|

Wall St.'s nasty job

|

|

May 4, 2001: 9:05 a.m. ET

U.S. stocks set to drop after jobs report much weaker than forecast

|

NEW YORK (CNNfn) - Stocks were set to open sharply lower Friday after investors looked at a much weaker-than-expected April jobs report and decided they didn't like what they saw.

Stock futures tumbled shortly after the government reported that the unemployment rate rose to its highest in 2-1/2 years in April as employers cut jobs. Stock futures tumbled shortly after the government reported that the unemployment rate rose to its highest in 2-1/2 years in April as employers cut jobs.

The unemployment rate climbed to 4.5 percent from 4.3 percent in March as employers shed a stunning 223,000 jobs, well above Wall Street forecasts.

A higher-than-expected unemployment rate is likely to hurt consumer confidence -- anxious jobholders may not be willing to go shopping. Strength in the consumer sector has helped keep the recent downturn from becoming a full-blown recession.

But with the numbers weaker than forecast, more interest rate cuts by the Federal Reserve are likely. Still, that was not enough to cheer Wall Street Friday morning. The central bank already cut rates four times this year, each time by a half percentage point, in a bid to prevent a recession.

The employment report was foreshadowed by a surprising increase in the number of initial unemployment claims filed last week. The Labor Department said 421,000 new claims were filed, up from a revised 12,000 the prior week. It was another sign of how widespread layoffs are becoming.

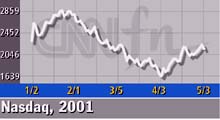

The Nasdaq composite index begins at 2,146.40 after losing 3.3 percent Thursday. The Dow Jones industrial average is at 10,796.65 following an 80-point drop, while the S&P 500 stands at 1,248.58 after dropping about 1.5 percent.

Asian markets closed mixed Friday, with Tokyo closed for a holiday. European markets were mixed ahead of the U.S. employment data.

Treasury prices jumped Friday morning as investors bet more rate cuts were coming, putting the 10-year note yield at 5.11 percent and the 30-year yield at 5.60 percent.

The dollar weakened against the euro and gained against the yen. Brent oil futures gained 16 cents to $28.29 a barrel in London.

Razorfish (RAZF: Research, Estimates), the Internet consulting firm, late Thursday reported a first-quarter loss that was narrower than expected. The New York-based company also named Jean-Philippe Maheu as CEO, replacing company co-founder Jeff Dachis. Shares of Razorfish fell 39 cents to $1.22 Thursday. Razorfish (RAZF: Research, Estimates), the Internet consulting firm, late Thursday reported a first-quarter loss that was narrower than expected. The New York-based company also named Jean-Philippe Maheu as CEO, replacing company co-founder Jeff Dachis. Shares of Razorfish fell 39 cents to $1.22 Thursday.

Also, Archstone Communities agreed to buy Charles E. Smith Residential Realty in a $3.6 billion deal that would make it the second-biggest apartment real estate investment company.

|

|

|

|

|

|

|