|

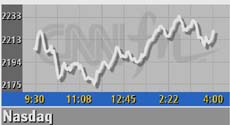

Two-month high on Nasdaq

|

|

May 2, 2001: 4:29 p.m. ET

Betting on an economic and earnings rebound, investors buy select techs

By Staff Writer Catherine Tymkiw

|

NEW YORK (CNNfn) - The Nasdaq composite index surged to a two-month high Wednesday as investors put money to work in the technology sector, betting that the worst was over for the economy and earnings.

"There is a better tone to the market and money is flowing back into both the Dow and the Nasdaq," said Alan Ackerman, senior vice president with Fahnestock & Co. "Many think we've seen the worst and the next interest rate cut by the Fed will help get the economy going."

Nick Angiletta, head of global trading with Salomon Smith Barney, agreed that sentiment is turning, and said tech stocks will be the leading beneficiaries.

"The techs look a lot better – it's not what techs can do for the economy but what the economy can do for techs," he said. "The techs look a lot better – it's not what techs can do for the economy but what the economy can do for techs," he said.

The Nasdaq capped four days of gains to reach its highest level since early March. The index rose 52.34 points, or more than 2 percent, to 2,220.58 – it closed at 2,223.92 on March 7.

Energy and consumer cyclical issues struggled as many market participants were reluctant to make any large bets ahead of Friday's unemployment report.

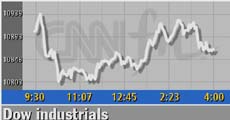

The Dow Jones industrial average slipped 21.66 points to 10,876.68. The blue chip index, which has fewer tech stocks than the Nasdaq, waffled on either side of breakeven in afternoon trading as investors sought select values. The Standard & Poor's 500 advanced 0.98 to 1,267.42. The Dow Jones industrial average slipped 21.66 points to 10,876.68. The blue chip index, which has fewer tech stocks than the Nasdaq, waffled on either side of breakeven in afternoon trading as investors sought select values. The Standard & Poor's 500 advanced 0.98 to 1,267.42.

"From a macro standpoint, clearly we're looking for information regarding employment (data from the government) on Friday as the next catalyst," said Matt Johnson, head of Nasdaq trading with Lehman Brothers. "There's been no information that's been market-moving as of late. But in general, the environment for tech investing has been good."

Market breadth was positive. Winners beat losers on the Nasdaq 2,420 to 1,496 as more than 2.55 billion shares changed hands. On the New York Stock Exchange, advancers outpaced decliners 1,548 to 1,520 as more than 1.34 billion shares were traded.

In other markets, Treasury securities edged higher. The dollar was little changed against the euro but weakened versus the yen.

Recent economic reports have signaled some underlying strength, but analysts cautioned investors should temper their enthusiasm until further evidence is released.

"The market has done better than I would have thought," James Awad, money manger with Awad Asset Management, told CNNfn's Before Hours. "You've got some signs that the economy is starting to stabilize -- it looks like the consumer is counteracting the negative effects of the capital spending slowdown in technology."

Techs mostly gain while others flounder

U.S. technology stocks headed higher from the start of trading after talk circulated that Cisco Systems (CSCO: up $2.20 to $20.00, Research, Estimates) is working through its inventory glut.

"Everyone is talking about Cisco getting rid of its inventory problem a little bit faster than people had thought," said Brian Finnerty, head of Nasdaq trading with C.E. Unterberg Towbin. "But the whole Nasdaq is looking better."

In a note to clients, Morgan Stanley analyst Christopher Stix said the enterprise market, or end user for networking equipment, in North America appears to be firming.

"While the market continues to be weak in comparison to last year, it appears to have stabilized, which on the margin this is good news for Cisco," he wrote.

The Dow got a lift from Eastman Kodak (EK: up $1.80 to $45.70, Research, Estimates), which reiterated it expects to earn $1.00 to $1.30 a share in the second quarter and said it intends to build on its success with internal and external investments and acquisitions. The First Call consensus for the photo products maker is $1.09 a share.

Kodak also held its analyst meeting Wednesday and Goldman Sachs analyst Jack Kelly said the company is adjusting its staff and the size of its capital expenditures to achieve a more realistic growth rate.

Exxon Mobil (XOM: down $2.30 to $86.50, Research, Estimates) pressured the Dow after the American Petroleum Institute reported a sharp rise in oil inventory that affected the broader energy sector.

Other big movers on the blue chip index included American Express (AXP: up $0.99 to $43.24, Research, Estimates), J.P. Morgan Chase (JPM: up $0.84 to $49.57, Research, Estimates), and Disney (DIS: up $0.70 to $31.25, Research, Estimates).

"It's a little bit of a divergent market," said Peter Cardillo, director of research with Westfalia Investments. "There's some money on the sidelines coming into the tech stocks, and any meaningful rally from here will probably be led by the tech group."

Despite the renewed confidence, the broader tech sector was mixed. IBM (IBM: down $3.11 to $115.40, Research, Estimates), Microsoft (MSFT: down $0.41 to $69.76, Research, Estimates), and Qualcomm (QCOM: down $1.65 to $60.10, Research, Estimates) were among the losers, while JDS Uniphase (JDSU: up $1.75 to $23.85, Research, Estimates), Oracle (ORCL: up $1.13 to $17.17, Research, Estimates), and Altera (ALTR: up $0.83 to $27.48, Research, Estimates) were among the gainers.

Gauging the economy

The inventory talk in the tech sector comes on the heels of a report by the National Association of Purchasing Management that included indications of inventory reductions and lower prices for raw materials.

In the day's economic news, factory orders rose 1.8 percent in March, the government said, just above expectations. In February, orders received by factories fell a revised 0.1 percent.

Analysts are encouraged that stocks have held up well in the face of average news. But they also said that investors should not get ahead of themselves in banking on the worst being over; instead, they should pick stocks selectively.

"The caution I have is stock prices are up a lot -- and we still may have signs of economic weakness and we may have some pretty sloppy earnings reports in the second quarter," Awad said. "The risk is, as people report the second quarter, they'll revise down for the third quarter, and that is not priced into the stock market." "The caution I have is stock prices are up a lot -- and we still may have signs of economic weakness and we may have some pretty sloppy earnings reports in the second quarter," Awad said. "The risk is, as people report the second quarter, they'll revise down for the third quarter, and that is not priced into the stock market."

Quarterly results were still rolling in for the period ended March 31.

Drugstore chain CVS (CVS: down $3.85 to $55.84, Research, Estimates) reported a record first-quarter profit that met Wall Street forecasts for the period.

Insurers Cigna (CI: down $15.85 to $92.85, Research, Estimates) and Humana (HUM: down $0.14 to $9.91, Research, Estimates) reported improved first-quarter results in line with Wall Street expectations, despite both companies seeing a drop in revenue. But Cigna's stock took a beating after the company warned that its results would fall short of expectations for the full year.

Chipmaker Cirrus Logic (CRUS: up $0.07 to $16.70, Research, Estimates) is one of the companies reporting results after the close. The company is expected to report earnings of 6 cents a share, up from 5 cents a year earlier.

Also scheduled to report after the bell are three business software makers: Macromedia (MACR: up $2.88 to $26.58, Research, Estimates), Compuware (CPWR: down $0.25 to $11.01, Research, Estimates), and PictureTel (PCTL: up $0.18 to $3.57, Research, Estimates) (PCTL: Research, Estimates).

In other corporate news, General Motors (GM: up $1.48 to $56.60, Research, Estimates) confirmed late Tuesday that it has approved further talks about the possible sale of its Hughes Electronics (GMH: up $1.05 to $23.05, Research, Estimates) satellite TV unit to the media company News Corp. (NWS: up $0.21 to $38.96, Research, Estimates). Any deal would combine Hughes' DirectTV satellite broadcast operations with News Corp.'s Sky Global Networks.

|

|

|

|

|

|

|