|

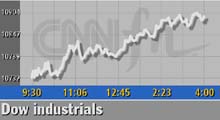

Dow rallies to 10-week high

|

|

May 1, 2001: 4:24 p.m. ET

Blue chips lead gains amid optimism in economy and earnings; late tech surge

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - The Dow Jones industrial average rallied to its highest level in two-and-a-half months Tuesday amid renewed investor confidence about an economic turnaround and corporate earnings growth.

Triple-digit gains on the Dow were led by consumer products maker Procter & Gamble, which issued a strong profit report. Blue chips also got a boost after a key report about manufacturing fell only modestly short of expectations, signaling some underlying strength.

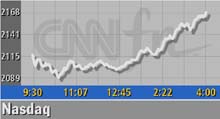

Technology stocks waffled throughout most of the trading session before buyers stepped into the fray with some conviction, boosting the tech-heavy Nasdaq composite index.

The recent economic reports, coupled with a string of interest rate cuts by the Federal Reserve, have also helped prompt some modest optimism – especially as quarterly corporate results wind down.

"You're coming out of earnings season with more evidence that the economy, particularly the manufacturing side, has bottomed," said Joe Battipaglia, chief investment strategist with Gruntal & Co. "There's growing enthusiasm and encouragement about the economy and the ultimate outlook for earnings, so that would put money managers and investors on the 'buy' side." "You're coming out of earnings season with more evidence that the economy, particularly the manufacturing side, has bottomed," said Joe Battipaglia, chief investment strategist with Gruntal & Co. "There's growing enthusiasm and encouragement about the economy and the ultimate outlook for earnings, so that would put money managers and investors on the 'buy' side."

The Dow Jones industrial average surged 163.37 points to 10,898.34 – its highest level since Feb. 13, when it closed at 10,903.32. The Nasdaq gained 52 points, or 2.5 percent, to 2,168.24. The Standard & Poor's 500 rose 16.98 points to 1,266.44.

While buying in technology stocks picked up momentum, analysts said the bulk of the buying still seemed to stem from some of the defensive issues on the Dow, such as Boeing (BA: up $1.63 to $63.43, Research, Estimates), Philip Morris (MO: up $1.99 to $52.10, Research, Estimates), and Coca-Cola (KO: up $1.44 to $47.63, Research, Estimates). While buying in technology stocks picked up momentum, analysts said the bulk of the buying still seemed to stem from some of the defensive issues on the Dow, such as Boeing (BA: up $1.63 to $63.43, Research, Estimates), Philip Morris (MO: up $1.99 to $52.10, Research, Estimates), and Coca-Cola (KO: up $1.44 to $47.63, Research, Estimates).

The strength in the afternoon rally was helped by news that House and Senate Republicans agreed to a tax cut of $1.35 trillion over 11 years, with an $100 billion retroactive cut this year to stimulate the economy. Congressional sources told CNN the White House has accepted the tax cut number, which is less than the $1.6 trillion tax cut President Bush originally proposed but close enough for the White House to claim a substantial victory.

"The market is smelling a positive surprise that Congress is going to do something good for the economy," said Michael Holland, chairman of Holland & Co. "What we're looking at is a growing conviction that the worst is behind us."

Market breadth was positive and volume picked up in the last hour of trading. Analysts said many investors were sitting on the sidelines as they digested the data. Add the fact that markets in 65 countries closed for a holiday, and analysts said investors were reluctant to place any large bets.

Winners beat losers on the Nasdaq 2,368 to 1,519 as more than 1.89 billion shares changed hands. On the New York Stock Exchange, advancers outpaced decliners 1,869 to 1,181 as more than 1.16 billion

shares were traded.

Among those overseas stock markets that were open, Tokyo closed sharply higher while Europe's were mixed. The dollar fell against the euro and the yen. Treasury securities rose.

Burst of buying in Dow

Analysts said the rising optimism was not yet strong enough for investors to pour money into riskier tech issues. Rather, investors were seeking safety in the Dow until more evidence surfaces that the economy was indeed strengthening.

"There are a lot of cross-currents in the market," said Tracy Eichler, investment strategist with UBS PaineWebber. "We're still a market that's torn between (concern about) earnings and interest rates."

With the bottoming out process in full swing, analysts said there are bargains to be found and investors should selectively start putting money back to work.

"People are beginning to feel like the boat is leaving the dock -- there is a lot of money on the sidelines," said Al Goldman, chief market strategist with AG Edwards. "The bottom line is we are transitioning from a bear mood to a bull mood, but it doesn't go straight up. Bear markets stink, but it creates very good opportunities for intermediate to long-term investors."

Tech stocks were mixed but the buying was gaining momentum. Among the leading gainers were Microsoft (MSFT: up $2.42 to $70.17, Research, Estimates) and IBM (IBM: up $3.37 to $118.51, Research, Estimates), while selling prevailed in stocks such as Dell Computer (DELL: down $0.48 to $25.76, Research, Estimates) and Oracle (ORCL: down $0.12 to $16.04, Research, Estimates).

Gruntal's Battipaglia said techs were the lagging sector in this turnaround because "they (investors) can get a better relative performance in the consistent earnings growers and eventually they'll get back to tech."

While most do not expect the major indexes to retest their lows for the year, analysts were encouraged by the resiliency of the markets -- led by the fact that there wasn't a significant selloff from the economic news.

"The market is acting very well," said Goldman. "The Wilshire 5000 index (one of the broader measures of stock market performance) in April had its biggest monthly advance in 10 years, so the market has come a long way in a short period of time."

Digesting economic news

All eyes and ears are now tuned into the economy, with market participants attempting to discern whether or not the slowdown has been tempered.

Analysts said new reports have signaled a recovery from recent weakness, but cautioned that further evidence was still needed.

"We shouldn't get too far ahead of ourselves in terms of an economic recovery," said Art Hogan, chief market strategist with Jefferies & Co. "I think the debate will become much more macro-economic instead of the micro focus we have had."

The National Association of Purchasing Management said its index of manufacturing barely edged up to 43.2 in April from 43.1 in March. A reading below 50 indicates a shrinking manufacturing sector. Wall Street analysts had forecast a reading of about 44.

Separately, the government reported a 1.3 percent increase in construction spending in March, far above forecasts for a 0.2 percent rise.

The Fed managed to surprise the markets twice in four months with two inter-meeting interest rate cuts, adding to the two cuts made at its regular meetings of the Federal Open Market Committee.

The FOMC, the Fed's monetary-policy making body, meets again May 15. Most market participants said that, while there seems to be some strength, another rate cut is needed.

"Four interest rate decreases in a row indicate a rebound," Sam Stovall, senior investment strategist with Standard & Poor's, told CNNfn's Before Hours. "I think the GDP (gross domestic product) report indicated we may see a 25 basis-point (one-quarter percentage point) cut at the May meeting. But our thought is the Fed will probably cut by a total of 50 (one-half percentage point) between the May and June meeting."

Companies still reporting results

Most of the top-tier companies already have posted their quarterly results for the quarter ended in March, but there still are more reports coming.

"We've sort of gotten through the meat of earnings season, and we're going to start focusing on the state of the economy," Jefferies' Hogan said.

Consumer products maker Procter & Gamble (PG: up $4.13 to $64.18, Research, Estimates) saw its fiscal third-quarter profit rise as it edged above lowered earnings forecasts for the period despite lower revenue.

| |

EARNINGS NEWS EARNINGS NEWS

|

|

| |

|

Click below for a comprehensive look at results and tallies

Corporate Results

|

|

|

Wireless telephone company Nextel Communications (NXTL: up $2.44 to $18.69, Research, Estimates) posted a smaller first-quarter loss amid the slowing U.S. economy and said it would cut 5 percent of its workers.

Expedia (EXPE: up $4.11 to $30.12, Research, Estimates), the online travel service affiliated with Microsoft, reported its first-ever operating profit late Monday. The company earned 9 cents a share, compared with a loss of 40 cents a year earlier. Expedia (EXPE: up $4.11 to $30.12, Research, Estimates), the online travel service affiliated with Microsoft, reported its first-ever operating profit late Monday. The company earned 9 cents a share, compared with a loss of 40 cents a year earlier.

Priceline.com (PCLN: up $1.74 to $6.59, Research, Estimates), the online discount travel service that's due to post first-quarter results after the bell, benefited from a Goldman Sachs upgrade. The company is expected to report that its loss widened to 5 cents a share from 4 cents a year earlier.

|

|

|

|

|

|

|