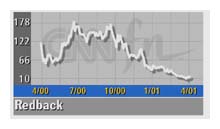

|

Redback trims 1Q loss

|

|

April 11, 2001: 5:39 p.m. ET

Strong revenue lowers company's loss to 13 cents per share, less than expected

|

NEW YORK (CNNfn) - Redback Networks Inc. reported Wednesday losses smaller than expected while the company's revenue surged 166 percent.

San Jose, Calif.-based Redback Networks (RBAK: down $0.10 to $15.84, Research, Estimates) reported pro forma net losses of $18.4 million, or 13 cents a share, compared with income of $1.4 million, or 1 cent, for the same time period last year. Before pro forma adjustments, first-quarter net losses were $400.5 million, or $2.92 a share, compared with a loss of $85.2 million, or 96 cents a share.

Earnings tracker First Call had expected a first quarter loss of 15 cents.

On April 2, Redback warned its first-quarter revenue would miss estimates, anticipating a loss of 15 cents. Wall Street had expected a profit of 5 cents a share. In addition, Redback announced it was cutting about 150 workers, 12 percent of its work force, citing a slowdown in the global telecommunications sector. At the time, executives blamed the shortfall on curtailed spending by its service-provider customers who are pushing back deployments and deferring purchases of new equipment in the face of a slowing U.S. economy. On April 2, Redback warned its first-quarter revenue would miss estimates, anticipating a loss of 15 cents. Wall Street had expected a profit of 5 cents a share. In addition, Redback announced it was cutting about 150 workers, 12 percent of its work force, citing a slowdown in the global telecommunications sector. At the time, executives blamed the shortfall on curtailed spending by its service-provider customers who are pushing back deployments and deferring purchases of new equipment in the face of a slowing U.S. economy.

"Despite the slowdown within the telecommunications industry, we

have confidence in the long-term growth of the broadband marketplace.

In addition, the next-generation metro optical market continues to

show strong promise," said Redback CEO Vivek Ragavan.

Redback Networks sells equipment that phone companies, Internet service providers, cable companies and other carrier use to build high-speed Internet connections for homes and businesses. Nearly 95 percent of its sales are to U.S.-based customers.

Redback said revenue hit $90.2 million for the quarter from $34.2 million for the prior year.

|

|

|

|

|

|

|