|

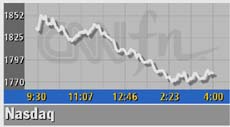

Nasdaq hits 29-month low

|

|

April 2, 2001: 4:35 p.m. ET

Rising concern about profit shortfalls in all sectors sparks broad selloff

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - The Nasdaq composite index hit a 29-month low Monday amid rising concerns that earnings, especially in the technology space, will continue to fall far short of expectations.

"The market's already nervous and the semis (semiconductors) have cracked," said Barry Hyman, chief market strategist with Weatherly Securities.

The Philadelphia Semiconductor Index fell 42 points, or 7.7 percent, at 503.17. Analysts often watch the semiconductor sector for indications about how the broader technology space will act.

"Lots of money has moved to the sidelines," said Alan Ackerman, senior vice president of Fahnestock & Co. "People are not comfortable with the uncertainty ahead, made up of the fact that many of the tech companies keep lowering their guidance." "Lots of money has moved to the sidelines," said Alan Ackerman, senior vice president of Fahnestock & Co. "People are not comfortable with the uncertainty ahead, made up of the fact that many of the tech companies keep lowering their guidance."

The Nasdaq fell 57.29 to 1,782.97, hitting levels not seen since Oct. 30, 1998, when it closed at 1,771.39. The indicator is now nearly 65 percent down from its March 10, 2000 high of 5,048.

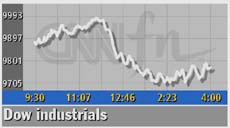

Industrial issues, which earlier lifted the Dow Jones industrial average, gave up their gains and the tech issues on the blue chip index also slumped as investors signaled a lack of confidence that the worst was over for all sectors.

One analyst suggested the early gains were unwarranted and not supported by the day's economic data. "Maybe it shouldn't have been (up)," said John Forelli, senior vice president with Independence Investment Associates. "We're not expecting to hear any good news from any companies."

The Dow dropped 100.85 to 9,777.93, after surging more than 100 points earlier in the session. The Standard & Poor's 500 shed 14.46 to 1,145.87. The Dow dropped 100.85 to 9,777.93, after surging more than 100 points earlier in the session. The Standard & Poor's 500 shed 14.46 to 1,145.87.

Market participants shrugged off the day's economic data, which signaled the eighth straight month of slowing in the manufacturing sector. The focus turned to individual corporate news, but investors remained wary.

The National Association of Purchasing Management's index edged slightly higher than expectations, but the data still indicated weakness in the manufacturing sector.

"I don't think it adds any certainty to investors' uncertainty about the future," Brett Gallagher, head of U.S. equities with Julius Baer, told CNNfn's Market Call.

Market breadth was negative. On the New York Stock Exchange decliners beat advancers 1,865 to 1,180 as more than 1.2 billion shares changed hands. Losers outpaced winners 2,716 to 1,019 on the Nasdaq as more than 1.81 billion shares were traded.

In other markets, Treasury securities edged lower. The dollar fell against the euro but edged higher versus the yen.

Amex warning weighs on sentiment

Investors still were unconvinced that the worst is over for profit warnings and for the slowing economy. Instead, the focus remained on individual corporate stories as economic data were digested.

Dow component American Express (AXP: Research, Estimates) fell $1.51 to $39.71 after it warned that it will miss first-quarter forecasts due to the write-down and sale of certain high-yield securities held in the investment portfolio of its subsidiary, American Express Financial Advisors.

Part of the problem with the influx of warnings is the lack of guidance from the companies as to when the bad news will end. Still, one analyst said much of that has been built into the market and the economy is still the bigger wildcard.

"We know companies are going to tell us they have no visibility – they don't know when it's going to get better," Liz Miller, portfolio manager with Trevor Stewart Burton & Jacobsen, told CNNfn's Before Hours. "Everyone knows its bad so it's in the market. The big question mark is still going to be the economy."

On the Dow, technology led the blue chips lower after industrial issues gave up their gains. IBM (IBM: Research, Estimates) slid $1.52 to $94.66, Hewlett-Packard (HWP: Research, Estimates) shed $2.35 to $28.93, International Paper (IP: Research, Estimates) fell $1.20 to $34.88, and 3M (MMM: Research, Estimates) shed $1.85 to $102.05.

And semiconductors pressured the Nasdaq. Applied Materials (AMAT: Research, Estimates) shed $3.50 to $40, Intel (INTC: Research, Estimates) slid 53 cents to $25.78, and Altera (ALTR: Research, Estimates) fell 75 cents to $20.69.

In other corporate news, DuPont (DD: Research, Estimates) advanced 26 cents to $40.96 after it said it is cutting 4,000 jobs, or about 4 percent of its work force, due to weakness in its key textile and apparel markets. In other corporate news, DuPont (DD: Research, Estimates) advanced 26 cents to $40.96 after it said it is cutting 4,000 jobs, or about 4 percent of its work force, due to weakness in its key textile and apparel markets.

The chemical maker also said it will take a second-quarter charge of about 40 to 45 cents a share for one-time costs from the restructuring, which should yield long-term savings of about $400 million a year before taxes.

NAPM edges higher

The manufacturing sector, which has slumped over the last months, continued to show weakness in March. The National Association of Purchasing Management said its index of industrial activity rose to 43.1 from 41.9 in February.

Though higher, any reading below 50 signifies contraction. The figures were just above expectations. Analysts polled by Briefing.com had forecast a reading of 42.5.

"We understand the manufacturing side is in a recession," said Bryan Piskorowski, market analyst with Prudential Securities. "The question is, Will the data bring forth a more forthright (aggressive) Fed?"

He said it was not surprising to see little reaction from the NAPM report since it came nearly in line with expectations and still confirms a weak economy in the industrial sector.

Separately, construction spending rose 0.6 percent in February to a seasonally adjusted annual rate of $834.2 billion, a record high, according to the Commerce Department. Wall Street analysts had forecast a 0.4 percent increase.

The reports come after the Federal Reserve cut interest rates last month for the third time this year in a bid to keep the slowing U.S. economy from slipping into recession.

|

|

|

|

|

|

|