|

J&J, Alza ink $10.5B deal

|

|

March 27, 2001: 11:44 a.m. ET

Johnson & Johnson and Alza set $10.5 billion all-stock deal

|

NEW YORK (CNNfn) - Johnson & Johnson Tuesday agreed to buy drug maker Alza Corp. for about $10.5 billion in stock, giving J&J access to new drugs and technology for administering medicines in innovative ways.

J&J also advised analysts to lower 2001 earnings estimates by 10 cents a share because of the deal. The boards of both company approved the merger, confirming speculation Monday that the companies had entered a deal. The transaction is expected to close early in third quarter, subject to regulatory conditions, the companies said.

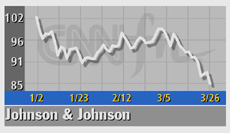

Terms of the purchase call for Johnson & Johnson (JNJ: Research, Estimates) to swap 0.49 of a share for each Alza share. Based on J&J's closing share price of $85.38 Monday, the purchase values Alza at $41.8362 a share, an 8 percent premium over Alza's $38.75 close on Monday. Terms of the purchase call for Johnson & Johnson (JNJ: Research, Estimates) to swap 0.49 of a share for each Alza share. Based on J&J's closing share price of $85.38 Monday, the purchase values Alza at $41.8362 a share, an 8 percent premium over Alza's $38.75 close on Monday.

"This exciting merger of two strong companies will strengthen several of our key pharmaceutical franchises, while accelerating sustainable revenue growth and bringing us important technologies for the future," J&J's CEO Ralph Larsen said in a statement. "It's an excellent strategic fit for Johnson & Johnson."

The announcement did little to help either stock. Alza (AZA: Research, Estimates) shares gained 15 cents to $38.90 Tuesday while Dow Component J&J fell $2.29 to $83.09.

New drugs

New Brunswick, N.J.-based J&J hopes to capitalize on promising new medications Alza has developed such as Ditropan XL for incontinence and Concerta, to treat attention deficit disorder.

Alza, based in Mountain View, California, said during a conference call with J&J that it sees 30 to 40 percent sales growth for its products over the next five years.

J&J gets the drug delivery technologies Alza has developed, industry analysts said.

"We think this is a good move for Johnson and Johnson. It boosts their pharmaceutical (sales) growth also brings them expertise in research and development of drug delivery," ABN AMRO Inc. analyst Girish Tyagi said.

Tyagi said integrating the two companies could hurt earnings in the short run. But Alza already logs more than $200 million in annual sales each for Concerta and Ditropan, which packaged with the drug delivery technology, make this a positive move, he said.

The transaction will hurt J&J's earnings in 2001 and 2002, and add to them in 2003, the company said. Excluding one-time charges, J&J expects dilution to earnings per share of 14 cents in 2001 and 5 cents in 2002.

The company also suggested analysts lower their 2001 earnings forecasts of $3.80-$3.88 a share by 10 cents, but said no changes should be made to 2002 forecasts.

Click here for consumer products and pharmaceutical stocks

For Johnson & Johnson, the deal would be an unusually large acquisition, beating the $4.9 billion it paid for biotechnology group Centocor in July, 1999.

Goldman Sachs advised J&J while J.P. Morgan Chase & Co. and Merrill Lynch & Co. served as financial advisor for Alza.

|

|

|

|

|

|

|