|

Dow rises above 10,000

|

|

April 10, 2001: 5:02 p.m. ET

Stocks rise as investors find share prices appear too cheap to pass up

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - U.S. stocks rallied Tuesday, sending the Dow Jones industrial average above 10,000 for the first time in nearly a month, as investors snapped up technology, financial and industrial stocks hammered by the year's steep selloff.

The gains, the third advance this month, handed the Nasdaq composite index its third-biggest percentage rise of the year. No single event sparked the buying. Instead, analysts said the gains reflect a bet among stock investors that months of losses amid hundreds of corporate profit and sales warnings were overdone.

"The economy doesn't really look like it's falling off a cliff," Arthur Cashin, head floor trader for UBS PaineWebber, told CNNfn's The Money Gang.

Fears about a fast-weakening economy mounted this year. But some say those worries, though legitimate, went too far, pushing stocks to levels too cheap to ignore. Fears about a fast-weakening economy mounted this year. But some say those worries, though legitimate, went too far, pushing stocks to levels too cheap to ignore.

"Stock prices took a major plunge and I think overshot on the downside," Tom Galvin, chief market strategist at Credit Suisse First Boston, told The Money Gang.

For most of the year, investors fretted about the risks of owning stocks. And many still do. But a growing number also appear worried about the risk of not owning equities. Treasury securities tumbled Tuesday as investors sought higher returns in stocks.

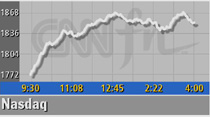

The Dow industrials gained 257.59 points, or nearly 2.6 percent, to 10,102.74, handing blue chips their first close above 10,000 since March 15. Technology stocks saw the biggest gains, with the Nasdaq rising 106.32, or about 6.1 percent, to 1,852.03. The Nasdaq's third-biggest percentage gain of the year was topped only by those on Jan. 3 and April 5.

The S&P 500 added 30.79, or 2.7 percent, to 1,168.38.

More stocks rose than fell. Advancing issues on the New York Stock Exchange topped declining ones 2,102 to 998 as 1.3 billion shares traded. Nasdaq winners beat losers 2,765 to 1,176 as 2.1 billion shares changed hands. More stocks rose than fell. Advancing issues on the New York Stock Exchange topped declining ones 2,102 to 998 as 1.3 billion shares traded. Nasdaq winners beat losers 2,765 to 1,176 as 2.1 billion shares changed hands.

In other markets, the dollar rose against the euro but fell versus the yen.

Break from bad news

For a day, financial disappointment from the nation's corporations ebbed. And any news on the economy will have to wait until Thursday's release of retail sales and consumer confidence data.

Instead, Wall Street seemed to look past the period of negative corporate pre-announcements to the time when companies report actual first-quarter results. Motorola, the mobile phone component maker, kicks off the major reports on Tuesday after the market close, followed by hundreds more in the weeks ahead.

Motorola was expected to report a loss of 7 cents a share after showing a profit of 20 cents per share in the year-ago period. Motorola was expected to report a loss of 7 cents a share after showing a profit of 20 cents per share in the year-ago period.

Shares of Motorola (MOT: up $1.50 to $13.00, Research, Estimates) rose ahead of the report. Like hundreds of other companies, Motorola has lowered its targets for the current quarter. But its shares, down about 80 percent from their 52-week high, may already have paid the price.

Most of Nasdaq's biggest movers, whose losses have more than halved the index over the last 13 months, drew buyers. They included Microsoft (MSFT: up $2.53 to $59.68, Research, Estimates), Cisco Systems (CSCO: up $1.37 to $15.86, Research, Estimates), and Sun Microsystems (SUNW: up $1.61 to $14.65, Research, Estimates).

"Technology stocks were grossly oversold going into this," Arnie Berman, chief market strategist at Wit SoundView, said. "The recovery in fundamentals won't happen all at once, but it will get under way in the second quarter."

But the bad news didn't completely end. Among the latest warnings, Cypress Semiconductor, a chipmaker, said that its first-quarter profit and sales will miss forecasts.

Lehman Brothers downgraded Cypress, Intel and Texas Instruments Monday, saying 2001 could be the worst year on record for the semiconductor industry.

But all three stocks rose, with Intel (INTC: up $1.57 to $24.77, Research, Estimates), Texas Instruments (TXN: up $2.09 to $29.60, Research, Estimates), and Cypress Semiconductor (CY: up $0.94 to $16.34, Research, Estimates).

Aetna (AET: down $6.35 to $29.80, Research, Estimates) wasn't as lucky. The insurer said rising medical costs will lead it to post a lower-than-expected first-quarter profit. Aetna (AET: down $6.35 to $29.80, Research, Estimates) wasn't as lucky. The insurer said rising medical costs will lead it to post a lower-than-expected first-quarter profit.

Wall Street's recent advances have proved dangerous. All of the big rallies over the last 13 months have been followed by lower lows.

"I'm still in the camp that says (this is) a rally in a bear market," Fred Sears, portfolio manager at Investor Capital Funds, told CNNfn.

The S&P 500, which accounts for about 75 percent of the market's value, remains 23.5 percent below its record high, within the 20 percent drop considered a bear market.

1Q reports on tap

The days ahead bring several closely watched quarterly reports. Yahoo!'s comes Wednesday, with General Electric and Honeywell also due this week. Hundreds of reports follow this month in what analysts forecast will be the worst quarter for profits in a decade.

Still, the market appears hungry for positive developments. News from Dell Computer that the computer maker would meet profit forecasts sparked a rally Thursday. Online retailer Amazon.com said it expects to post a narrower-than-expected loss, causing big gains Monday.

For investors facing big losses, the direction of interest rates should also be a positive. The Federal Reserve, which lowered borrowing costs three times this year, is expected to do so again next month.

"I don't think you want to fight the Fed going into the end of this year," Ron Hill, of Brown Brothers Harriman, told CNNfn's Street Sweep.

Tuesday's gains were broad. Of the 30 Dow industrials, 26 rose, including 3M (MMM: up $3.99 to $108.57, Research, Estimates), Boeing (BA: up $2.95 to $59.82, Research, Estimates), IBM (IBM: up $3.05 to $99.05, Research, Estimates), JP Morgan Chase (JPM: up $2.88 to $43.30, Research, Estimates) and Alcoa (AA: up $1.75 to $39.25, Research, Estimates) .

But with no single news event driving the action, analysts looked for other, less tangible reasons behind the advance.

"The sentiment has changed today," Linda Jay, floor trader at LaBranche & Co., told CNNfn's Market Call.

How long that holds remains to be seen.

|

|

|

|

|

|

|