|

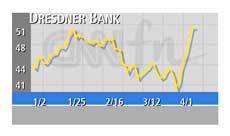

Allianz, Dresdner agree tie

|

|

April 1, 2001: 2:27 p.m. ET

German insurer agrees to buy Dresdner Bank for $21 billion

|

LONDON (CNN) - German insurer Allianz agreed on Sunday to buy Dresdner Bank for $21 billion, creating one of the world's leading financial powerhouses.

Allianz, which owns 21. 4 percent of Dresdner, plans to offer one of its shares plus  200 ($175) for every 10 Dresdner shares in a deal valuing Dresdner at 200 ($175) for every 10 Dresdner shares in a deal valuing Dresdner at  53.13 per share, or 53.13 per share, or  29.7 billion. 29.7 billion.

The combination of the world's second-largest insurer and Germany's third-largest bank will have a market value of The combination of the world's second-largest insurer and Germany's third-largest bank will have a market value of  109 billion, placing it second in Europe behind HSBC Holdings with a market capital of 122.8 billion. 109 billion, placing it second in Europe behind HSBC Holdings with a market capital of 122.8 billion.

According to Reuters, the financial powerhouse will rank fourth behind Citigroup, AIG and HSBC. The deal was approved by the boards of both companies in separate meetings on Sunday.

"The partnership with Dresdner Bank is our joint response to the challenges of the market," Allianz Chief Executive Henning Schulte-Noelle said.

Allianz and Dresdner plan to hold a joint press conference on Monday to unveil further details.

Dresdner's investment banking unit, Dresdner Kleinwort Wasserstein, could be floated within the next few years. DKW employees will be offered shares in the business, the companies said.

Dresdner has bad luck with mergers. Last April, it called off its $28.7 billion merger with Deutsche Bank, citing a disagreement over the future of its investment banking arm, DKB. CommerzBank AG, Germany's fourth-largest bank. It then failed in its July attempt to buy Dresdner in a $40 billion-plus takeover when the firms could not agree on how to value the deal.

"Allianz and Dresdner Bank will bundle their forces and in future focus on the three core areas, insurance, asset management and banking," the companies said.

German insurer Allianz is under pressure to strengthen its distribution network for insurance and investment products amid rising competition in the booming retirement savings field.

Under the terms of the transaction, Allianz will sell its 13.5 percent stake in HypoVereinsbank, Germany's second-largest bank, to reinsurer Munich Re. For its part, Munich Re, which owns 5.4 percent of HypoVereinsbank, will sell its 40 percent stake in life insurer, Allianz Leben, to Allianz. Under the terms of the transaction, Allianz will sell its 13.5 percent stake in HypoVereinsbank, Germany's second-largest bank, to reinsurer Munich Re. For its part, Munich Re, which owns 5.4 percent of HypoVereinsbank, will sell its 40 percent stake in life insurer, Allianz Leben, to Allianz.

Munich Re will increase its stake in insurance arm Ergo Versicherungsgruppe to 95 percent and HypoVereinsbank in turn increases its stake in Munich Re's Ergo to 5 percent from 2.7 percent.

"With the reduction of cross shareholdings, Allianz and Munich Re will create the conditions for a necessary reordering of Germany's financial services sector," Allianz CEO Schulte-Noelle said.

Allianz, like many other German companies, plans to reduce its holding in rivals and other corporations after the German government abolished tax on the sale of assets last year, in an effort to drive consolidation.

Dresdner Chief Executive Bernd Fahrholz, Leonhard Fischer and horst Muller will join the board of Allianz, the statement said.

|

|

|

|

|

|

|