|

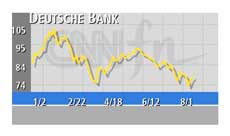

Deutsche Bank profits hit

|

|

August 1, 2001: 7:26 a.m. ET

Europe's largest bank hit by rising costs and the effects of slowdown

|

LONDON (CNN) - Deutsche Bank, Europe's largest, said on Wednesday first-half net profit fell 35 percent as costs grew and the economic slowdown hit business.

Deutsche said net profit in the half year to June 30 dropped to  2.45 billion ($2.15 billion), or 2.45 billion ($2.15 billion), or  4.51 per share, from 4.51 per share, from  3.77 billion, or 3.77 billion, or  6.66 a share, in the first half of 2000. 6.66 a share, in the first half of 2000.

Chief Executive Rolf Breuer said the Frankfurt-based bank expects to cut more jobs and sell assets and holdings in other companies to boost efficiency and earnings

Deutsche has struggled to control costs and boost profit from its retail banking division amid Germany's economic slowdown, and after failing to find a partner during Europe's wave of consolidation in financial services. Deutsche has struggled to control costs and boost profit from its retail banking division amid Germany's economic slowdown, and after failing to find a partner during Europe's wave of consolidation in financial services.

Breuer told Reuters he did not rule out a takeover of Commerzbank or other banks in whole or part. Insurer Allianz's (FALV) takeover of Dresdner Bank earlier this year rearranged the German banking landscape, triggering the resumption of talks with possible partners, he said, though talks have not yielded results.

"I don't rule out Commerzbank," Brewer said. "There is nothing more concrete to report."

Deutsche shares (FDBK) were down 2.2 percent in Frankfurt at  78.17 in midday trading, while Commerzbank (FCBK) rose more than 1.7 percent to 26.26. Commerzbank initially shot up more than 3 percent after Bewer's comments. 78.17 in midday trading, while Commerzbank (FCBK) rose more than 1.7 percent to 26.26. Commerzbank initially shot up more than 3 percent after Bewer's comments.

Deutsche said it booked more than  1 billion in tax-free gains in the second quarter from the sale of a 2.2 percent stake in Munich Re, the world's largest reinsurer. 1 billion in tax-free gains in the second quarter from the sale of a 2.2 percent stake in Munich Re, the world's largest reinsurer.

The decline in first-half profit is exaggerated by asset sales in the second quarter of last year when Deutsche booked about  2.38 billion in net income from the sale of a stake in Allianz, Europe's No. 2 insurance company. 2.38 billion in net income from the sale of a stake in Allianz, Europe's No. 2 insurance company.

The performance, however, highlighted Deutsche's position as one of Europe's least efficient banks as costs grew 7 percent to  10.98 billion and provisions for bad loans tripled to 10.98 billion and provisions for bad loans tripled to  429 million in the half from 429 million in the half from  144 million in the same six months of 2000. 144 million in the same six months of 2000.

CEO Breuer told a news conference after the results were released that the bank was in the middle of a strategic review to increase efficiency and lower costs. He said he expected more job cuts in the bank's retail business.

"We're also talking about job cuts in our private banking business," said Breuer, who said he does not see the German economy improving before the end of the fourth quarter. "We're also talking about job cuts in our private banking business," said Breuer, who said he does not see the German economy improving before the end of the fourth quarter.

In February, the German bank announced it was cutting 2,600 jobs in a restructuring programme after previously announcing a reorganization of its businesses.

First-half profits before taxes fell 37 percent to  3.08 billion from 3.08 billion from  4.88 billion in the same six months a year ago. Return on equity, excluding goodwill amortization, fell to 21 percent from 36.4 percent in the first half of 2000. 4.88 billion in the same six months a year ago. Return on equity, excluding goodwill amortization, fell to 21 percent from 36.4 percent in the first half of 2000.

Breuer also said that key U.S. investment banking revenue also began to fall off towards the end of the second quarter.

On Tuesday, Deutsche announced it had agreed to sell its U.S. online brokerage National Discount Brokers to Ameritrade (AMTD: Research, Estimates), the third-largest U.S. online brokerage, for $154 million in shares. Deutsche last year paid $900 million for the 84 percent of NDB it didn't already own.

|

|

|

|

|

|

|