|

Europe finishes mixed

|

|

March 30, 2001: 11:34 a.m. ET

Techs, autos drag Frankfurt lower; financials, drugs lift Paris, London

|

LONDON (CNN) - Europe's markets ended mixed on Friday, with techs and autos down in Frankfurt while financials rose amid Allianz and Dresdner Bank talks.

London's FTSE 100 climbed 0.8 percent, or 45.3 points, to 5,633.7, led by biotech firm Celltech (CCH) and health care supplies maker Nycomed Amersham (NAM).

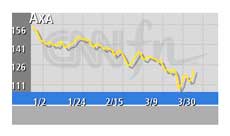

In Paris, the CAC 40 blue chip index rose 0.4 percent, or 22.53 points, to 5,180.45, with insurer Axa (PCS) and drugmaker Sanofi-Synthelabo (PSAN) posting the biggest percentage gains.

Frankfurt's electronically traded Xetra Dax fell 0.5 percent, or 28.48 points, to 5,850.45 in late trade, as losses in software maker SAP (FSAP3) and automaker Volkswagen (FVOW) outweighed banking gains.

In Amsterdam, the AEX index rose 1 percent and the SMI in Zurich added 1.7 percent. The MIB 30 in Milan gained 0.2 percent.

The pan-European FTSE Eurotop 300, a broader index of the region's largest stocks, rose 0.3 percent, with its insurance sub-index up 2.4 percent and its banking component 1.7 percent higher. The computer services and software sector was down 3.9 percent.

In the U.S., the technology heavy Nasdaq composite index fell 1.3 percent while the blue-chip Dow Jones industrial average was little changed in midday trade.

In the currency market, the euro hovered around a 15-week low after the European Central Bank decided not to cut interest rates on Thursday. The currency bought 87.93 cents from 88.21 in late New York trade on Thursday.

The ECB has signaled that it will cut rates, maybe as soon as its next meeting on April 11, as concerns persist that a U.S. economic slowdown could damage the European economy.

Banking and financial shares were among the top gainers in Paris and Frankfurt.

Allianz, the world's second-largest insurer, and Dresdner are in advanced talks that could lead to the creation of a financial powerhouse. A deal could be announced early next week, a source told CNN on Thursday. Allianz, the world's second-largest insurer, and Dresdner are in advanced talks that could lead to the creation of a financial powerhouse. A deal could be announced early next week, a source told CNN on Thursday.

Allianz rose 4.2 percent and Dresdner jumped 3.3 percent, to top the leader board in Frankfurt.

As part of Allianz's possible tie-up with Dresdner, the German insurer reportedly may sell its 14 percent stake in HypoVereinsbank (FHVM), Germany's second-largest bank, to reinsurer Munich Re (FMVM).

HypoVereinsbank rose 2 percent and Munich Re, which posted a 54 percent increase in annual profit, gained 2.3 percent.

Commerzbank (FCBK), which looks vulnerable to a take over, rose 4.8 percent.

France's Axa (PCS), the world's biggest insurer, surged 6.7 percent. Societe Generale (PGLE), the second-largest bank in France, rose 3.2 percent and BNP Paribas (PBNP) added 1.6 percent. France's Axa (PCS), the world's biggest insurer, surged 6.7 percent. Societe Generale (PGLE), the second-largest bank in France, rose 3.2 percent and BNP Paribas (PBNP) added 1.6 percent.

UK asset manager Schroders (SDR) and bank HSBC Holdings (HSBA) each added 3.6.

Telecom stocks were mixed after a two-day pummeling. France Telecom (PFTE) climbed 2.2 percent while London heavyweight, mobile phone operator Vodafone (VOD) fell 2 percent.

Swisscom, the former monopoly, rose 1.7 percent after it concluded a second big property sale within a month in an attempt to reduce its debt.

Sweden's Ericsson, the world's biggest maker of mobile phone networks, slumped 5.9 percent.

Europe's biggest software maker SAP (FSAP3) fell 4.7 percent after it announced it was buying U.S. partner TopTier for $400 million. UK accounting software maker Sage Group (SGE) lost 3.1 percent.

Elsewhere, automaker Volkswagen (FVOW) fell 4.1 percent while rival BMW (FBMW) shed 3.3 percent.

UK biotech firm Celltech (CCH) rose 5.6 percent and health care supplies maker Nycomed Amersham (NAM) climbed 5.5 percent.

French drugmaker Sanofi-Synthelabo (PSAN) lost 4 percent.

|

|

|

|

|

|

|