|

Firm fights short sellers

|

|

April 19, 2001: 2:49 p.m. ET

MicroStrategy asks its shareholders to fight those who are betting against them

|

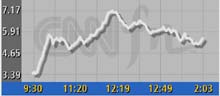

NEW YORK (CNNfn) - Shares of MicroStrategy rose as much as 141 percent Thursday after the business software maker took aim at the traders who have been selling the company's stock short.

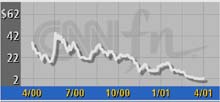

In an unusual move, MicroStrategy, whose stock is down 93 percent from its 52-week high, asked its shareholders to register stock in their own names. This, the company said, will prevent brokers from lending that stock to traders who borrow shares in the hopes of buying them back at a lower price and pocketing the difference.

| |

|

|

MicroStrategy's tough year | | |

"Promptly call your brokers and have your MicroStrategy stock taken out of street name or put into a cash account," the company wrote in a press release Thursday morning. "What would change? A short seller would not be able to borrow your stock for short sales without your permission."

For now, MicroStrategy's (MSTR: up $2.66 to $5.63, Research, Estimates) strategy seems to be working, following a rough year when the company settled a lawsuit involving alleged accounting irregularities.

But Scott Philips, who follows MicroStrategy for Merrill Lynch, said the company suffers from problems that likely have drawn the short sellers to its stock.

Vienna, Va.-based MicroStrategy late last year settled a Securities and Exchange Commission investigation after an earnings restatement caused its stock to plunge. The company neither admitted nor denied wrongdoing.

|

|

|

But the company's stock posts a strong daily gain | | |

"There are fundamental issues that the company is trying to come to grips with," said Philips, who added staff defections to the list.

"The issue is, why is there short interest, and the answer is there's some significant flaws," said Philips, who has a "hold" rating on the stock.

Referring to the problems, the company's letter from CEO Michael Saylor called the year a "rocky" one for shareholders. Saylor said the company will be cutting costs and focusing on the business intelligence software market in an attempt to become profitable this year.

But the bulk of the letter focuses on, and concludes with, a very direct appeal to shareholders.

"Because of the heavy short selling pressure on our stock, we believe that your immediate help would be desirable," Saylor wrote. "Accordingly, we are asking stockholders to call their brokers to have their shares promptly taken out of street name or a margin account."

Somebody was listening. More than 8.6 million shares of MicroStrategy had changed hands by Thursday afternoon, compared with average daily volume of 584,000 shares.

|

|

|

|

|

|

|