|

BA, American talk venture

|

|

June 6, 2001: 4:19 p.m. ET

British Airways, American Airlines talk to regulators about an alliance

|

NEW YORK (CNNfn) - British Airways and American Airlines have started talks with regulators to revive a joint venture, according to the two airlines.

The two airlines are in talks with regulators in Brussels, Belgium, in London and in Washington to find out what conditions would be imposed on a revived attempt to form a North Atlantic joint venture, a spokesman for American Airlines confirmed Wednesday.

"It's no secret we want to deepen our relationship with British Airways," said Becker. "There have been high level discussions going on between officials of American and British Airways. We do not have a deal at this point, hope to be able to have one."

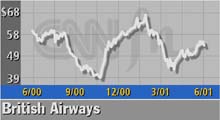

Shares of British Airways (BAB: down $0.82 to $53.23, Research, Estimates) (BAY) and AMR Corp. (AMR: down $0.31 to $37.85, Research, Estimates), the holding company that owns both American and the recently purchased Trans World Airlines, were both off in trading Wednesday on a day that saw most major U.S. airline stocks trading lower.

A spokesman for British Airways and Becker confirmed to CNN that the chief executives of the two companies will be in Washington on Monday to meet with U.S. Secretary of Transportation Norman Mineta about strengthening the alliance between the two carriers.

"We do wish to deepen our relationship with American," said the BA spokesman "We have said this before. (BA CEO Rod) Eddington will be in the States next week and will meet Mineta. This will be their first meeting. We have nothing else to add."

The two carriers announced plans for an alliance in 1996, and have long booked passengers on each other's planes. But the link has trailed agreements between other major carriers, such as United Airlines and Germany's Lufthansa because the United States and Britain do not have an liberalized aviation agreement.

| |

|

|

Chart shows trading in British Airways' American Depository Receipts. | |

Such an agreement, known in the industries as "open skies" agreement that gives greater access to each nation's airports by the other nation's carriers, is needed before the U.S. government would grant antitrust exemption that would allow the carriers to hold discussions on rates, schedule, and other joint decision making. The carriers could not merge, but such agreement would allow them to share in revenue and profits on trans-Atlantic flights.

Talks were held between British and U.S. negotiators on an open skies agreement after the initial American-BA deal was announced in 1996, but nothing ever came of those discussions. Becker said the lack of anti-trust immunity has put the oneworld alliance, which includes American and BA, at a great disadvantage to other alliances.

One airline analyst, who spoke on the condition that his name not be used, said that the antitrust immunity is very important for American and BA's joint efforts. But he said that the two would also face negotiators' demands that would loosen their control of 40 percent of the available slots at London's Heathrow Airport, the preferred airport for air travelers in London.

"Without that (antitrust immunity) you really lack the vital backbone to bring the alliance to life. You need the trans-Atlantic anchor," said the analyst. "But when you're in negotiation, you're in world of quid pro quo. It has to be where what you're giving up creates enough value for BA and American to make it worth it. That's a very complicated negotiation and why it's taken so long."

Click here for a look at airline stocks

But Ray Neidl, analyst for ABN Amro, said that despite current talk, he doesn't think either airline will be willing to make the compromises necessary to win regulatory agreement between the two countries.

"BA is very happy with it's higher yielding service in the North Atlantic, and American is also very strong there," he said. "Unless they get exactly what they want, I don't see it happening anytime soon. What they have now is not the full integration that KLM and Northwest Airlines (NWAC: down $0.36 to $26.39, Research, Estimates) have, but they can live with it."

Britain and the United States have a pact dating back to 1977, which means that only two airlines from each nation may fly trans-Atlantic routes to and from Europe's busiest airport at Heathrow, west of London.

Becker argues that the growth of other air hubs in Europe and the entry of United and Lufthansa's Star Alliance into Heathrow through its inclusion of bmi british midland has changed the competitive landscape since the last time the discussions were held.

"The international landscape has changed dramatically over the last 5 years, since first time we proposed a partnership with British Airways," he said. "The Star Alliance now has 27 percent of the slots at Heathrow."

|

|

|

|

|

|

|