|

Techs rise again

|

|

May 2, 2001: 4:59 p.m. ET

Optimism about Cisco Systems, Priceline ignite latest rally

|

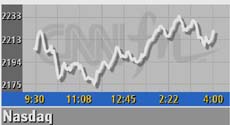

NEW YORK (CNNfn) - U.S. technology stocks rose Wednesday, sending the Nasdaq composite index to a two-month high, amid signs that many tech outfits are on their way to burning through the glut of inventory that has been weighing on their bottom lines.

The networking segment was showing the most strength, boosted in large part by solid gains in shares of Cisco Systems. Internet stocks moved higher after Priceline.com said it would post a profit this quarter.

Semiconductor stocks also gained.

The Nasdaq composite index, which is weighted heavily with technology names, rose 52.36 points, or 2.4 percent, to 2,220.60, its highest levels since March 7.

Shares of Cisco (CSCO: up $2.20 to $20.00, Research, Estimates), a leading supplier of the equipment used to route traffic over the Internet, led the Nasdaq higher, rising more than 9 percent. Some market observers attributed that sharp gain to the idea that Cisco is making good progress working through the $2.5 billion in inventory it said it would write down in the current quarter. Shares of Cisco (CSCO: up $2.20 to $20.00, Research, Estimates), a leading supplier of the equipment used to route traffic over the Internet, led the Nasdaq higher, rising more than 9 percent. Some market observers attributed that sharp gain to the idea that Cisco is making good progress working through the $2.5 billion in inventory it said it would write down in the current quarter.

Large networking-equipment suppliers such as Cisco have been particularly hard hit by the slowdown in the U.S. economy and its subsequent impact on the capital spending plans of telecommunications service providers, many of which have either deferred or cancelled new-equipment orders.

The swiftness of that downturn left Cisco and most of its counterparts with a lot of products, but no buyers, a situation which led to disappointing quarterly profits and, in many cases, extreme cost-cutting measures which included massive layoffs.

Companies like Cisco also sell equipment to large corporations for their computer networks, which are referred to in the industry as "enterprise customers." The slowdown in corporate technology spending also has weighed on networking-equipment vendors' profits.

In a note to clients Wednesday, Morgan Stanley analyst Christopher Stix said the enterprise market in North America appears to be firming. "While the market continues to be weak in comparison to last year, it appears to have stabilized, which on the margin this is good news for Cisco," Stix said.

Even so, Stix warned that the service provider market, which he said represents roughly 33 percent of Cisco's business, continues to be a sore spot, and the enterprise market in Europe has shown signs of weakness. He maintained a "neutral" rating on the company's shares, which he said are fairly valued even with the positive data points he described.

The stocks of most other networking-equipment suppliers rose, including Nortel Networks (LU: up $0.37 to $11.27, Research, Estimates), Juniper Networks (JNPR: up $1.86 to $65.11, Research, Estimates) and Ciena (CIEN: up $1.57 to $60.17, Research, Estimates).

The American Stock Exchange's networking index rose 27.22 points to 493.12.

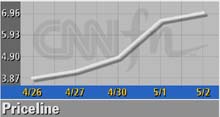

Internet stocks also rallied. Priceline.com (PCLN: up $0.37 to $6.96, Research, Estimates) rose after the online discount service late Tuesday reported a first-quarter operating loss that was narrower than expected and forecast a profit for the current quarter. Internet stocks also rallied. Priceline.com (PCLN: up $0.37 to $6.96, Research, Estimates) rose after the online discount service late Tuesday reported a first-quarter operating loss that was narrower than expected and forecast a profit for the current quarter.

Other Internet stocks advanced on the news, including CMGI (CMGI: up $1.67 to $5.82, Research, Estimates); InfoSpace (INSP: up $0.71 to $5.64, Research, Estimates) and Internet Capital Group (ICGE: up $0.80 to $3.69, Research, Estimates).

The Goldman Sachs Internet index rose 7.66 points to 154.65, a 5.2 percent gain.

The buildup in inventory among the networking equipment suppliers also has weighed on the profits of the companies that supply the components used to make that equipment, especially semiconductors.

Stocks in the chip segment also were moving mostly higher Wednesday, with communications chip makers posting some of the strongest gains.

Among them were LSI Logic (LSI: up $0.58 to $21.34, Research, Estimates), Applied Micro Circuits (AMCC: up $1.08 to $27.54, Research, Estimates), Vitesse Semiconductor (VTSS: up $3.29 to $37.77, Research, Estimates), and Broadcom (BRCM: up $6.40 to $48.36, Research, Estimates).

Other chip makers, as well as the suppliers of the equipment used to manufacture chips, were on the rise as well. Shares of Intel (INTC: up $0.76 to $31.94, Research, Estimates) gained.

Adding to the momentum in the chip segment Wednesday was the latest sales report from the Semiconductor Industry Association, an industry trade group.

The group reported Wednesday that chip sales in March fell 7 percent from February's levels. But at the same time, it reiterated its position that the industry will complete the inventory correction in the third quarter and will begin to recover in the fourth quarter. Those comments were similar to those several industry executives have made recently after they reported their latest quarterly financial results.

The Philadelphia Stock Exchange's semiconductor index, or Soxx, rose 4.41 points at 670.65

The Goldman Sachs Internet index was up 3.9 points at 150.89, a 2.7 percent gain.

|

|

|

|

|

|

|