|

Techs pull back from gains

|

|

May 3, 2001: 4:52 p.m. ET

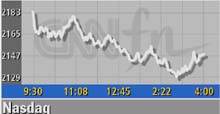

After a week-long run-up, the Nasdaq composite posts a loss

|

NEW YORK (CNNfn) - U.S. technology stocks fell for the first time in a week Thursday as investors paused after a buying spree sent the Nasdaq composite index to a two-month high.

The Nasdaq, heavy with tech stocks, fell 74.43 points, or 3.3 percent, to 2,146.17. The index, though down for the year, still remains more than 31 percent above its early April low.

As such, analysts said it was not surprising for the index to give back some gains. The selling also came amid signs of economic weakness. The U.S. Labor Department said the number of new jobless claims rose to its highest level in five years. Shortly afterward, a report released by outplacement firm Challenger Gray & Christmas showed that the pace of job cuts in the U.S. continued to accelerate in April.

Stocks in the dot.com segment were showing particular weakness, dragging the Goldman Sachs Internet index down 8.29 points lower to 146.36. Stocks in the dot.com segment were showing particular weakness, dragging the Goldman Sachs Internet index down 8.29 points lower to 146.36.

All of the big dot.com names fell, including: online retailing leader Amazon.com (AMZN: down $0.36 to $16.75, Research, Estimates); Internet media company Yahoo! (YHOO: down $2.09 to $20.83, Research, Estimates); online auctioneer eBay (EBAY: down $2.19 to $51.51, Research, Estimates); and Web advertising firm DoubleClick (DCLK: down $0.65 to $12.91, Research, Estimates).

The stocks of online travel services providers, which had been among the biggest gainers this week after a series of strong earnings reports, also were showing signs of weakness. Those moving to the downside Thursday included Priceline (PCLN: down $1.15 to $5.81, Research, Estimates) and Travelocity (TVLY: down $4.15 to $31.35, Research, Estimates). At the same time, shares of Expedia (EXPE: up $2.42 to $31.23, Research, Estimates) extended their gains

Meanwhile, the stocks of data-networking equipment vendors moved mostly lower.

The networking segment got a boost on Wednesday after a Morgan Stanley analyst issued a research note in which he made some cautiously optimistic comments about Cisco's business outlook.

Companies like Cisco (CSCO: down $1.34 to $18.66, Research, Estimates), a leading supplier of the equipment used to route traffic over the Internet, and other network-equipment suppliers have been faced recently by a glut of inventory as the slowdown in the U.S. economy has prompted its customers, especially telecommunications service providers, to defer or cancel new-equipment orders.

Some market observers on Wednesday attributed the sharp rise in Cisco shares and other networking-equipment makers' stock in part to investors reaching out for any good news in the beaten-down market segment, and in part to positive signals from suppliers of the electronic components used to build those systems.

Stocks of other networking-equipment suppliers moved lower as well Thursday, including: Nortel Networks (NT: down $0.68 to $15.87, Research, Estimates); Lucent Technologies (LU: down $0.57 to $10.70, Research, Estimates); Juniper Networks (JNPR: down $4.29 to $60.82, Research, Estimates); and Ciena (CIEN: down $5.51 to $54.66, Research, Estimates).

The American Stock Exchange's networking index declined 26.62 points to 466.50.

Elsewhere in the hardware segment, the stocks of most of the top-tier U.S. PC vendors fell.

Shares of Dell (DELL: down $1.80 to $24.93, Research, Estimates), the world's largest PC maker, led the way down. Tom Meredith, Dell's senior vice president of business development and strategy, told investors gathered at a Merrill Lynch technology conference Thursday that executives "will be ruthless in how we address our cost structure going forward," and job cuts will be likely.

Worried about Dell cutting computer prices, UBS Warburg later downgraded Dell to "buy" from "strong buy."

Other PC makers losing ground included Hewlett-Packard (HWP: down $1.08 to $27.57, Research, Estimates) ,Gateway (GTW: down $0.62 to $18.39, Research, Estimates) and Compaq (CPQ: down $0.55 to $17.40, Research, Estimates).

The Goldman Sachs computer hardware index fell 15.59 to 339.05.

Stocks in the semiconductor segment also were moving lower for the most part, with a few noteworthy exceptions.

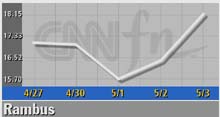

Among the exceptions, Rambus (RMBS: up $1.75 to $18.15, Research, Estimates) which makes money by licensing a technology used to speed up computer memory systems, rose more than 10 percent after an electronics trade paper reported late Wednesday that a federal judge forced the company to disclose the royalty rates its licensees have agreed to pay. Among the exceptions, Rambus (RMBS: up $1.75 to $18.15, Research, Estimates) which makes money by licensing a technology used to speed up computer memory systems, rose more than 10 percent after an electronics trade paper reported late Wednesday that a federal judge forced the company to disclose the royalty rates its licensees have agreed to pay.

The Electronic Buyers' News reported on its Web site that eight computer memory-chip makers are paying Rambus 3.5 percent for the right to manufacture certain memory chips using a Rambus-patented design. That's considerably higher than analysts had estimated, the report said.

That disclosure, made in connection with Rambus' patent dispute with German semiconductor maker Infineon Technologies (IFX: down $1.55 to $40.25, Research, Estimates), was just the latest development in that case which resulted in a sharp movement of Rambus shares. Earlier this week, Rambus shares fell more than 7 percent on news that the judge in that case had tossed out all but three of the more than 50 specific claims Rambus had filed against Infineon.

Elsewhere in the semiconductor segment, shares of Cirrus Logic (CRUS: up $3.62 to $20.32, Research, Estimates) rose following its latest quarterly earnings report. The company met the Street's expectations and lowered its revenue forecast slightly for the current quarter. Executives said they expect profit margins to improve as the company backs away from some of its less profitable product areas.

At the same time, shares of communications chipmaker Vitesse Semiconductor (VTSS: down $3.38 to $34.39, Research, Estimates) slid after it announced plans to lay off roughly 12 percent of its employees and take a restructuring charge ranging between $1.5 million and $2 million.

The broader semiconductor segment moved lower as well. The Philadelphia Stock Exchange's semiconductor index lost 23.58 points to 647.07, a 3.5 percent decline.

|

|

|

|

|

|

|