|

Accenture files $1B IPO

|

|

April 19, 2001: 12:01 p.m. ET

Former Andersen consulting unit files for $1B IPO led by Goldman and Morgan

|

NEW YORK (CNNfn) - Accenture Ltd., the world's biggest consulting firm, filed Thursday with the Securities and Exchange Commission to raise $1 billion in an initial public offering.

Accenture has yet to specify a price range or the number of shares it will offer, but the IPO will be jointly led by underwriters Goldman Sachs & Co. and Morgan Stanley. The company will trade on the New York Stock Exchange under the symbol "ACN."

CNNfn.com reported last Monday that Accenture partners were to vote this week on whether to change the firm's partnership structure and proceed with an IPO. Accenture's 2,500 partners voted overwhelmingly Thursday to proceed with the offering.

"Our partners' decision reflects our organization's commitment to enhance our long-term growth, strengthen our ability to deliver the highest-value solutions to our clients and continue to provide competitive rewards to motivate and attract the best people," said a statement from Joe W. Forehand, Accenture's managing partner and CEO.

Accenture, which is headquartered in both Palo Alto, Calif. and Hamilton, Bermuda, provides management and technology consulting services to 4,000 clients such as the London Stock Exchange, Dresdner Bank, Alcatel (ALA: down $1.46 to $32.54, Research, Estimates) and Motorola Inc. (MOT: up $0.45 to $15.65, Research, Estimates). Accenture, which is headquartered in both Palo Alto, Calif. and Hamilton, Bermuda, provides management and technology consulting services to 4,000 clients such as the London Stock Exchange, Dresdner Bank, Alcatel (ALA: down $1.46 to $32.54, Research, Estimates) and Motorola Inc. (MOT: up $0.45 to $15.65, Research, Estimates).

The firm, formerly known as Andersen Consulting, won its freedom from parent firm Andersen Worldwide last August. The firm had been involved in a bitter dispute over being forced to share profits with sister firm Arthur Andersen, the global accounting firm. Andersen Consulting changed its name to Accenture on Jan. 1 as a result of that split.

Andersen has hired 17,000 employees since September and currently has more than 70,000 employees in 46 countries.

In October, partners voted to approve a plan that could lead to a partial public offering of stock. The firm has spent the past six months reviewing the analytical, legal, financial and regulatory work needed to consider an IPO.

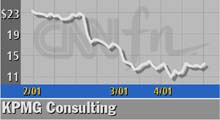

The Accenture offering will follow the IPO from rival KPMG Consulting Inc., another former unit a Big Five accounting firm. KPMG Consulting (KCIN: up $2.14 to $15.55, Research, Estimates) went public in February, raising $2 billion with a debut price of $18 a share.

But the market has not been good to KPMG Consulting. After a first-day bump of about 30 percent the stock has steadily lost ground since early March and has dropped 15 percent from its $18 offer price.

PricewaterhouseCoopers has said it is eyeing either a sale or IPO spinoff of its consulting unit. Last week, PwC said it plans to cut up to 1,000 jobs at its U.S. consulting business, or 8 percent of the unit's 12,000 work force.

Accenture is very profitable, posting $5.7 billion revenue on $1.4 billion operating income for the six months ended Feb. 28. and $10.3 billion revenue in fiscal 2000.

|

|

|

|

|

|

|