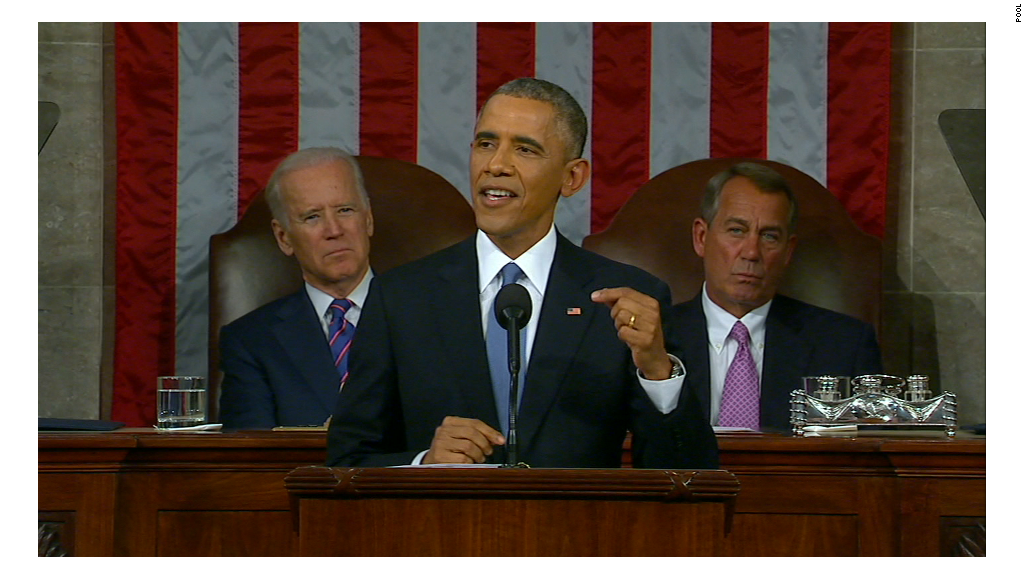

President Obama wants to make community college free -- but don't hold your breath.

Yes, his announcement went viral earlier this month, but this kind of change requires congressional action and Republicans now control both the House and Senate. Even if Congress acts, states could opt out of participating altogether.

For now, students need to come up with about $3,300 for a year at the average two-year college. And that only covers tuition and fees. Other expenses could ring up an additional $13,000, according to The College Board. Instead of waiting for Washington to make a change, here are other ways to foot the bill.

Pell Grants: The federal government gives out grants of up to $5,730 to about 9 million students a year. They can be used for tuition, fees, books and living expenses. It's based on financial need, and those making less than $60,000 typically qualify for at least some award, said Robert Kelchen, a professor of higher education at Seton Hall University. Students must submit the FAFSA form in order to be eligible.

Related: Obama wants community college to be free

Scholarships: Check the college's financial aid office, but don't forget about local groups that may offer awards based on special talents or interests. Some are merit-based, but others can be based on need, so be sure to fill out the FAFSA form early. Some states and colleges have a finite amount of money to dole out, and it's allocated on a first-come, first-serve basis each year.

Related: Colleges with the best bang for your buck

Think about a teaching career: You can get up to $4,000 a year from the federal government for pursuing a teaching degree. But you must agree to teach in a high-need field in a low-income area for at least four years after graduating, or you have to pay the money back.

Tax credit: Every student is eligible for a tax refund each year. Students making less than $80,000 are eligible for a maximum of $2,500. Of course, you still have to pay for tuition upfront before the credit comes your way.

Related: Nearly 8 out of 10 U.S. taxpayers get refunds

Move to Tennessee or Chicago: There are already programs here that help cover the cost of community college, similar to the one proposed by President Obama. The state of Tennessee will cover the cost of tuition at a community college or technical school that's not already covered by Pell Grants and other state scholarships.

Chicago will similarly cover the remaining cost of tuition, fees and books. Students who earn a 3.0 GPA in high school, place into college-level math and English courses, and are accepted into one of the City Colleges of Chicago are eligible.

Related: Why Chicago is mandating coding education

Ask your employer: Some companies, big and small, offer discounts on college tuition, but they often dictate which school is eligible. Starbucks (SBUX) offers some money to workers who take classes at Arizona State University's online program, and Wal-Mart (WMT) gives a discount to those taking classes at an online school called American Public University. Home Depot (HD) supports employees pursuing a degree at any accredited college, university or technical school.