|

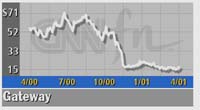

Gateway meets Street

|

|

April 19, 2001: 5:57 p.m. ET

PC maker takes huge restructuring charge, sees stronger second half

|

NEW YORK (CNNfn) - Gateway Inc. met Wall Street first quarter expectations Thursday but took a $533 million restructuring charge as the firm continues to be hard-hit by a slowdown in the PC market.

Including a one-time $533 million charge, San Diego-based Gateway (GTW: up $0.72 to $18.02, Research, Estimates) reported a first-quarter loss of $503 million, or $1.56 a share, compared with net income of $120 million, or $0.36 per diluted share, for the same time period last year. Excluding the charge, accounting changes and losses on a consumer loan portfolio, Gateway had a loss of $6 million, or 1 cent a share, in the quarter.

Earnings tracker First Call expected Gateway to report a loss of 1 cent a share. First Call expects a 2 cent profit in the second quarter and 39 cents for fiscal 2001.

In February, Gateway reduced expectations for the first quarter and said it expected to break even on an operating income basis. The company also said it could record as much as $275 million in charges due to layoffs and other restructuring measures.

In January, Gateway founder Ted Waitt replaced chief executive Jeff Weitzen, who stepped down. In January, Gateway founder Ted Waitt replaced chief executive Jeff Weitzen, who stepped down.

Sales in the first quarter dropped 15 percent to $2.03 billion. Gateway sold 1.1 million units globally, a 12 percent drop from last year, the company said in a statement.

"While our revenue performance in the quarter was negatively impacted by our own strategic decision to focus on more profitable revenue streams going forward, this is a strategy that should yield healthier shareholder returns both now and in the future," Waitt said.

Excluding special charges, Gateway expects to break even, on an operating income basis, for the rest of the first half. The company expects sales to fall, compared with last year, but foresees a return to profitability on an operating income basis in the second half.

Pricing the key in 2Q

Chief Financial Officer Joe Burke said on Thursday that he expects

unit sales to decline in the second quarter at about the same rate as the first quarter. How a similar decline in unit sales in the second quarter would translate into actual sales declines would depend on pricing, he told Reuters.

PC prices have been falling fast, with PC makers competing for share in a the midst of a slowdown. Burke said that he did not yet know how much more the company would need to cut prices to compete with other computer makers.

"There are absolutely competitive pressures," he said. "I don't know if I'd characterize it as a price war."

Gateway expects to take one-time pretax charge of $25 million in second quarter and $10 million charge in third quarter, both related to restructuring.

Gateway (GTW: up $0.72 to $18.02, Research, Estimates) shares dropped 12 cents to $17.90 in after-hours trading on Instinet.

|

|

|

|

|

|

|