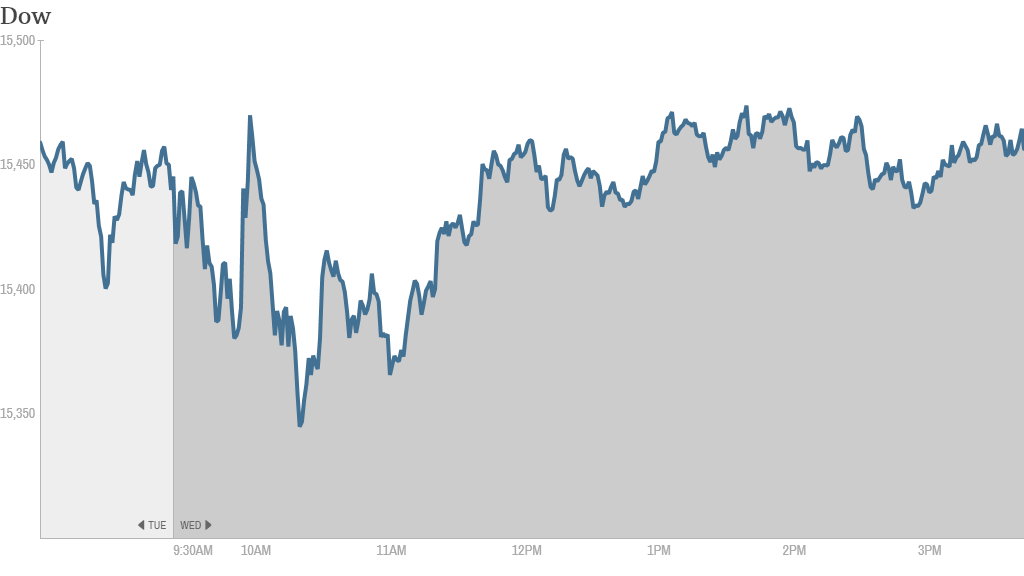

Investors were unwilling to make any big moves Wednesday. And with an important jobs report coming at the end of the week, could you blame them?

The Dow Jones industrial average and the S&P 500 both barely budged. The Nasdaq ended the day with losses.

The Dow has fallen more than 7% since the start of 2014. The selling has fueled speculation about a so-called correction, typically defined as a drop of 10% or more.

In a sign of investors' frayed nerves, CNNMoney's Fear & Greed index continued to signal "extreme fear" in the market. But some say the selling creates an opportunity to buy stocks at a discount.

"Though nobody likes a correction, it is a normal and healthy part of the market cycle," said Ron Florance, an investment strategist at Wells Fargo Wealth Management.

Investors have been rattled by turmoil in emerging markets, where central banks have been struggling to shore up shaky currencies. Meanwhile, the Federal Reserve has been scaling back its bond-buying program.

More recently, worries about the health of the U.S. economy have weighed on stocks. Economic data for January, including a manufacturing report Monday, have been weaker than expected. While winter weather may be partly to blame, the spate of soft economic data have raised questions about the outlook for growth this year.

On Wednesday, payroll processor ADP said that 175,000 jobs were added in January. That was in line with expectations but was the slowest level of growth since August. The government will release its latest figures about job growth and the unemployment rate on Friday.

Related: Fear & Greed Index still in extreme fear

CVS kicks $2 billion habit. CVS Caremark (CVS) said it will stop selling tobacco products, starting Oct. 1. Shares fell on the move, which CVS said will result in $2 billion of lost revenue.

The reaction on StockTwits was mixed. Some traders welcomed the decision to stop selling a product that CVS chief executive officer Larry Merlo said was "inconsistent with our purpose."

"Glad to hear $CVS decision to no longer sell tobacco products even if it hurts sales. I do own shares & will maintain them," said TraderMK

But others criticized CVS for eschewing tobacco while continuing to sell other unhealthy and addictive products.

"$CVS Appalled by the rows of sugary drinks. The beer & wine. THEY HAVE A CANDY AISLE! Slim jims are another kind of evil," said Billy_D_Scrillions.

Others bashed CVS for giving up a significant revenue stream.

"$CVS Tobacco and cigarettes is like the #1 customer. They now have alienated a big portion of their customer base. Bad move!" said BiopharmaPro.

3D printers crash. Shares of 3D Systems (DDD) plunged after the company warned that earnings will be below its previous forecast. Rival 3D printing companies Stratasys (SSYS), ExOne (XONE) and voxeljet (VJET) all fell sharply as well.

Related: New 3D printing fund may not print money

After a big run-up last year, 3D printing stocks have come crashing down in 2014. So far this year, 3D Systems has been the hardest hit -- shares are down 35% year to date. But some traders are still betting that 3D printing technology has long-term potential.

"$DDD Huge over reaction sell off makes a great entry point for longs!" said GaryN69.

Merck (MRK) reported earnings and sales in line with forecasts, while GlaxoSmithKline (GSK) raised its dividend as it posted earnings-per-share that came in slightly below expectations.

Time Warner (TWX), the parent company of CNNMoney, announced a new $5 billion share buyback program as it reported slightly better-than-expected earnings. Shares rose on the news.

Twitter (TWTR) reported a surprise quarterly profit for the fourth quarter after the close. It was Twitter's first earnings report since its IPO. Sales topped forecasts as well. But guidance, while strong, was not as rosy as expected and shares tumbled in after hours trading.

Shares of mobile chip company ARM Holdings (ARMH) rebounded a bit after posting a sharp drop Tuesday. ARM's stock has fallen by 20% since the start of 2014, making it one of the worst performers on the CNNMoney Tech 30 index.

European markets ended little changed following the release of positive economic data.

Meanwhile, Asian markets closed with mixed results. Indonesia's economy grew by 5.7% in the fourth quarter, compared with the same period the previous year. That was better than expected and may calm fears about its ability to weather the storm battering it and the other so-called "Fragile Five" emerging markets.