|

Daimler posts huge 1Q loss

|

|

April 25, 2001: 10:05 a.m. ET

Carmaker limits loss excluding charges, but analyst says it delayed bad news

|

NEW YORK (CNNfn) - DaimlerChrysler posted a smaller-than-expected first-quarter loss, although an analyst said Wednesday it was an accounting move that allowed it to limit the red ink in the quarter.

The German-American carmaker reported a loss of  373 million, or 373 million, or  0.37 a basic share, which equals $328 million, or 33 cents, excluding special items. The company earned 0.37 a basic share, which equals $328 million, or 33 cents, excluding special items. The company earned  1.7 billion, or 1.7 billion, or  1.69 a basic share, on the same basis a year earlier. 1.69 a basic share, on the same basis a year earlier.

Analysts surveyed by earnings tracker First Call were looking for a loss of 47 cents a share in the quarter.

Stephen Reitman, a Merrill Lynch analyst based in London, said a smaller-than-expected loss at Mitsubishi Motors, the Japanese automaker in which it holds a controlling minority stake, led to Daimler's better-than-forecast performance.

|

|

|

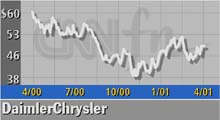

Value of DaimlerChrysler's U.S. shares. | | |

"It looks like they'll record  400 million in losses in future quarters," he said. "Without that, they would have come in line with the guidance. I don't think we can be too positive on the basis of these figures." 400 million in losses in future quarters," he said. "Without that, they would have come in line with the guidance. I don't think we can be too positive on the basis of these figures."

The company took substantial charges related to restructuring plans and layoffs at its troubled Chrysler unit as well as at Mitsubishi. That led Daimler to post a net loss of  2.36 billion, or 2.36 billion, or  2.35 a share, which equals $2.07 billion, or $2.07 a share, in the quarter. 2.35 a share, which equals $2.07 billion, or $2.07 a share, in the quarter.

The company, based in Stuttgart, Germany, announced plans in late February to take $3.9 billion in charges as part of a three-year recovery plan aimed at restoring Chrysler to profitability.

Chief Executive Juergen Schrempp came under fire from shareholders last month over his failed plan to create a world automaking powerhouse. He reiterated his support both for keeping the U.S. Chrysler unit and investing in Japanese automaker Mitsubishi.

Click here for a look at auto stocks

A key to its restructuring plan is the elimination of about 26,000 jobs at Chrysler and another 9,600 jobs at Mitsubishi.

Shares of DaimlerChrysler (DCX: down $0.54 to $49.37, Research, Estimates) fell in early New York trading, while its shares lost  1.45 to 1.45 to  54.55 in trading in Frankfurt after the results were announced. 54.55 in trading in Frankfurt after the results were announced.

Merrill Lynch's Reitman said the soaring costs of incentives in the U.S. market were particularly troubling. He said marketing costs, which includes incentives, now stand at 21 percent of Chrysler's sales.

"We all gasped when it got to 13.3 percent last year," he said. "Now it's at 21 percent."

Daimler's Chrysler unit reported a loss of  1.4 billion, or $1.2 billion, excluding special charges, compared with an operating profit of 1.4 billion, or $1.2 billion, excluding special charges, compared with an operating profit of  1.4 billion a year earlier. Commercial vehicles lost 1.4 billion a year earlier. Commercial vehicles lost  138 million, or $121 million, compared with the 138 million, or $121 million, compared with the  258 million operating profit in the first quarter of 2000. The company is the world's largest builder of heavy trucks. 258 million operating profit in the first quarter of 2000. The company is the world's largest builder of heavy trucks.

Its Mercedes-Benz passenger car and smart car unit earned  670 million, up from 670 million, up from  591 million a year earlier. 591 million a year earlier.

Overall sales fell 13 percent in the quarter to  35.5 billion, or $31.2 billion. Sales rose 13 percent at its Mercedes-Benz passenger car unit, but fell 28 percent at Chrysler to 35.5 billion, or $31.2 billion. Sales rose 13 percent at its Mercedes-Benz passenger car unit, but fell 28 percent at Chrysler to  13.6 billion, or $11.98 billion. 13.6 billion, or $11.98 billion.

The company said it expects full-year revenue of  145 billion, which comes to about $127.5 billion. That would be below the First Call forecast of $148.9 billion. 145 billion, which comes to about $127.5 billion. That would be below the First Call forecast of $148.9 billion.

|

|

|

|

|

|

|