|

Retail sales, profits sink

|

|

April 12, 2001: 1:22 p.m. ET

Sears, Wal-Mart warn on first quarter; others report March sales below plan

|

NEW YORK (CNNfn) - The nation's two biggest retailers, Wal-Mart Stores Inc. and Sears Roebuck & Co., warned Thursday that weak sales will cause them to miss first-quarter earnings estimates, a signal that consumers are spending less as the economy slows.

Separately, the government reported U.S. retail sales dropped 0.2 percent in March after being flat in February. That's below analysts' forecasts for a flat reading in March.

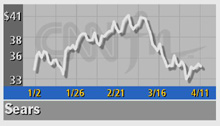

Hoffman Estates, Ill.-based Sears (S: down $0.11 to $34.54, Research, Estimates) said it now expects to earn 53 cents a share in the first quarter compared with 65 cents a share a year earlier. Analysts on average had expected Sears to earn 57 cents a share, according to earnings tracker First Call.

Sears also said sales at stores open at least a year, a closely watched figure known as comparable- or same-store sales, fell 5.3 percent in March while total store sales were down 5.1 percent. Sears also said sales at stores open at least a year, a closely watched figure known as comparable- or same-store sales, fell 5.3 percent in March while total store sales were down 5.1 percent.

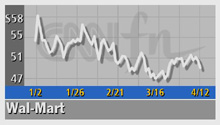

Wal-Mart Stores (WMT: down $1.09 to $49.14, Research, Estimates), the world's largest retailer, said same-store sales grew 3.5 percent in March, trailing the 5.5 percent gain in that measure reported in March 2000. Overall sales increased 11.3 percent to $18.8 billion in the period.

In a recorded telephone announcement Thursday, Wal-Mart also warned that first-quarter earnings will fall short of expectations due to cooler weather, which it said chilled sales of spring merchandise. The company now expects to earn about 31 cents a share for the quarter. Analysts on average were expecting 32 cents a share, according to First Call.

Sluggish March sales cap a month in which retailers having cleared out winter and holiday inventories but failed to generate strong sales of spring merchandise, analysts said. Sluggish March sales cap a month in which retailers having cleared out winter and holiday inventories but failed to generate strong sales of spring merchandise, analysts said.

Concerns over the slowing economy, corporate layoffs and a volatile stock market have prompted consumers to zip up their wallets in the month, said Kurt Barnard, president of Barnard's Retail Trend Report in Upper Montclair, N.J. That view was supported by the latest weekly report Thursday on first-time jobless claims, which rose to their highest level in five years.

"This is actually a little worse than I expected, and particularly bad when viewed within the context of a year ago, which was already very weak," Barnard said.

Retail sales are important to the Federal Reserve and economists because they provide an early glimpse into consumer confidence numbers, which are due April 25. Fed Chairman Alan Greenspan has said he pays careful attention to consumer confidence as an economic measure when considering a change in interest rates.

The Fed's policy-making Federal Open Market Committee next meets on May 15.

So far the Fed has aggressively lowered interest rates three times this year in an effort to keep the U.S. economy out of a recession. Although consumers have been spending less at the stores, analysts have said a saving grace for the economy is housing sales, which have remained fairly robust.

Existing home sales figures are due out later this month.

Meanwhile, the nation's biggest retailers continue to struggle.

Sales slide for most

Federated Department Stores (FDS: down $0.09 to $31.76, Research, Estimates), operator of Macy's and Bloomingdale's, said March comparable-store sales decreased 3.2 percent while total company sales fell 5.9 percent. CEO James Zimmerman attributed the drop to "deteriorating consumer confidence in the wake of current economic uncertainty."

Kmart (KM: up $0.07 to $8.82, Research, Estimates), the nation's No. 3 retailer, reported a 1 percent increase in March same-store sales, reflecting the effects of a corporate-wide restructuring effort under new CEO Chuck Conaway that has included shuttering under-performing stores, reduced advertising spending, clearing out inventory, tidying up the stores and improving customer service. Kmart (KM: up $0.07 to $8.82, Research, Estimates), the nation's No. 3 retailer, reported a 1 percent increase in March same-store sales, reflecting the effects of a corporate-wide restructuring effort under new CEO Chuck Conaway that has included shuttering under-performing stores, reduced advertising spending, clearing out inventory, tidying up the stores and improving customer service.

Troubled Gap Inc. (GPS: down $0.69 to $23.09, Research, Estimates) reported an 8 percent decline in March same-store sales though total sales increased 11 percent. The operator of Gap, Old Navy and Banana Republic stores reported lower sales at all three divisions. CFO Heidi Kunz said she anticipates "margin pressure" in April because of huge markdown sales at the end of March. While big discounts benefit the consumer, they mean less profit on each sale.

Discount retailer Target Corp. (TGT: down $0.38 to $35.32, Research, Estimates) reported a 2.4 percent increase in same-store sales and an 8.4 percent jump in net sales. Though one of the few retailers to see a gain in March, the company said sales came in slightly below plan.

Kohl's Corp. (KSS: down $0.05 to $52.75, Research, Estimates), based in Menomonee Falls, Wis., reported a 1.9 percent decline in same-store sales and a 13.1 percent increase in overall sales. CEO Larry Montgomery said the company remains comfortable with its previous first-quarter earnings estimate of 20 cents to 21 cents a share, up from 16 cents a share a year ago.

CLICK HERE to view retail stocks

And Dillard's (DDS: down $4.08 to $16.97, Research, Estimates), the Little Rock, Ark.-based chain, said March comparable-store sales plummeted 13 percent.

Meanwhile, the troubled Plano, Texas-based J.C. Penney (JCP: up $0.97 to $17.40, Research, Estimates) said based on current trends, the company should come in at or slightly above the high end of forecasts for the quarter ending this month. Analysts surveyed by First Call estimate the company will earn 7 cents a share in the period, with forecasts ranging from 2 to 11 cents.

Penney, the nation's fifth-largest retailer, has been in the process of reorganizing and closing stores, leading overall sales to slip 0.2 percent to $2.9 billion for the month. But sales at department stores open at least a year gained 2.7 percent. Same-store sales at its Eckerd drugstores rose 8.7 percent.

Specialty retailers hit

Specialty retailers, which often do well in their niche markets, also had a tough go of it in March.

Apparel retailer Abercrombie & Fitch (ANF: down $3.13 to $31.86, Research, Estimates) saw same-store sales decline 4 percent from a year ago even though overall sales increased 23 percent. The chain, which caters mostly to teen-agers and young men and women, blamed cool winter weather for hurting sales of spring items. The company, which also said it remains comfortable with previous guidance for flat first-quarter earnings per share, also said it launched its spring clearance sales five days earlier than normal to maximize the busy week leading up to Easter.

The Sharper Image Corp. (SHRP: down $1.38 to $8.99, Research, Estimates), which had largely been riding on the strength of Razor Scooters and other popular items, warned it will post a sharply wider first quarter loss as it reported a 1 percent slide in March same-store sales. But total sales increased 17 percent. The company said slackening scooter sales accounted for the same-store sales decrease.

Talbots Inc. (TLB: down $3.79 to $36.91, Research, Estimates) reported an 8 percent drop in same-store sales and a 3 percent decline in total company sales. The upscale apparel chain blamed pushing back the start of its mid-season sale and bad weather for the decrease. The company also said it remains comfortable with first-quarter earnings forecasts of 60 to 62 cents a share.

Other retailers reporting sales included The Children's Place (PLCE: down $2.95 to $22.05, Research, Estimates), which had a 9 percent decrease in same-store sales; Gymboree Corp. (GYMB: down $1.65 to $7.85, Research, Estimates), which posted a 52 percent increase in same-store sales; Bebe Stores (BEBE: up $1.37 to $17.07, Research, Estimates), whose same-store sales fell 1.8 percent; Gadzooks Inc. (GADZ: down $0.91 to $18.69, Research, Estimates), whose sales declined 6.6 percent; and Jo-Ann Stores Inc. (JAS.B: down $0.05 to $2.88, Research, Estimates), which had a 2.5 percent increase.

|

|

|

|

|

|

|