|

Wall Street's losing week

|

|

May 11, 2001: 5:01 p.m. ET

This time, it's strong economic data that sends stocks and bonds lower

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - A tough week on Wall Street worsened Friday after a batch of strong economic data signaled that interest rates may not go much lower.

The Dow Jones industrial average and Nasdaq composite index fell for the fourth time in five days. Analysts linked the latest losses to reports showing surprise gains in consumer spending and confidence.

For 14 months, stocks fell as the economy and corporate profits weakened. But Friday's figures, with their strength, raised questions about how aggressive Federal Reserve policy makers need be in lowering interest rates at their meeting Tuesday and beyond. Treasury securities, whose movements are tied to interest rates expectations, also declined, sending yields soaring.

"I do think the economic data scared people a little bit," Maureen McCarthy, head of equity trading at Robertson Stephens, told CNNfn's The Money Gang. McCarthy forecasts that the Fed will lower interest rates Tuesday by the smallest of increments, a quarter-percentage point. "I do think the economic data scared people a little bit," Maureen McCarthy, head of equity trading at Robertson Stephens, told CNNfn's The Money Gang. McCarthy forecasts that the Fed will lower interest rates Tuesday by the smallest of increments, a quarter-percentage point.

But Bill Gross, chief investment officer at Pimco, which runs some of the nation's biggest bond funds, disagrees. He expects a half-percentage point cut, the fifth such reduction this year.

"I think ... that the economy is declining," Gross told The Money Gang. He said he believes the nation is in recession.

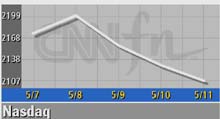

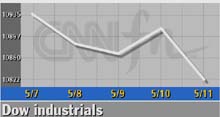

The Dow industrials lost 89.13 points, or nearly 1 percent, to 10,821.31, sending it down 1.2 percent on the week. The Nasdaq, heavy in technology stocks, shed 21.43 points, or 1 percent, to 2,107.43, and is down 3.8 percent over the last five days. The S&P 500 declined 9.51 to 1,245.67, pushing it 1.7 percent lower on the week.

More stocks fell than rose in light trading volume. Declining issues on the New York Stock Exchange beat advancing ones 1,764 to 1,278 as 895 million shares traded. Nasdaq losers topped winners 2,152 to 1,689 as 1.4 billion shares changed hands. More stocks fell than rose in light trading volume. Declining issues on the New York Stock Exchange beat advancing ones 1,764 to 1,278 as 895 million shares traded. Nasdaq losers topped winners 2,152 to 1,689 as 1.4 billion shares changed hands.

In the currency market, the dollar fell against the euro but held steady versus the yen.

Trio of data

Rising corporate layoffs and falling stock prices losses were not enough to keep consumers from opening their wallets last month. Retail sales rose 0.8 percent in April, the Commerce Department said, well above forecasts. A sharp rise in the price of gasoline helped fuel the gains.

Later, the University of Michigan said its preliminary gauge of consumer sentiment rose to 92.6 in May from 88.4. That topped forecasts and brought the index to its highest levels since January. Inflation at the wholesale level also rose, the government said.

The stock market began its steepest decline following the release of the Michigan numbers, which, coupled with the retail sales gains, may complicate the Fed's ability to aggressively cut rates.

"It puts the Federal Reserve in a bit of a conundrum," Michael Farr, president of Farr Miller and Washington, told CNNfn's Market Call. "It puts the Federal Reserve in a bit of a conundrum," Michael Farr, president of Farr Miller and Washington, told CNNfn's Market Call.

The Fed, which has cut rates four times this year by a total of two percentage points, has said it is worried about slowing economic growth.

So are investors. Twenty-two of the 30 components in the Dow industrials fell Friday, led by IBM (IBM: down $3.39 to $111.81, Research, Estimates), which suffered a downgrade from Bear Stearns following an analysts' meeting.

Merck (MRK: down $0.58 to $75.94, Research, Estimates) also fell. The drugmaker said it will buy Rosetta Inpharmatics (RSTA: up $7.43 to $17.34, Research, Estimates), a genomics company, for about $260 million.

But Schering-Plough (SGP: up $1.20 to $38.30, Research, Estimates) , the maker of the allergy drug Claritin, Coppertone sunscreen products and Dr. Scholl's foot-care goods, rose after BusinessWeek said Merck may be looking to buy the company. Company officials declined to comment.

Alcoa (AA: down $1.64 to $40.27, Research, Estimates) and International Paper (IP: down $1.08 to $37.35, Research, Estimates) rounded out some of the Dow's big decliners.

American General (AGC: up $0.48 to $45.10, Research, Estimates) rose. American International Group (AIG: down $0.90 to $82.10, Research, Estimates) agreed to buy the financial services company for $23 billion.

Investors snapped up shares of Ameritrade (AMTR: up $0.25 to $11.00, Research, Estimates) after reports said CIBC, a Canadian investment bank, is in talks to buy the brokerage. The story, first published by USA Today, was later reported by CNNfn.

But most tech stocks fell, including Intel (INTC: down $1.07 to $27.94, Research, Estimates), WorldCom (WCOM: down $0.19 to $17.62, Research, Estimates), and JDS Uniphase (JDSU: down $0.57 to $20.69, Research, Estimates).

The stock market faces the problem of time. Analysts expect that the economy and corporate profits will recover later this year. But news on earnings and growth is expected to remain negative for some time.

This week, Cisco Systems (CSCO: up $0.22 to $19.05, Research, Estimates) was unable to give a clear outlook on the networking equipment business. National Semiconductor (NSM: down $0.52 to $25.00, Research, Estimates) and FedEx (FDX: down $0.79 to $38.41, Research, Estimates) both warned that profit in the current quarter will fall short of targets, a sign that the slowing economy is not done hurting sales. This week, Cisco Systems (CSCO: up $0.22 to $19.05, Research, Estimates) was unable to give a clear outlook on the networking equipment business. National Semiconductor (NSM: down $0.52 to $25.00, Research, Estimates) and FedEx (FDX: down $0.79 to $38.41, Research, Estimates) both warned that profit in the current quarter will fall short of targets, a sign that the slowing economy is not done hurting sales.

Perhaps, more than usual, the economy is proving difficult to handicap. Friday's economic data, though strong on the surface, also revealed areas of weakness. March retail sales were revised lower while consumer confidence still remains at historically low levels. And last week, a report showed that unemployment in April rose to its highest levels in more than two years. That came after the nation's gross domestic product rose 2 percent in the first quarter, twice the gains that Wall Street expected.

"We are really not sure if the economy is continuing to expand or continuing to contract," Sam Stovall senior investment strategist at Standard & Poor's, told CNNfn's The Money Gang.

Like the economy, the market is at something of a crossroads. The Nasdaq, though down 58 percent from last year's peak, is still up 28.6 percent from its April low. Off nearly 8 percent from last year's record high, the Dow industrials have surged almost 16 percent from this year's low.

Bulls are encouraged by history. The Standard & Poor's 500 index, which fell last year, has almost never declined for two straight years. It has done so only once since 1940 -- in 1973 and 1974.

|

|

|

|

|

|

|