|

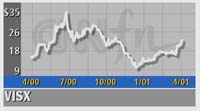

Icahn pushes for VISX sale

|

|

April 18, 2001: 3:47 p.m. ET

Corporate raider pushes for $32-share sale of VISX, talks with two buyers

By Staff Writer Luisa Beltran

|

NEW YORK (CNNfn) - The proxy fight between corporate raider Carl Icahn and VISX Inc. heated up Wednesday as Icahn revealed that he has held talks with two firms regarding the sale of the laser eye-surgery company.

The preliminary discussions with two unnamed ophthalmic firms call for a cash-stock sale of VISX where shareholders would receive about $32 a share.

| |

|

Carl Icahn,

Financier | | |

In an interview with CNNfn.com, Icahn claimed that VISX management was incapable of realizing the value of the company. Icahn has a 10.5 percent stake in Santa Clara, Calif.-based VISX, the nation's No.1 maker of laser vision correction products. The financier has reached out to the Industrial Bank of Japan, which has indicated it would supply financing.

"We'd like to see the company put up for sale," Icahn said. "VISX [management] is giving lip service to a sale."

VISX could not be reached for comment.

VISX CEO Davila and a former CEO have both sold nearly all of their VISX shares for a good price, so Icahn contends that management would not gain much from a sale.

As proof, Icahn pointed to a VISX conference call in January where the company said it was not up for sale. He also pointed to VISX's first-quarter earnings announced April 12, where the company claimed that profit rose 62 percent but posted first-quarter net income of $12.6 million, or 21 cents a share, compared with $19.6 million, or 30 cents a share, in 2000.

"Their earnings are way down. It's time for management to go," Icahn said.

The proxy fight began on April 10 when Icahn proposed, in a filing with the Securities and Exchange Commission, an auction of the company for a minimum $32 a share. With 57.6 million shares outstanding, a purchase of VISX (EYE: up $1.29 to $21.40, Research, Estimates) would be valued at $1.8 billion. A $32 share price would represent a near 40 percent premium to VISX's current share price of $22.95.

VISX countered two days later that it had already implemented a thorough review of its strategic alternatives and a "process" led by financial advisor Goldman Sachs & Co. has failed to result in a transaction.

"With regard to the Icahn group's revised platform to auction the company, VISX believes Mr. Icahn continues to offer nothing new to VISX stockholders," the company said in an April 12 statement.

Icahn's scheme would plunge VISX into debt, dilute earnings, and restrict the company's future ability to invest, the company said in the statement.

But Icahn continues to push for a sale that, he said, would be similar to the auction of Nabisco. Icahn was able to buy shares for as low as $8 each and he helped persuade management to sell Nabisco in an open auction. Last June, R.J. Reynolds Tobacco Holdings agreed to buy Nabisco parent Nabisco Group Holdings for $9.8 billion, or $30 a share.

While VISX is not a similar company, Nabisco was also reticent to pursue an auction. While VISX is not a similar company, Nabisco was also reticent to pursue an auction.

"We've been through a number of these and we think (VISX) should be sold to someone else," he said.

Icahn also doubts if Goldman Sachs, VISX's financial adviser, has been actively searching for a buyer. "The company has said it doesn't want to be sold," he said.

Icahn is now waiting for VISX to respond. The final test will occur May 4 when Barberry Corp., an Icahn investment vehicle, will attempt to a elect a slate of five directors, which will include Icahn, to VISX's board at the company's annual meeting.

"If my slate gets elected I will recommend to the slate that they put the company up for sale," he said. "We will see."

|

|

|

|

|

|

|