|

Barrett rejects Shell

|

|

March 23, 2001: 12:00 p.m. ET

U.S.-based gas producer rejects $1.8 billion takeover bid from Shell

|

NEW YORK (CNNfn) - The saga between Shell Oil Co., a unit of Royal Dutch/Shell Group, and Barrett Resources Corp. grew more complex as Barrett's board of directors unanimously rejected Shell's $1.8 billion takeover bid.

Barrett's board said late Thursday that Shell's $55 cash offer is an inadequate attempt to buy the firm at a price advantageous to Shell. Barrett recommended that its shareholders reject the buyout attempt.

"The Shell offer undervalues Barrett and does not reflect the current or long-term values inherent in the company," the company said in a statement.

Shell then countered that it was disappointed with Barrett's board decision and said its $55 offer "represents full and fair value for the company." Shell will review future options in light of Barrett's decision.

"Barrett offered essentially no new factual information about its business that had not already been factored into Barrett's share price prior to Shell's 24 percent premium proposal," Shell said in a statement.

Barrett is a natural gas and oil exploration and production company, focused mainly on the United States, mostly in the Rocky Mountain states of Colorado, Wyoming and Utah. Barrett is a natural gas and oil exploration and production company, focused mainly on the United States, mostly in the Rocky Mountain states of Colorado, Wyoming and Utah.

Shell, which has been trying to build up its gas assets, is also trying to complete gas purchases of New Zealand's Fletcher Challenge Energy and Woodside Petroleum in Australia, where it has run into political opposition.

On March 7, Shell proposed a cash acquisition of Barrett Resources at a price of $55 per share and said it would launch an offer for all outstanding shares if Barrett's board did not agree to the proposal. In addition to the cash offer, Shell said it would assume some $400 million in debt.

At that time, Denver-based Barrett (BRR: Research, Estimates) shunned the $1.8 billion takeover bid and invited other companies to make competitive bids. Barrett also directed its management to pursue strategic alternatives.

On March 12, Shell bypassed Barrett's board and offered its deal directly to shareholders. Shell's offer was conditional on it winning a majority of Barrett stock, and shareholders have until midnight April 6 to decide what to do. Barrett Resources Corp. then said it would consider the $1.8 billion bid.

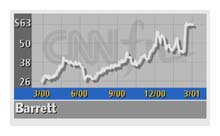

Barrett shares have climbed 34 percent since the announcement of Shell's takeover bid earlier this month. Barrett shares gained 75 cents to $61.75 Friday in midday trading.

|

|

|

|

|

|

|