|

Rate cut: Where's mine?

|

|

May 15, 2001: 3:23 p.m. ET

Sure, rates are lower, but some borrowing costs may not budge

By Staff Writer Jake Ulick

|

NEW YORK (CNNfn) - The Federal Reserve just cut interest rates. So let the goods times roll.

Well, not exactly. True, the central bank's latest big cut in borrowing costs will force commercial banks to lower their prime lending rates, cheapening loans for consumers and businesses.

But the world of credit is a complicated one. And because the bond market -- whose gyrations affect billions of dollars in other interest rates such as mortgages -- tries to react to Fed moves ahead of time, some of the best borrowing rates may be a thing of the past.

"There are rates that may not move at all and there are rates that may move opposite to what the Fed has done," said Robert Brusca, chief economist at Ecobest Consulting.

That may disappoint those seeking a break in mortgage costs and credit card payments commensurate with the latest Fed's half-percentage-point cut.

|

|

|

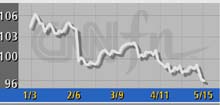

The price of the 10-year note has fallen, and its yield has gained, even as the Fed cuts rates | |

"Most other market interest rates often move ahead of time," said Mike Moran, chief economist at Daiwa Securities.

The Fed is hardly irrelevant. Economists agree that its five rate cuts this year have already begun lifting the economy that started to slow last summer. But the relationship between central bank moves and all interest rates are not one of synchronicity.

Take the Treasury bond market, where yields have moved higher this year, even as the Fed lowered rates.

Click here for CNNfn's special report on the Fed's latest move

The Fed controls the federal funds rate, the rate that banks charge each other for overnight loans. And that rate has now fallen a dramatic 2.50 percentage points this year. This, the fastest-paced drop in Chairman Alan Greenspan's, tenure comes as policy makers try to keep the economy from slipping into a recession.

But the mortgage rates have not directly followed. According to Fannie Mae, which buys billions of dollars in mortgages, the average rate on the a 30-year fixed mortgage bottomed in March before rising in April. This year, the 30-year rate has fallen just 0.28 percentage points.

Blame it on the bond market. Traders of Treasury securities say the selloff in prices, which sends yields higher, is an effort to anticipate a time when the economy improves and the Fed is no longer lowering rates. Blame it on the bond market. Traders of Treasury securities say the selloff in prices, which sends yields higher, is an effort to anticipate a time when the economy improves and the Fed is no longer lowering rates.

"What they are anticipating is a pickup in economic activity in the second half of the year," Daiwa's Moran said.

The bond market, in a way, has been trying to prevent the Fed from stimulating the economy so much that it generates inflation. Bond investors fret that rising inflation will erode the value of their fixed-income payments. So they demand higher yields to compensate for this investment risk.

In addition to affecting mortgage rates, bond yields are tied to the rates that corporations pay to borrow money. And with those rates in the rise, corporate treasurers have been rushing to borrow money. According to Reuters, companies sold a record $26.3 billion of high-quality U.S. corporate bonds last week. WorldCom (WCOM: down $0.06 to $17.80, Research, Estimates) was among those selling debt recently, betting that rates might not fall much more. The No. 2 U.S. long-distance phone company floated $11.9 billion in bonds.

That's not to say the best days for all forms of cheaper borrowing costs are over. Changes in the federal funds rate show up most immediately in the prime lending rate. That's the rate that banks charge their most credit worthy customers.

And this year's cuts may already be working their way into the economy. Retail sales surged in April, according the government, while consumer confidence showed a rebound in early May. The nation's gross domestic product grew by 2 percent in the first quarter. That's twice what Wall Street expected. And as the economy improves, banks often lower the rates they charge on credit cards.

Changes in fed funds will also show up in short-term borrowing rates, like those companies use for loans that must be paid back quickly. Rates on certificate of deposit should also fall, making stocks a more attractive investment, a potential boom for hard-hit equity investors. Changes in fed funds will also show up in short-term borrowing rates, like those companies use for loans that must be paid back quickly. Rates on certificate of deposit should also fall, making stocks a more attractive investment, a potential boom for hard-hit equity investors.

James Annable, economist at WingspanBank.com, says this year's lower rates have already led to increased home refinancing, meaning consumers have more money to spend on other things. But the rising bond yields, he says, may signal that some of the best rates have passed.

"What the market's figuring out is the Fed is coming toward an end of this movement," Annable told CNNfn's The Money Gang.

Where's the end? Ecobest's Brusca is looking for the fed funds rate falling to 3.50 percent from the current 4 percent.

Daiwa's Moran sees the rate dipping less, to 3.75 percent.

Some day, the Fed will begin lifting borrowing costs once again. And for consumers trying to lock in good rates before that happens, the bond market may be beating them again.

Moments after the Fed cuts rates on Tuesday, the Treasury securities suffered sold-off, sending yields higher.

|

|

|

|

|

|

|