|

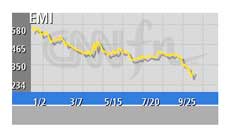

EMI profit to slide 20%

|

|

September 25, 2001: 5:40 a.m. ET

Shares in British music group plunge more than 26% on profit warning

|

LONDON (CNN) - EMI, the biggest music publisher, warned on Tuesday profit for the year would slide 20 percent as conditions in the industry deteriorate.

The world's third-largest record company, with artists such as Radiohead, Janet Jackson and Mariah Carey on its roster, said it has seen a "marked deterioration" in conditions, particularly in the U.S. and Latin America.

EMI's stock plunged more than 26 percent to 244 pence after the warning. EMI's stock plunged more than 26 percent to 244 pence after the warning.

Before the profit warning the company's stock had fallen 40 percent as the British music company was forced to abandon merger plans with rivals.

Its planned merger with Warner Music last year and BMG this year were scuppered by anti-competition concerns. The European Union was unwilling to see competition in the industry reduced from five players to just four.

EMI said it plans to take a £100 million ($146 million) charge to cut costs and plans to combine its European and U.S. business in a bid to save £65 million a year. About 100 jobs have already gone in Latin America "in response to the deepening economic crisis there," the company said.

"We now expect EMI Recorded Music sales for the full year to be lower that the previous year," the company said. "As a result of lower turnover, coupled with significant margin pressure, we now expect our first half operating result ... to be a small loss."

Sales of recorded music fell in the second quarter, with September "proving to be particularly difficult," EMI said.

The London-based company expects operating profit from its music publishing arm to be broadly in line with last year's level of £51 million pounds in the first half.

"A good second half release schedule, including albums from Lenny Kravitz, Robbie Williams, Garth Brooks and Pink Floyd, EMI is targeting a second half operating profit in line with last year," EMI said. But pretax profit is forecast to decline by 20 percent.

As part of it restructuring, EMI said it is considering exiting the manufacturing and distribution business and is in talks with a number of potential partners. An announcement is expected around the turn of the year, the company said.

|

|

|

|

|

|

|