|

Airline 1Q losses mount

|

|

April 18, 2001: 3:33 p.m. ET

United warns of more red ink; Delta CEO says feds have promised no pilots strike

|

NEW YORK (CNNfn) - Red ink rained down from the skies Wednesday as six of the nation's largest air carriers reported losses for the first quarter, hit by slowing demand for business travel and labor unrest at many of the carriers.

The parent of United Airlines, the world's largest carrier, warned Wednesday it sees more losses ahead. But there was some good news for airline investors as well, as the CEO of the airline that has seen the worst labor problems -- Leo Mullin of Delta Air Lines -- said he has received assurances that President Bush will intervene to keep pilots there flying if labor and management reach and April 29 strike deadline without a settlement.

|

|

|

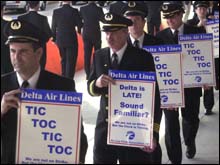

Delta Air Lines CEO Leo Mullin says the airline has assurances from federal officials that they would act to block a strike by the No. 3 airline's pilots, shown here on an informational picket line earlier this year. (Courtesy: ALPA) | | |

"Every signal we have from the federal government is that if in fact an impasse is reached at the end of the 30-day cooling off period, the government will ensure that no strike occurs," Mullin said during a conference call for analysts and other investors Wednesday.

Delta (DAL: up $2.22 to $43.32, Research, Estimates) reported a larger-than-expected loss for the first quarter Wednesday, as did UAL Corp. (UAL: up $2.31 to $35.96, Research, Estimates), owner of United Airlines, and US Airways Group Inc. (U: down $1.53 to $33.82, Research, Estimates).

AMR Corp. (AMR: up $2.75 to $37.75, Research, Estimates) -- the world's largest airline holding company since it added Trans World Airlines to its American Airlines holdings earlier this month, reported a smaller-than-expected loss for the first quarter Wednesday, as did No. 4 Northwest Airlines (NWAC: up $1.63 to $25.55, Research, Estimates) and No. 9 America West Holdings (AWA: up $0.19 to $9.85, Research, Estimates). All the airlines reporting results Thursday other than Northwest and US Airways made money in the year-earlier period.

All the airlines have said they're seeing a decline in demand for business travel in the current situation. The four largest carriers -- United, American, Delta and Northwest -- all have open contracts at this time, and have unions threatening strikes that could be scaring away passengers.

Bush could block strike at Delta

President Bush has yet to state what he would do in the case of a strike at Delta, although he has expressed concern that a major airline strike would hurt the nation's slowing economy.

He used his powers under the labor laws controlling airlines to name a "presidential emergency board" at Northwest Airlines earlier this year, which blocked the mechanics there from going on strike for at least 60 days. During that 60 day period, the airline and the Aircraft Mechanics Fraternal Association reached a tentative contract agreement.

But Bush has declined to use his powers to stop a strike by pilots at Delta feeder airline Comair, which flies about half the flights under the name Delta Connection.

A spokesman for the National Mediation Board, the federal agency that oversees airline labor relations, said it would not be appropriate for the agency to comment on Mullin's statement.

Karen Miller, spokeswoman for the Air Line Pilots Association, repeated the union's past contention that presidential invention would be bad for both sides. If there is no agreement during the 60 days a PEB considers the dispute, the union would be clear to strike at that point unless Congress votes to impose a settlement.

"All it's going to do is delay the period of uncertainty for the public," she said. "I don't see how it's in anyone's best interest." She could not say what federal officials had told the union about the possibility of intervention.

Officials from Delta and ALPA, which represents 9,800 pilots at Delta and 569 pilots at low-cost, lower-paid carrier Delta Express, returned to federally-mediated talks Wednesday.

United has an open contract with the International Association of Machinists, which represents its mechanics, ramp workers and customer service employees. But the National Mediation Board, which oversees labor relations in the airline industry, has yet to declare a 30-day cooling- off period in those talks which must occur before a union can strike under in the industry's labor law.

United's flight attendants have also authorized a strike, saying the company's proposed purchase of US Airways would violate its contract. But the airline disputes that the union has a legal right to strike.

American is in talks with its flight attendants, but again there is no 30-day cooling-off period at that carrier. Northwest is waiting for results of a ratification vote on its tentative agreement with its mechanics union.

Drop in business travel hurting industry

The losses posted Wednesday were not a great surprise. Only two major carriers will report a profit for this period: Continental Airlines (CAL: up $1.44 to $47.15, Research, Estimates), which reported a better-than-expected results Monday; and Southwest Airlines (LUV: up $0.58 to $18.17, Research, Estimates) which is expected to report a profit Thursday.

While analysts are expecting a return to the black for the industry in the traditionally stronger second quarter, the profits are expected to be off from year-earlier results, and may well be below current forecasts.

But the warnings from UAL may help to lower forecasts at a number of carriers. UAL said it believes it will lose money again in the second quarter, which would be far worst results than the 93 cent a share consensus profit forecast from First Call.

It also said that without a reversal in current revenue trends, it will lose money for the full year as well. First Call's forecast had been for the company to earn $2.48 in the last three quarters of the year, less than either the forecast or actual loss in the first quarter, so a full-year loss would not be a surprise.

For the just completed quarter UAL lost $305 million, or $5.82 a share, excluding a charge for a change in accounting practices. That was far worse than the $4.28 a share loss forecast by First Call for the period. A year earlier, the company earned $136 million, or 84 cents a share.

AMR loss not as bad as forecast

AMR reported it lost $43 million, or 28 cents a share, in the quarter. That's a little better than the 31 cents a share loss forecast by analysts surveyed by earnings tracker First Call. But the result is well below the profit of $89 million, or 57 cents a share, reported a year earlier.

The company's revenue rose 4 percent to $4.8 billion in the period.

"Without a doubt, the weakening U.S. economy caused a reduction in business travel that affected our performance in the first quarter," said Don Carty, AMR's CEO. He also pointed to bad weather and high fuel prices as factors in the results. Fuel costs were 24 percent higher than the year earlier quarter.

Carty said AMR's purchase of TWA, approved earlier this month, will be a key to the airline's speeding its economic recovery. The company continues to operate TWA as a separate carrier, though it intends to merge it into American later this year.

Feeder airline strike hits Delta results

Atlanta-based Delta, the nation's third-largest carrier, lost $122 million, or $1.02 a share, which also was larger than the First Call forecast of an 85-cent-a-share loss for the period, as well as the company's March 13 warning, which projected losses of 70-to-90 cents a share.

| |

|

|

Delta said its losses were worse than its earlier guidance due to a strike by pilots at its Comair unit, shown here on the picket line March 26, the first day of the strike. (Source: CNNfn file) | | |

The company earned $172 million, or $1.27 a share, in the year-earlier period.

The company said its loss exceeded its own warning because of the strike at its Comair feeder airline unit, which started March 26. The strike by pilots there reduced revenue at the carrier by $24 million, despite its start so close to the end of the quarter, and reduced the company's earnings per share by 12 cents.

Overall revenue at Delta fell to $3.8 billion from $3.9 billion a year earlier.

Losses grow at smaller carriers

Northwest, the nation's No. 4 carrier, lost $123 million, or $1.47 a share, better than the $1.64 a share loss forecast by analysts. The Minneapolis-based carrier lost $42 million, or 51 cents a share, in the year-earlier period.

US Airways, which along with UAL is awaiting approval for its purchase by UAL, lost $164 million, or $2.45 a share, excluding special charges. That was significantly wider than the $1.77 a share forecast by First Call, and is greater than the loss of $115 million, or $1.72 a share, reported on the same basis a year earlier.

"US Airways is experiencing the combined impact of a weak economic environment and expanding competition from low-cost competitors and network carriers," said a statement from Rakesh Gangwal, its CEO.

"The competitive environment underscores the necessity of US Airways becoming part of a larger network and thus we remain fully focused on our merger with United Airlines," said Stephen Wolf, US Airways chairman.

Click here for a look at airline stocks

The company's revenue gained 6.8 percent to $2.2 billion, but comparisons were helped because the year-earlier period included the threat of a strike by its flight attendants, and threats of a shutdown of the airline by management before an 11th-hour contract agreement.

America West lost $12.8 million, or 38 cents a share. That's better than the 45-cent loss forecast by analysts. A year earlier, America West reported a profit of $14.6 million, or 40 cents a diluted share. Revenue at the carrier increased 4.4 percent to $587.5 million.

The loss sparked the Phoenix-based carrier to announce a cost-reduction plan including the return of five leased jets, a cut of 10 percent in management and clerical payroll, as well as a 33 percent reduction in overtime. The company said the moves should save $75 million annually, and that it would cut capital spending by an additional $25 million.

"We believe these are the proper steps in this economic environment," said a statement from W.A. Franke, the airline's CEO. "Business travel has slowed dramatically while fuel prices remain high, resulting in reported losses for the airline industry in the hundreds of millions of dollars. We believe that uncertain times call for early and decisive action."

|

|

|

|

|

|

|