|

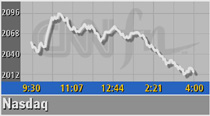

Nasdaq, Dow falter

|

|

April 24, 2001: 4:56 p.m. ET

Stocks give back an early gain as bad news sinks in, spurring trepidation

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - Another round of troubling corporate and economic news sent U.S. stocks lower for a third straight session Tuesday. The losses put the Standard & Poor's 500 index in bear market territory for the second time this year.

JDS Uniphase, Compaq Computer and AT&T all warned that profits will miss forecasts. Lucent Technologies posted a wider-than-expected quarterly loss. And a survey of U.S. households showed that consumer confidence tumbled in April amid growing corporate layoffs and a falling stock market.

The significance of the news, though ignored for much of the session, built toward the close, reviving some fears that stocks may have yet to bottom. The significance of the news, though ignored for much of the session, built toward the close, reviving some fears that stocks may have yet to bottom.

"If we are going to test new lows, this is probably as good a time as any to get out," Kim Fennebresque, president and CEO of SG Cowen, told CNNfn's Street Sweep. "I think there is an enormous amount of caution impairing the economy."

Fennebresque said the economy may take longer to turn around than some expect. And stock investors, he said, may be able to get lower prices later.

The Nasdaq composite index fell 42.71 points, or 2 percent, to 2,016.61 while the Dow Jones industrial average lost 77.89 points, or 0.8 percent, to 10,454.34.

The S&P 500 slid 14.89, or 1.2 percent, to 1,209.47. From its record high of last year, the broad index has fallen more than 20 percent, the level considered a bear market.

Still, buying on weakness has proven profitable in April, when many dips led to higher highs. While the major stock indexes are still lower for the year, some market watchers say it's time to get back into stocks ahead of any sustained rebound.

"I think we are at or close to as bad as it's going to get," Linda Jay, New York Stock Exchange trader at LaBranche & Co., told CNNfn's Market Call. "I think we are at or close to as bad as it's going to get," Linda Jay, New York Stock Exchange trader at LaBranche & Co., told CNNfn's Market Call.

Market breadth was mixed. Advancing stocks on the NYSE topped declining ones 1,536 to 1,495 as 1.2 billion shares traded. But Nasdaq losers edged out winners 2,018 to 1,848 as 1.9 billion shares changed hands.

In other markets, Treasury securities edged lower. The dollar rose against the euro and yen.

More warnings

Another round of companies said they are having trouble as demand for their products slows. Among them, JDS Uniphase (JDSU: down $3.36 to $20.82, Research, Estimates), which makes fiber-optic equipment, warned that earnings for its fourth quarter ending June 30 will miss targets. To trim costs, the company announced it will cut 5,000 jobs, or 20 percent of its work force.

Rival Corning (GLW: down $0.40 to $22.70, Research, Estimates) also fell.

In other losers, Compaq (CPQ: down $3.15 to $17.50, Research, Estimates), the No. 2 computer maker, lowered its financial targets for the current quarter and posted a first-quarter profit that fell short of estimates. Losses spread to Compaq rival Dell Computer (DELL: down $3.50 to $25.85, Research, Estimates).

But not all companies were punished for saying they will miss profit or sales targets. Among them, AT&T (T: up $0.14 to $22.12, Research, Estimates) warned that profit in the second quarter will come up short. The company also said first-quarter earnings fell to 6 cents a share excluding special items, just above revised estimates. But not all companies were punished for saying they will miss profit or sales targets. Among them, AT&T (T: up $0.14 to $22.12, Research, Estimates) warned that profit in the second quarter will come up short. The company also said first-quarter earnings fell to 6 cents a share excluding special items, just above revised estimates.

Lucent Technologies (LU: up $1.05 to $10.25, Research, Estimates) an AT&T spinoff whose stock traded above $82 in late 1999, reported a fiscal second-quarter loss that was wider than expected.

Despite the losses, Arnie Berman, managing director at Wit Soundview, said that not being in the market in the may be riskier than avoiding it.

"It makes much more sense to buy weakness" than to sell on strength, said Berman. "The period of the maximum rate of deterioration is behind us."

The confidence of consumers took another tumble this month. Consumer sentiment fell to 109.2, according to the Conference Board's index. That's well below the 113 expected by economists surveyed by Briefing.com.

But while the fall appears dramatic, Ian Shepherdson, chief U.S. economist at High Frequency Economics, said the index has really only slipped to February levels following a gain in March.

"Despite undershooting the consensus, these numbers do not look too bad to us," Shepherdson said. "Confidence might well dip further -- job fears hit a 28-month high this month -- but the big plunge looks to be over."

The confidence of consumers has declined amid growing job cuts and a falling stock market. Federal Reserve policy makers took a step to turn that around last week when they surprised Wall Street with an unusual interest rate cut between meetings. But the Conference Board surveyed people before the Fed action.

The year's fourth interest rate cut, which sparked a rally, should eventually increase spending by consumers and business by making it cheaper to borrow money. Still, timing that rebound can be tricky.

Marshall Acuff, equity strategist at Salomon Smith Barney, expects that the market could have more trouble before improving.

"I'd be inclined to gradually put money in, but if I do so I'd do so on a diversified basis," Acuff told CNNfn's Before Hours.

Acuff is spreading his bets, favoring forest products stocks, financials, health care and blue chip tech shares such as IBM (IBM: up $0.67 to $112.67, Research, Estimates) and Intel (INTC: down $1.18 to $29.14, Research, Estimates). Acuff is spreading his bets, favoring forest products stocks, financials, health care and blue chip tech shares such as IBM (IBM: up $0.67 to $112.67, Research, Estimates) and Intel (INTC: down $1.18 to $29.14, Research, Estimates).

Diversification may not have proven profitable Tuesday. Only 10 of the 30 stocks in the Dow industrial rose and none of them gained more than 67 cents.

In other financial results, online retailer Amazon.com (AMZN: down $0.52 to $15.68, Research, Estimates) after the close of trading reported a narrower-than-expected first quarter loss.

In addition to Amazon, investors Wednesday will have a chance to react to another round of economic data including figures on new and existing homes sales as well durable goods orders, all for March.

The figures come with the market at a crossroads. The Nasdaq, 23 percent above its early April low, still remains more than 50 percent below its record high of last year. The Dow industrials, 12 percent above their low, are still 10 percent below their high.

|

|

|

|

|

|

|