|

Tough quarter on Wall St.

|

|

March 30, 2001: 5:17 p.m. ET

Friday brings a rare advance during a rough three months in the market

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - U.S. stocks edged higher Friday in a session that capped off a quarter of losses amid 12 months of declines.

The first quarter's drop, which came as hundreds of companies warned that the slowing economy would hurt earnings, hit investors already bruised by last year's losses.

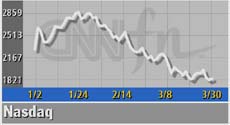

It didn't start out this way. Stocks rose in January, only to fall steeply during the next two months. The Nasdaq composite index, down nearly 40 percent last year, lost another 25.5 percent of its value in the quarter.

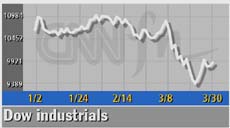

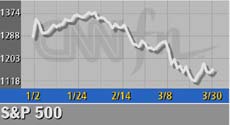

A broader index, the S&P 500, slid into bear market territory this month for the first time since 1987, and posted its worst quarterly performance since 1990. And the Dow Jones industrial average, whose defensive stocks saved it from big losses last year, shed 8.4 percent of its value in the first quarter, falling below the 10,000 mark that it first crossed two years ago. A broader index, the S&P 500, slid into bear market territory this month for the first time since 1987, and posted its worst quarterly performance since 1990. And the Dow Jones industrial average, whose defensive stocks saved it from big losses last year, shed 8.4 percent of its value in the first quarter, falling below the 10,000 mark that it first crossed two years ago.

"Really what the markets have been struggling with is: What is the direction of the economy and therefore corporate profits," Gail Dudack, NYSE market strategist, told CNNfn's Street Sweep.

That direction has been mostly down. Still, on Friday the Nasdaq added 19.69 points, or 1.1 percent, to 1,840.26, while Dow industrials gained 79.72, or nearly 1 percent, to 9,878.78.

The S&P 500 advanced 12.38 to 1 percent, to 1,160.33, ending the quarter with a 12 percent loss. On the week, both the Dow and S&P rose while the Nasdaq fell.

More stocks rose than fell. Advancing issues on the New York Stock Exchange beat declining ones 2,102 to 967 as 1.1 billion shares changed hands. Nasdaq winners topped losers 2,354 to 1,416 on trading volume of 2 billion shares. More stocks rose than fell. Advancing issues on the New York Stock Exchange beat declining ones 2,102 to 967 as 1.1 billion shares changed hands. Nasdaq winners topped losers 2,354 to 1,416 on trading volume of 2 billion shares.

In other markets, the dollar rose against the yen and euro. Treasury securities finished the day the way they finished the quarter: with gains.

Gains amid losses

The quarter's decline came even as the Federal Reserve cut interest rates three times in an effort to avoid recession. But Fred Kobrick, portfolio manager at Kobrick Capital Management, believes the central bank will succeed in stimulating growth.

"I know that people are worried that (Fed Chairman Alan Greenspan) is not doing enough," Kobrick told CNNfn's Street Sweep. "But these cuts take months. It really will have an effect."

But recently, a string of sales and bottom line warnings more than offset the Fed's medicine. In the latest, semiconductor equipment maker Cirrus Logic (CRUS: Research, Estimates) said it expects profits for the next two quarters to come in sharply below analysts' expectations. Cirrus Logic fell 63 cents to $14.94.

Cirrus is hardly alone. The company joins communications equipment maker Nortel Networks, appliance maker Maytag and brokerage Charles Schwab among firms having trouble selling their products or services. Cirrus is hardly alone. The company joins communications equipment maker Nortel Networks, appliance maker Maytag and brokerage Charles Schwab among firms having trouble selling their products or services.

Many of the hard-hit technology stocks whose losses sent the Nasdaq down 63.5 percent in the past year continued to fall Friday. Intel (INTC: Research, Estimates) dropped 25 cents to $26.31 while Dell Computer (DELL: Research, Estimates) fell $1.25 to $25.69.

But defensive stocks, which have held up better amid the economy's slowdown, advanced.

Drugmaker Merck (MRK: Research, Estimates) rose $1.70 to $75.90, oil producer Exxon Mobil (XOM: Research, Estimates) gained $2.71 to $81, and tobacco company Philip Morris (MO: Research, Estimates) added 62 cents to $47.48.

Among other winners, American Express (AXP: Research, Estimates) rose $2.34 to $41.30 after BusinessWeek magazine said Citigroup may be interested in buying the financial services company. Citigroup (C: Research, Estimates) added 28 cents to $44.98.

Tyson Foods (TSN: Research, Estimates) rose $1.97 to $13.97 after bowing out of its proposed merger with IBP. Beef and pork producer IBP (IBP: Research, Estimates) fell $6.39 to $16.40.

The latest figures on the economy showed more problems among the manufacturing sector. The Chicago Purchasing Management Index of industrial activity fell to its lowest levels since March 1982, dropping to 35 in March from 43.2.

A closely watched survey on consumer sentiment from the University of Michigan edged higher in March but remains at low levels. The attitudes of consumers, whose spending fuels two-thirds of the economy, have fallen with the sinking stock market and rising corporate layoffs.

"We fully expect sentiment to drop sharply, putting in place the conditions for much softer consumer spending numbers," Ian Shepherdson, chief U.S. economist at High Frequency Economics, said.

But for now, spending by consumers appears to be holding up. Consumer spending rose 0.3 percent in February after jumping a revised 1 percent in January. Personal income grew 0.4 percent, the government said.

Investors hope the next three months are better than the last three, when no sectors in the S&P 500 rose. That's a sharp contrast from last year, when technology stocks tumbled but areas like health care, utility and real estate investment trust stocks gained.

Consumer cyclicals, the best performing of the S&P sectors, fell 0.4 percent this year through Thursday's close while technology lost 23.4 percent. Consumer cyclicals, the best performing of the S&P sectors, fell 0.4 percent this year through Thursday's close while technology lost 23.4 percent.

Companies next month begin reporting results for the first three months of the year. And it doesn't look good. Analysts surveyed by First Call expect profits slid 8 percent in the quarter. Those results, if they hold, would hand Corporate America its worst quarter for earnings since 1991.

Still, Brian Finnerty, head of Nasdaq trading at C.E. Unterberg Towbin, remains bullish. He points to the deep investor pessimism, a sign that the market's bottom could be near, coupled with large reserves in money market funds that could fuel a rally when deployed.

But Jim Melcher of Balestra Capital says the worst may not be over. He argues that stock prices, though down, may not fully reflect the slowdown in corporate profits.

"Valuations for stocks are still high," Melcher told CNNfn's Market Call.

|

|

|

|

|

|

|