|

To millionaire status...and beyond

Paul and Audrey Yazbeck are taking control of their money and they're having fun doing it.

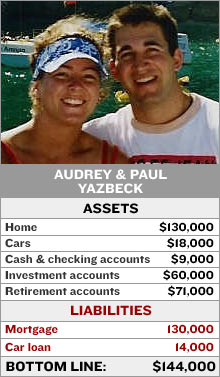

NEW YORK (CNNMoney.com) - Before you become convinced America's youth is woefully unprepared for financial reality, meet Paul and Audrey Yazbeck. Paul, 25, and Audrey, 24, have already socked away more than $125,000. Audrey is an accountant, and Paul, who attended college on an Army scholarship, currently is serving as an Army officer.

At the rate they're saving, the Yazbecks will be millionaires well before retirement. But they're setting their sights beyond the millionaire mark. "Our main goal is financial freedom. It's all about keeping our options open," Paul said. While taxable accounts, Roth IRAs and 401(k)s may be hobgoblin to most twenty-somethings, the Yazbecks know the ins and outs of each of these financial planning products. Early bird gets the worm

They also understand the importance of saving early. "Each positive money move we make now compounds into more positive results for the future," Audrey said. The couple intends to have children down the road, and they'd like to have the option of having one parent stay at home in the future. They saved $50,000, or about Paul's entire paycheck, last year and are setting a similar target for 2006. Besides shaving everyday costs by brewing coffee at home and bringing their lunch to work, they also act on every saving opportunity. Take the mortgage on the town home they bought in Georgetown, Texas, which is about 20 miles north of Austin. Originally they had a 30-year fixed mortgage, but refinanced when a three-year adjustable-rate mortgage at a lower rate became available. Adjustable-rate mortgages can be riskier than fixed-rate ones because rates can increase over the lifetime of the loan. But since the couple plans on selling the house within the next three years, the refinancing seemed like a smart choice, they said. They expect the refinancing to save them about $2,500. Budget for success

Each month the Yazbecks -- who make about $115,000 a year, or $9,600 a month before taxes -- carefully budget their expenses and track their spending. They earmark about a third of their income for investing, and most of these dollars go to maxing out their 401(k) plans and making regular contributions to their Roth IRAs. About 90 percent of their savings are invested in stocks and mutual funds, but they're also considering diversifying away from equities. While the Yazbecks are meticulous about their budget, they don't let it rule their life. "We're not bound by it, but use it to guide and track our goals," Audrey said. Money can be a sore point for many couples, but the Yazbecks avoid conflict by working together on their financial roadmap. Paul has found such satisfaction in planning that he is considering becoming a certified financial planner when he's eligible to leave the Army. "The future looks really bright," he says. ____________________ Stumped by stocks? Mystified by mutual funds? Nervous about your nest egg? MONEY Magazine wants to answer your investing questions in an upcoming issue. E-mail answer_guy@moneymail.com. ____________________ For Millionaires in the Making Christopher Ortega and Alicia McDonald, click here. For Millionaires in the Making Mark and Kristi Johnson, click here.

For more Millionaires in the Making, click here. |

|