which IBM and HP threw everything they could at us, including old products with new names and new products with 'super' names, we still took market share away from them," McNealy added. "This time we're tearing into what those re-branded mainframe makers thought was their safe haven -- continuous up time, round-the-clock availability, and investment protection -- and bringing it to customers who understand the value of a dollar."

IBM fires back

Not to be outdone, IBM will be making an announcement of its own Wednesday. The company is expected to reveal for the first time an element of its battle plan against Sun that it says has helped it snare many of Sun's former customers.

An IBM spokesman said Tuesday that the company about 16 months ago deployed a "rapid deployment instructional program" designed to move Sun customers using the Solaris operating system over to AIX, IBM's Unix operating system.

So far, more than 1,000 server system administrators specializing in the Solaris operating system have completed the program, called the AIX for Solaris Administrators Project, or ASAP, according to IBM spokesman Jim Larkin. So far, more than 1,000 server system administrators specializing in the Solaris operating system have completed the program, called the AIX for Solaris Administrators Project, or ASAP, according to IBM spokesman Jim Larkin.

"ASAP has helped IBM take more than $150 million worth of Unix business from Sun since its inception," Larkin said.

IBM's deployed the ASAP training sessions in geographic regions with heavy concentrations of Sun customer accounts, Larkin said.

The classes are designed to get Solaris administrators up and running on AIX rapidly, with attendees receiving lab exercises, hands-on AIX instruction and related Web training. The class also prepares customers to take the IBM Certification Test for AIX System Administration, Larkin said.

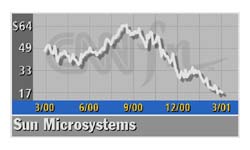

Shares of Sun Microsystems (SUNW: Research, Estimates) fell $1.69 to $17.37, an 8.9 percent decline in a down day for the Nasdaq Tuesday. The company's stock has fallen more than 73 percent from a 12-month high of $64.65.

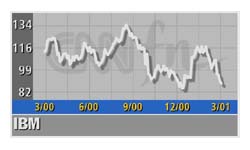

IBM (IBM: Research, Estimates) shares fell $4.30, or 4.6 percent, to $88.30 on the New York Stock Exchange on Tuesday, putting them more than 34 percent below their 12-month high of $134.93.

|

|

|

|

|

|

|