|

Motorola warns on 2Q

|

|

April 11, 2001: 10:32 a.m. ET

Mobile phone and semiconductor maker sees loss widening from 1Q

|

NEW YORK (CNNfn) - Motorola Inc. warned Wednesday that it expects a second-quarter loss much wider than Wall Street forecasts, a day after reporting its first quarterly loss in 15 years.

The mobile phone and semiconductor maker said that while it expects sales to increase slightly in the April-June period from the prior three months, a less favorable mix of sales and lower semiconductor sales will contribute to the weak performance.

|

|

|

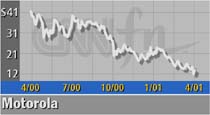

A series of warnings from Motorola has taken its share price down by about 75 percent from its 52-week high. |

The company, which has issued a series of warnings in recent months, said it expects that the loss per share in the second quarter will be a few cents larger than the 9 cent a share loss reported on a pro forma basis for the first quarter. Wall Street analysts surveyed by earnings tracker First Call had been forecasting a loss of 2 cents a share for the second quarter versus a profit of 23 cents a share a year earlier.

But Motorola (MOT: up $0.40 to $13.40, Research, Estimates) shareholders apparently are becoming inured to the company's warnings, as shares were up slightly in early trading, even though the first-quarter loss reported after the market close Tuesday was larger than analysts expected.

Hopes to return to profitability in second half

Motorola also said it expects a return to profitability in the second half, due partly to cost-cutting measures and partly to an improvement in the market for its products. It said that should leave the company with a small profit for the entire year on annual sales below 2000 levels.

First Call's forecast called for earnings per share of 13 cents for the year, down from 84 cents in 2000, and annual sales of $36.5 billion, down from $37.6 billion last year.

But the company said the details of the rebound are still uncertain.

"We're still staring at quite a few unknown situations in the marketplace," President Robert Growney said in a conference call with investors and analysts Wednesday morning. "We're anticipating some improvement in order flow. We are looking forward to the time when we can have a little more precision to this as the order patterns change."

Executives emphasize balance sheet strength

Also in the conference call, Motorola CEO Christopher Galvin compared the current business environment to the boom and bust tech cycles of 1984-85 and 1975-76.

He said Motorola has a five-point plan, including cutting costs and creating new products, in a bid to make the company No. 1 or No. 2 in most of the businesses in which it has chosen to compete.

Both Galvin and Growney emphasized that Motorola's balance sheet is strong, following a report of a liquidity crisis that drove the company's stock sharply lower last Friday. They criticized the report and reiterated that even with the loss the company had positive cash flow from operations and net proceeds from investments during the period, and expects to have positive cash flow for the full year. Cash flow consists of profits plus depreciation and other non-cash charges.

Click here for a look at wireless stocks

Click here for a look at chipmaker stocks

"In this type of situation you shore up your balance sheet," said Galvin, who listed that as the second point of his five-point program.

The company had cash, cash equivalents and short-term investments of $4.4 billion at the end of the quarter, compared with notes payable and current portion of long-term debt of $4.9 billion. Growney said the company has secured significantly larger credit lines than now in use.

"We continue to have ability to issue commercial paper," he said.

The company also said it is looking at the sale of "significant, non-strategic" operations, partly as a way of freeing up resources. It also expects to cut back on new investments and capital spending for the remainder of the year.

|

|

|

|

|

|

|