|

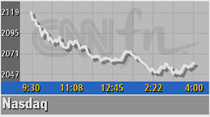

Nasdaq falls nearly 5%

|

|

April 23, 2001: 4:56 p.m. ET

April's early rally gives way to losses as investors' profit concerns remain

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - Worries about weakening corporate profits returned to Wall Street Monday, sending U.S. stocks lower after a two-week rally sent the major indexes to some of their highest levels in a month.

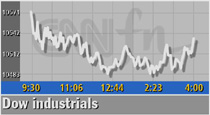

Intel and Oracle paced losses for the Nasdaq composite index when two brokerages downgraded those stocks. The day's declines, which spread to the Dow Jones industrial average, came after another round of companies, including 3M and SBC Communications, warned that this year's financial results will fall short.

"The big question is whether (the gains of April) were the beginning of a sustainable rally," said Chuck Carlson, portfolio manager for Horizon Investment Services. "My sense is it's probably too soon for that." "The big question is whether (the gains of April) were the beginning of a sustainable rally," said Chuck Carlson, portfolio manager for Horizon Investment Services. "My sense is it's probably too soon for that."

Carlson doesn't see substantial gains until certainty emerges that the worst news about slowing corporate sales and earnings is over. That, he said, isn't likely to happen until the second half of the year. Carlson forecasts only limited gains until then.

In addition to earnings concerns, the market's recent gains also have become a liability during a time when all advances are met with suspicion.

"To rally like we've done over the last couple of weeks, (the day's losses are) only to be expected," Nick Angilletta, global head of retail sales at Salomon Smith Barney, told CNNfn's The Money Gang.

The Nasdaq fell 104.10 points, or 4.8 percent, to 2,059.31 while the Dow industrials slipped 47.62 to 10,532.23. The S&P 500 dropped 18.62 to 1,224.36.

More stocks fell than rose. Declining issues on the New York Stock Exchange topped advancing ones 1,829 to 1,243 as 1 billion shares traded. Nasdaq losers beat winners 2,413 to 1,461 as 1.8 billion shares changed hands. More stocks fell than rose. Declining issues on the New York Stock Exchange topped advancing ones 1,829 to 1,243 as 1 billion shares traded. Nasdaq losers beat winners 2,413 to 1,461 as 1.8 billion shares changed hands.

In other markets, Treasury securities rose as investors seeking safety from falling stocks moved into fixed-income securities. The dollar advanced against the euro but edged lower versus the yen.

Oracle, Intel fall

Last week, the Nasdaq rose 10 percent while the Dow gained 4.4 percent. The stock market often pulls back after short rallies, and that pattern continued Monday. At the same time, worries resurfaced about the outlook for technology companies.

Lehman Brothers cut its rating on Oracle (ORCL: down $2.60 to $17.15, Research, Estimates) to a "buy" from "strong buy" and lowered its earnings estimates for the software maker.

In a note to clients, Lehman analyst Neil Herman worried that for Oracle, the current quarter may be "unusually weak given the tough U.S. macroeconomic environment and potentially weakening conditions in international markets."

Merrill Lynch, meanwhile, made negative comments on the chip sector and downgraded Intel (INTC: down $2.11 to $30.32, Research, Estimates) to "neutral" from "accumulate."

Joe Osha, who covers chip stocks for Merrill Lynch, said recent gains "increased the downside that investors face between here and the fundamental bottom for the semiconductor industry, which is still at least a quarter away." Joe Osha, who covers chip stocks for Merrill Lynch, said recent gains "increased the downside that investors face between here and the fundamental bottom for the semiconductor industry, which is still at least a quarter away."

Analysts for months have debated whether slowing demand for software and semiconductors has finally bottomed. At the same time, investors have attempted to get into these stocks at good values before demand, and prices, pick up. But the notes from Merrill and Lehman suggest the worst for these companies has not passed.

Another round of companies, meanwhile, said they would miss Wall Street's targets.

While SBC Communications (SBC: down $0.75 to $39.25, Research, Estimates) posted a profit that met forecasts, the regional phone company warned it will miss expectations for the full year.

3M (MMM: up $3.80 to $116.30, Research, Estimates), which makes Scotch tape and Post-it notes, also said its full-year results will come up short and that it will eliminate 5,000 jobs. The company's first-quarter earnings were in line with analysts' targets.

Click here for a look at the latest warnings

American Express (AXP: down $0.99 to $40.51, Research, Estimates) said quarterly profit fell to 40 cents a share, topping lowered forecasts.

Oil producer Exxon Mobil (XOM: up $2.83 to $88.00, Research, Estimates) said its first-quarter profit jumped to $1.44 a diluted share, topping forecasts.

Defensive stocks such as tobacco, drug and utility shares, which often rise when tech shares fall, advanced Monday. They included Merck (MRK: up $0.64 to $74.25, Research, Estimates) and Philip Morris (MO: up $0.79 to $47.95, Research, Estimates). The Dow Jones utility index gained 7.32 points, or 1.9 percent, to 392.90.

About half of the companies in the S&P 500 have reported results for the first three months of 2000, and many of them have topped Wall Street expectations. Still, many of those expectations were sharply lowered when a record number of companies pre-announced that they would miss estimates.

The market's latest losses come amid a time of short-term gains. The Nasdaq closed Friday 32 percent above its April 4 low but more than 50 percent from last year's record highs.

Historically, the market has always rebounded. But the question remains when. The Dow Jones industrial average has more than tripled over the last nine years. But the period before that was tough. It took the Dow 11 years, between 1972 and 1983, for the Dow to rise from 1,000 to 1,100, a gain of 10 percent.

Investors, hammered by 12 months of losses, still appear wary, according to a survey that tracks sentiment. UBS PaineWebber and the Gallup Organization said Monday its index of investor optimism declined dramatically in April.

The poll, a survey of 1,003 randomly selected investors, was conducted before the Federal Reserve made a surprise, inter-meeting interest rate cut last Wednesday that sent the markets rallying. The poll, a survey of 1,003 randomly selected investors, was conducted before the Federal Reserve made a surprise, inter-meeting interest rate cut last Wednesday that sent the markets rallying.

A closely-watched read on the confidence of consumers, whose spending counts for about two-thirds of the nation's gross domestic product, comes Tuesday. The index from the Conference Board, a private research group, is expected to fall again in April.

With stock prices sinking and corporate layoffs rising, consumer confidence has deteriorated. But John Forelli, vice president at Independent Advisors, remains upbeat, particularly for stocks outside of technology

"With four Fed rate cuts working their way through, we may be back on a solid growth track toward the end of the year," said Forelli, who expects another half percentage point rate cut by the Fed before the end of June.

|

|

|

|

|

|

|