|

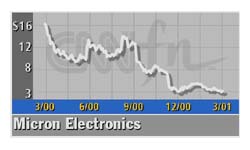

Micron logs loss, flees PCs

|

|

March 23, 2001: 1:18 p.m. ET

PC and memory units account for bulk of company's $168.9 million loss

|

NEW YORK (CNNfn) - Micron Electronics on Friday reported a wide fiscal second-quarter loss, where the Street had been expecting a profit, and the company said it is preparing to sell off its struggling personal computer business.

Before the U.S. markets opened, Micron Electronics, which is majority-owned by chipmaker Micron Technology, said its net loss for the quarter was $168.9 million, or $1.75 per share. Analysts had generally expected to company to report a profit of 2 cents per share during the quarter.

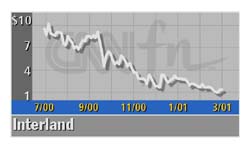

In a teleconference with analysts Friday, executives at Micron Electronics downplayed the wide disparity between the reported quarterly results and the Street's expectations, focusing instead on their newly-announced merger with Interland, an Internet-hosting firm.

Under the terms of a definitive merger agreement, Micron Electronics agreed to buy Interland for roughly $130 million in stock. When completed, the transaction will create the third-largest Web hosting company in the United States.

The deal is part of a broader shift in Micron Electronics' business focus. The Nampa, Idaho-based company makes PCs, memory modules and provides Web hosting services.

But Micron Electronics also said Friday it will divest all of its businesses except for the Web hosting business.

The company said it has forged an agreement with a private technology-equity investment firm which will buy its PC business, called Micronpc.com, although it would not disclose the name of the firm nor the amount it expects to receive for the unit.

At the same time, Micron Electronics said it will sell its memory-module business, called SpecTek, back to Micron Technology. The net result of that transaction, which includes certain real estate and intellectual property, will give Micron Electronics about $42 million, the company said.

The bulk of the company's fiscal second-quarter losses came from those units, which Micron Electronics' Chief Financial Officer James Stewart said lost a combined $159 million.

Stewart said the company expects the SpekTek transaction to be completed by the end of March, and said his "best estimate" for the completion of the PC business sale is by the end of the current quarter.

Prior to the completion of the PC unit sale, Stewart said the company will lay off roughly 400 of its employees, or 20 percent of the total.

"We saw a significant slowdown in PC revenue and this action is needed to rightsize the PC headcount," he said.

Executives would not say when they expect the merger with Interland to be completed.

Excluding the operating results of the businesses Micron Electronics is planning to sell, the company said its loss for the fiscal second-quarter amounted to $9.7 million, or 10 cents per share.

The merger plan still needs approval by shareholders in both companies and federal regulators. The merged company will be headed by Micron Electronics Chairman Joel Kocher, who will be chairman and chief executive officer, and Interland Chief Executive Ken Gavranovic, who will become vice chairman. The merger plan still needs approval by shareholders in both companies and federal regulators. The merged company will be headed by Micron Electronics Chairman Joel Kocher, who will be chairman and chief executive officer, and Interland Chief Executive Ken Gavranovic, who will become vice chairman.

Micron Electronics had delayed its earnings report, which also pushed the release of Micron Technology earnings back until next week. Analysts expect the company to report a loss of a penny per share.

Shares of Micron Electronics (MUEI: Research, Estimates) were down 16 cents at $3.28 in Nasdaq trade Friday. At the same time, Interland (ILND: Research, Estimates) shares were up 41 cents at $2.16.

|

|

|

|

|

|

|