|

Bad timing on Wall St.

|

|

March 25, 2001: 7:00 a.m. ET

After a tough stretch for stocks, the bad news may not be over

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - For the fast-falling U.S. stock market, the timing couldn't be worse. The week ahead brings the first quarter's final five days, a period when companies often reveal they won't meet Wall Street's profit forecasts.

These warnings could get ugly amid an economic slowdown poised to hand corporate America its worst quarter for earnings in a decade.

"Normally the peak [profit warning] weeks would be [this] week and the two weeks after that," said Chuck Hill, director of research at earnings tracker First Call. And that's not all. Hill expects a record number of warnings from companies who next month report actual results for the January-March period.

For the first quarter, analysts surveyed by First Call forecast profits among companies in the Standard & Poor's 500 index falling 7.2 percent, on average. That tally, if it holds, would be the worst quarter since 1991.

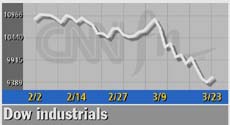

Earnings weakness has spelled trouble for Wall Street. Last week, the Dow Jones industrial average briefly entered bear market territory, while the Nasdaq composite index closed as much as 63.7 percent below its record high. The S&P 500 remains 20 percent off its peak hit last year. Earnings weakness has spelled trouble for Wall Street. Last week, the Dow Jones industrial average briefly entered bear market territory, while the Nasdaq composite index closed as much as 63.7 percent below its record high. The S&P 500 remains 20 percent off its peak hit last year.

Still, Charles Pradilla, chief market analyst at SG Cowen Securities, sees opportunities, particularly in hard-hit tech stocks.

"I think we are way overdue for a rally," said Pradilla, who figures the Nasdaq in the short-term could rise about 15 percent above its intraday low of 1,794.21 hit last week. As last week ended, the market did post gains.

Bond yields, Pradilla said, are getting low enough to draw investors into stocks, whose prices have cheapened dramatically this year. And the Federal Reserve, which cut interest rates last week for the third time this year, is expected to do so again in May. Historically, periods of falling rates are good for stocks.

Bottom gazing

Still, few analysts are ready to call a bottom for a market that has regularly defied such predictions. First Call's Hill says profits may not reach their nadir until the fourth quarter of this year – or beyond.

And John Lonski, chief economist at Moody's Investors Service, says the worst may not be over for stocks even amid some of the most attractive prices in months. And John Lonski, chief economist at Moody's Investors Service, says the worst may not be over for stocks even amid some of the most attractive prices in months.

Lonski calls the stock market this week's most important economic indicator for its ability -- with a rally or plunge -- to inflate or sour consumer sentiment, which has dropped sharply this year.

A closely watched gauge of consumer confidence comes Tuesday. The Conference Board's index of sentiment is expected to have fallen to 105 in March, according to economists surveyed by Briefing.com, from February's reading of 106.2, which was already a 4-1/2-year low.

The sentiment of consumers, whose spending fuels about two thirds of gross domestic product, has darkened in recent months amid falling stock prices and increased layoffs.

Charles Schwab (SCH: Research, Estimates), DoubleClick (DCLK: Research, Estimates) and Procter & Gamble (PG: Research, Estimates) all announced payroll reductions last week. Still, the job market has held up reasonably well. The nation's unemployment rate in February remained unchanged at 4.2 percent, nearly a 30-year low. But most economists say they believe the job market's best days are behind it.

In other economic news, Monday brings February's existing home sales data. Home sales are expected to fall to an annual rate of 5.04 million.

February's new home sales, meanwhile, are expected to slip to 912,000 from 921,000 in January.

But even with the declines, the housing market remains in fairly good shape.

The same can't be said for the final reading on the nation's gross domestic product for the last three months of 2000. It's expected to confirm that the economy grew at its slowest rate in 5-1/2 years in the fourth quarter.

Orders for durable goods in February, meanwhile, are expected to rise 0.5 percent following a 6 percent decline in January. But the figures, due Thursday, often swing wildly month to month.

Walgreen, PG&E report

The week ahead brings few high-profile profit reports. Walgreen Co. (WAG: Research, Estimates), the drugstore chain, is expected to post a gain in profits, with earnings per share rising to 28 cents from 23 cents in the year-ago period.

Palm Inc (PALM: Research, Estimates), the maker of handheld computing devices, is expected to report that quarterly profits fell to 1 cent a share from 3 cents in the year-ago period.

Two of the nation's most influential figures in finance will hit the speaking circuit in the days ahead. Alan Greenspan, the Federal Reserve chairman, headlines the speakers at the National Association of Business Economists on Tuesday. And Treasury Secretary Paul O'Neill will address the association on the same day.

O'Neill and his predecessors have talked about the importance of a strong dollar.

Officials at the Treasury Department have gotten what they want in that area. Typically, the dollar falls as the U.S. economy and stock market weaken. But the dollar has surged against the euro and yen this year.

"The usual tools to forecast the dollar have broken down," said Marc Chandler, chief currency analyst at Mellon Bank.

The dollar's strength could make it tougher for U.S. exporters to sell products overseas. And the dollar's buoyancy could also pose problems for multinational companies which must convert overseas profits into dollars.

And more bad profit news from corporate America could give investors one more reason to worry about stocks following a week when the New York Daily News and the New York Post both put the stock market on their covers with the same headline: "Mad Dow Disease."

|

|

|

|

|

|

|