|

Nokia warns on 2Q

|

|

June 12, 2001: 1:35 p.m. ET

Spread of U.S. economic slowdown cited; restructuring charge planned

|

NEW YORK (CNNfn) - Nokia Corp., the world's largest maker of mobile phones, warned that it will post a lower-than-expected profit in the second quarter and said it will take a restructuring charge in the period.

The company said it believes second-quarter earnings per share excluding special items will come in the  0.15-to- 0.15-to- 0.17 range, or 13-to-15 cents a share. Analysts surveyed by U.S. earnings tracker First Call expected EPS of 18 cents in the current period. The company earned 0.17 range, or 13-to-15 cents a share. Analysts surveyed by U.S. earnings tracker First Call expected EPS of 18 cents in the current period. The company earned  0.21, or 19 cents, per share a year ago. 0.21, or 19 cents, per share a year ago.

|

|

|

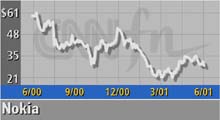

Share price represents trading of American depositary shares. | |

It said sales growth will be less than 10 percent in the period rather than earlier guidance of 20 percent.

The news sent shares of Nokia (NOK: down $5.62 to $23.09, Research, Estimates) sharply lower in New York Stock Exchange trade, where they fell nearly 20 percent.

Nokia said its restructuring charge will come to  190 million, or $161.5 million. In addition to restructuring, the charge will cover a goodwill write-off of Nokia Internet Communications. 190 million, or $161.5 million. In addition to restructuring, the charge will cover a goodwill write-off of Nokia Internet Communications.

The Finland-based company blamed a spreading of the U.S. economic slowdown to other regions of the globe for the new forecasts. It also said it is seeing general economic uncertainty, ongoing technology transition and less aggressive marketing by wireless phone operators.

It said it expects the slowdown to continue into the second half of the year. While it did not give new second-half guidance, Nokia said it will do so July 19 when it releases second-quarter results.

Click here for a look at wireless stocks

Sam May, wireless communications analyst at U.S. Bancorp Piper Jaffray, told CNNfn's The Money Gang that there have been several factors causing weakness in the handset as well as the wireless infrastructure market, so he wasn't altogether surprised by the warning.

At the same time, May said it gives him a little more cause for concern about the time frame under which a recovery in the industry may begin to take hold. Industry observers generally had expected wireless phone makers to see improvements in their business in the second half. (151K WAV) or (151K AIFF)

In early April, Motorola (MOT: down $0.87 to $13.99, Research, Estimates), the No. 2 supplier of mobile phones, also warned that its second-quarter results will be weaker than previously expected. The Schaumburg, Ill.-based company said it expects to post a loss a few cents wider than the 9 cents per share it lost in the first quarter.

Ericsson (ERICY: down $0.27 to $5.23, Research, Estimates), which ranks third in global handset sales, also has been lowering its financial targets.

May said he does not expect either of the companies to guide Wall Street's expectations lower before they report their latest quarterly results.

"I wouldn't be surprised to see some weakness relative to expectations for either of those, but I don't really expect to see pre-announcements," he said. "A lot of that has been gotten out of the way already."

Nokia said it now believes that the global wireless phone market will show "very modest growth" from 2000 levels, when 405 million handsets were sold.

The company also said it believes its own wireless sales growth will outpace market growth, and that its network business, through which it sells wireless communications infrastructure equipment, will see annual growth at least equal to growth of that overall sector.

|

|

|

|

|

|

Nokia

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|