|

J&J buys Alza for $11.8B

|

|

March 26, 2001: 7:08 p.m. ET

Drugmaker J&J bids $11.8B stock for California drugmaker, no collar

|

NEW YORK (CNN) - Drug and health products maker Johnson & Johnson agreed to buy California drugmaker Alza in a $11.8 billion stock purchase, according to published reports Monday.

The boards of both companies met late Monday, approved the transaction and were wrapping up the deal, the interactive version of the Wall Street Journal said. However, no announcement is expected Monday, a source told CNNfn.com.

Terms of the deal call for Johnson to offer a fixed exchange ratio of 0.49 of its share for each Alza share. Based on J&J's closing share price of $85.38 Monday, the purchase values Alza at $41.8362 a share. The transaction does not include a collar, the WSJ said.

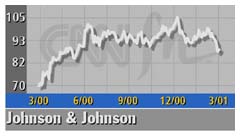

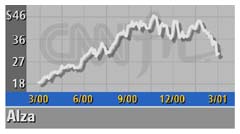

News of the deal caused Alza shares to skyrocket, climbing $8.70, or 28.95 percent, to $38.75 Monday. Shares for J&J meanwhile dropped $2.83 to $85.38. News of the deal caused Alza shares to skyrocket, climbing $8.70, or 28.95 percent, to $38.75 Monday. Shares for J&J meanwhile dropped $2.83 to $85.38.

Johnson & Johnson (JNJ: Research, Estimates), which makes personal care products such as Band-Aids and baby shampoo as well as prescription drugs and medical devices, wants to expand its pharmaceutical business.

Both the Financial Times and Wall Street Journal had reports of the deal Monday, citing unnamed sources familiar with negotiations.

The FT pegged the deal at more than $8 billion while the Journal said the offer would be $42 to $48 a share, or a premium of between 28 percent and 33 percent from Friday's close for Alza (AZA: Research, Estimates), when its shares gained $2.55 to $30.05.

Alza has a promising line-up of products under development, and a strong presence in urology and oncology, the Financial Times said. The Journal report said J&J is attracted to its business of drug delivery products.

Johnson & Johnson declined comment. A spokesman for Mountain View, Calif.-based Alza also declined to comment "on rumors."

Too much?

For Johnson & Johnson, the deal would be an unusually large acquisition, beating the $4.9 billion it paid for biotechnology group Centocor in July 1999.

Johnson & Johnson would not be paying too hefty a premium for Alza at $48 a share, analysts said. A $48-per-share buyout would represent a near 60 percent premium to Alza's $30.05 closing share price Friday. However, Alza shares traded in a higher range, $40-to-$46 a share, the prior six months.

"If you look at Alza's chart you will see that they traded at $40 for last six-to-eight months, so perhaps this is not such a huge premium," said analyst Girish Tyagi, of ABN AMRO Inc.

Johnson & Johnson will gain a strong franchiser of drug delivery technologies, especially patch delivery of drugs, Tyagi said.

"This is not a horrendous price to pay for Alza," said another analyst who declined to speak on the record. "They get a couple of drugs — Ditropan XL and Concerta -- which they already co-market with Alza. There are also some things in the pipeline."

The Alza acquisition would fit into J&J's strategy of mixing small deals with medium-sized purchases; the Alza buyout would represent a medium-sized deal. It also would end a period of uncertainty for Alza, which called off a $7.3 billion purchase by Abbott Laboratories (ABT: Research, Estimates) that it agreed to in 1999 because of antitrust concerns.

At $48 a share, the deal will be probably be dilutive by 15 cents to 20 cents in the first year and then 10 cents to 15 cents in 2002, said analyst Kurt Kroger, of Bank of America Montgomery. At $48 a share, the deal will be probably be dilutive by 15 cents to 20 cents in the first year and then 10 cents to 15 cents in 2002, said analyst Kurt Kroger, of Bank of America Montgomery.

If true, the Alza transaction would be a strategic buy for J&J, Kroger said. J&J's pharmaceutical line has dried up and the 102-year-old company is under pressure to come up with a blockbluster drug.

J&J's anti-anemia drug Procrit, which goes by the name EPO, will be facing competition from partner Amgen, which is forming its own version of the drug. At about $3.2 billion sales in 2001, EPO is a blockbuster-type drug for J&J, Kroger said.

The company's antipsychotic drug, Risperdal, will also be facing competition -- from Pfizer, which will be introducing its own antipsychotic drug. Risperdal, at $1.7 billion sales, is one of the larger drugs for J&J.

"Over the past couple decades J&J never had a blockbluster but they also felt they never were at risk. Turns out they do have blockbusters," Kroger said.

Alza, with about $1.2 billion revenue, will give J&J an impressive pipeline of products including Concerta, which treats attention-deficit disorder, and Ditropan, for overactive bladders.

"These products in the hopper are potentially blockbuster status," Kroger said. "I think it's a great deal."

|

|

|

|

|

|

|