|

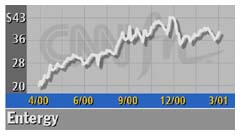

Entergy deal unplugged

|

|

April 2, 2001: 3:41 p.m. ET

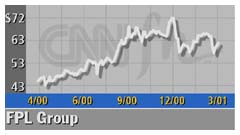

$7B merger with FPL cancelled; FPL says Entergy did not provide data

|

NEW YORK (CNNfn) - Entergy Corp. and FPL Group Inc. called off their troubled $7 billion merger Monday.

The two utilities said the decision was mutual and that neither would seek the termination fee provided for under terms of the merger agreement.

Entergy said in a statement "that accepting various positions taken by FPL would leave Entergy with no merger of equals, as approved by shareholders."

The New Orleans-based company added the deal had no prospects for regulatory approval. The New Orleans-based company added the deal had no prospects for regulatory approval.

FPL Group indicated its decision centered on discrepancies in Entergy's financial forecasts and Entergy's repeated refusal to provide financial documents and other information requested by FPL pursuant to the merger agreement.

FPL said secondary factors include likely restrictions by regulatory authorities on the ability to grow and operate the combined companies, as well as disagreements on operating and managing the combined companies.

The deal was announced last July as a merger of equals that would have created the nation's largest power producer. FPL Group has annual revenue of more than $6 billion and employs 11,350 people. Through its Florida Power & Light unit it serves about 3.8 million customers.

Entergy has revenue of about $9 billion with 12,200 employees and 2.5 million customers.

But two weeks ago the companies issued a joint statement warning of problems, citing "governance structure/value-related issues and integration of the two companies going forward."

This is the second deal involving FPL to die in the last year. In April 2000 an $11 billion purchase of FPL by the Spanish firm Iberdrola was scuttled amid reports of opposition by the Iberdrola board. This is the second deal involving FPL to die in the last year. In April 2000 an $11 billion purchase of FPL by the Spanish firm Iberdrola was scuttled amid reports of opposition by the Iberdrola board.

FPL tried to reassure its investors of its growth prospects Monday, saying it still expects 7 percent annual earnings-per-share growth, excluding merger-related costs. Analysts surveyed by earnings tracker First Call forecast growth along those lines in both 2001 and 2002.

Click here for a look at utility stocks

"I am disappointed that we were unable to complete the merger with Entergy Corp., " FPL CEO James Broadhead said. "Yet, I am even more convinced today that FPL Group will be a formidable competitor in the energy business and will generate solid value for our shareholders and customers as a stand-alone company."

Entergy said it is now stronger than it was eight months ago and projected earnings of $3.30 to $3.50 per share for 2002, higher than current Wall Street forecasts.

Shares of FPL (FPL: Research, Estimates) fell 27 cents to $61.03 in afternoon trading, while Entergy (ETR: Research, Estimates) shares rose 14 cents to $38.14.

|

|

|

|

|

|

|