|

Xerox 1Q loss below target

|

|

April 19, 2001: 1:03 p.m. ET

Company warns of larger-than-expected 2Q loss, predicts 2nd-half profit

|

NEW YORK (CNNfn) - Troubled copier maker Xerox Corp. posted a smaller-than-expected loss for the first quarter Thursday and warned its second-quarter loss will be larger than expected.

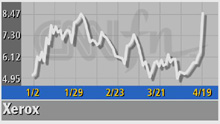

Yet its shares soared nearly 40 percent after the company said it anticipates a return to profitability in the second half, prompting bargain-hungry investors to snap up the stock, which has been trading near 52-week lows of about $3.

Stamford, Conn.-based Xerox (XRX: up $2.10 to $8.50, Research, Estimates) reported a loss of 12 cents a share from operations in the quarter, excluding gains from the sale of assets and a restructuring charge. Analysts surveyed by earnings tracker First Call forecast the company would lose 28 cents a share, compared with a profit of 30 cents a share a year earlier.

But the company said it expects a loss in the second quarter in line with the first-quarter results, and then a return to profitability in the second half of the year. The First Call forecast called for only a 7 cent a share loss in the second quarter. But the company said it expects a loss in the second quarter in line with the first-quarter results, and then a return to profitability in the second half of the year. The First Call forecast called for only a 7 cent a share loss in the second quarter.

"Xerox's performance in the first quarter is evidence of significant cash and operational improvements as well as the effectiveness of our turnaround strategy," CEO Paul Allaire said.

Xerox has been struggling in recent quarters as it hesitated to invest in computer printers, scanners and networking systems as did its rivals, Canon (CAJ: down $0.15 to $40.79, Research, Estimates) and Hewlett-Packard (HWP: down $0.14 to $31.76, Research, Estimates). Instead, Xerox continued to focus on its tried and true copier and document business, for which the market subsequently decline.

Click here to view other technology stocks

The problems became so big that last fall rumors of bankruptcy began circulating, which Xerox vehemently denied.

The company has been struggling to catch up with competitors ever since, announcing a massive turnaround plan last October that includes selling off non-core assets and trimming jobs.

|

|

|

|

|

|

|